Mining indicators around Bitcoin have turned sharply bearish, with several key metrics painting a challenging picture for the network’s economic backbone. Hash rate expansion, profitability compression, and miner side stress are reshaping the short-term outlook. Yet, history repeatedly shows that when miners start feeling the squeeze, the broader market often sets the stage for a rebound.

That fracturing dynamic creates an intriguing moment, because while traditional mining profitability narrows, emerging alternatives like Bitcoin Hyper ($HYPER) are using this environment to gain traction. With a presale attracting tens of millions and staking rewards that contrast sharply with miner revenue declines, the project is picking up attention from investors searching for new upside.

Market turbulence often fuels innovation. Miner pressure, network congestion, and softening institutional demand have created friction for Bitcoin, but it’s also the kind of backdrop where fresh narratives break out and capital migrates to newer opportunities. Bitcoin Hyper sits right inside that window, offering yield, scalability, and early stage exposure without the headaches tied to mining hardware or electricity costs.

Bitcoin’s Mining Pressure Intensifies as Profitability Slumps

Recent figures show a surge in hash rate, pushing above the 1.05 zettahash level and driving mining difficulty to all-time highs around 150.84 trillion. Difficulty spikes like this usually reflect network strength, yet they also act as economic pressure cookers. Higher difficulty means higher competition, and as competition increases, miner rewards shrink in dollar terms unless Bitcoin’s price climbs in parallel.

Hashprice, which measures miner revenue per hash power, has slid under $50 per petahash, among the lowest levels seen this cycle. When hashprice declines while operational expenses remain fixed, miner margins collapse. Many smaller operators are already cutting rigs, reducing output, or shutting down temporarily to manage costs.

Adding to that, outflows from institutional products have signaled reduced appetite from large buyers. Negative premiums across certain venues reinforce the idea that big money is rotating out of Bitcoin for now. Fee activity has also slumped, reducing revenue that miners rely on when block rewards alone aren’t enough.

But here’s the counterintuitive twist: prolonged periods of miner stress often precede recoveries. Historically, miner capitulation removes forced selling pressure, once weaker miners exit, network difficulty adjusts, and price often begins building momentum again. Indicators tied to miner exhaustion have even flashed bullish recently, suggesting BTC may not be done with its cycle yet.

That “reset effect” is what makes the current setup compelling. If Bitcoin finds support and bounces, the market usually starts chasing higher beta plays too. That’s where Bitcoin Hyper enters the conversation.

Bitcoin Hyper’s High Yield Model Fits the Market’s New Reality

While miners deal with falling profitability, Bitcoin Hyper is moving in the opposite direction, offering an entry path that removes the burdens of hardware, energy costs, and mechanical risk. Its presale is already past $28.5 million, reflecting unusual strength in a cautious market.

The token is priced at $0.013335 during presale, meaning early participants can calculate potential ROI using the additional source’s forward looking estimates. With projected highs around $0.02595 in 2025, the upside narrative becomes clear. Pair that with 40% staking rewards, and you get something miners simply cannot touch: predictable yield without operational overhead.

Instead of competing for block rewards like Bitcoin miners, holders of Bitcoin Hyper simply stake to earn. That reward structure taps into a growing investor preference for low maintenance yield sources, especially at a moment when mining economics are deteriorating.

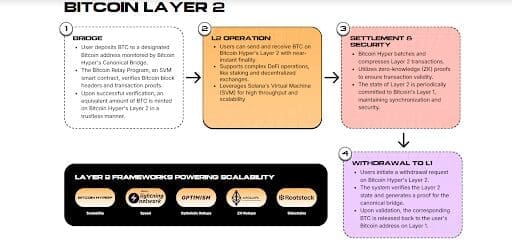

What sets Bitcoin Hyper apart isn’t just tokenomics. The project is designed around scalability, accessibility, and an ecosystem approach rather than the brute force computational model powering Bitcoin. In a climate where difficulty and hash rate drain miner profitability, a token that mirrors the Bitcoin brand while avoiding its mining bottlenecks becomes incredibly compelling.

The presale traction reinforces that thesis. The combination of a sub-penny range entry, a strong raise over $28.5M, and high staking rewards signals a community forming early, a crucial ingredient for momentum once the token lists.

As sentiment shifts and Bitcoin stabilizes, newcomers often look for adjacent narratives with stronger upside potential. Bitcoin Hyper is shaping itself into exactly that, a Bitcoin-themed, yield driven, early stage token positioned at the intersection of trend and timing.

Stack rewards with Bitcoin Hyper.

Why Bitcoin Hyper’s Presale Is Drawing Capital

Presales tend to thrive when the broader market is uncertain, and this one is no exception. Investors frustrated by mining noise or stagnant returns are gravitating toward models offering clarity and fixed incentives. At a time when Bitcoin miners are facing compression, Bitcoin Hyper delivers the opposite: strong staking yield, predictable mechanics, and early phase low pricing.

The presale’s surge beyond $28.5M shows confidence, but it also shows timing. Early buyers want exposure before the next bullish wave, whether triggered by miner capitulation, macro catalysts, or network level BTC recovery. And when that wave hits, the tokens that launched during uncertainty often see the strongest upside.

Join the presale for Bitcoin Hyper.

Key Takeaways

- Bitcoin’s mining difficulty, hash rate expansion, and falling hashprice are creating one of the toughest environments miners have faced this cycle.

- Institutional appetite is softening, with outflows and lower fee activity adding pressure to Bitcoin’s near term trend.

- Historically, miner capitulation phases often precede rebounds as network difficulty resets and selling pressure eases.

- Bitcoin Hyper offers a staking based alternative to mining, supported by a multi-million dollar presale and high yield incentives that align with current market sentiment.