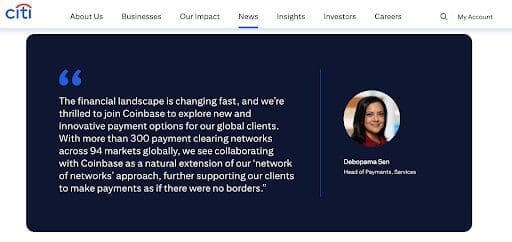

The institutional tide in crypto is turning again. Citi, one of the largest banks in the world, has partnered with Coinbase to create a new digital payments framework for large transfers. The collaboration aims to help global clients move funds quickly across borders using blockchain rails rather than traditional settlement systems.

This development highlights a growing trend of institutions no longer just experimenting with crypto infrastructure. They’re preparing to deploy it at scale. That’s where Digitap ($TAP), the world’s first omni bank, comes in.

It is already operating a live ecosystem with Visa integration. The payments app is available on both the Apple App Store and Google Play Store, giving users instant access to a working platform that bridges fiat and crypto.

Institutions Are Finally Moving Beyond Infrastructure

For years, institutional crypto engagement focused on building the plumbing, such as custody, compliance, and blockchain integration. That phase is now reaching maturity. Banks like Citi are moving toward blockchain-enabled products that solve real client needs, such as cross-border settlement, liquidity management, and frictionless payments.

The partnership is an early signal that legacy financial firms are ready to use digital assets in live financial operations. This marks a crucial shift from research to implementation. The conversation has moved from building to deployment and usability. As this transformation unfolds, attention is moving toward real-world applications that connect TradiFi with DeFi.

The industry is evolving from networks and protocols to user-facing systems that make digital assets practical and accessible. This progression mirrors the early internet boom, when value shifted from infrastructure providers to companies that offered seamless, intuitive products built on top of those networks.

As this evolution continues, institutions will need proven consumer-facing ecosystems to complement the backend infrastructure.

Crypto’s Next Growth Phase: From Rails to Applications

The Citi announcement comes during a pivotal period for the crypto industry. BTC ETFs have normalized institutional entry into digital assets, and now attention is shifting to adoption. Financial institutions aren’t just holding crypto, they’re using it. That means the projects that stand to benefit most aren’t necessarily L1 networks, but the applications built on top of them.

Digitap’s approach to integrated crypto-finance, where users can spend, save, and stake directly through a single interface, puts it in the same category as early fintech disruptors like Revolut and PayPal, but fully decentralized. It also differs from traditional neobanks in its open-access structure, with no KYC requirements in eligible regions.

This makes it one of the few platforms that cater to the 1.4B unbanked adults worldwide. This global accessibility transforms Digitap from a niche crypto project into a real-world banking solution. The presale’s rapid growth further underscores investor confidence. Crossing the $1.2M milestone is not just a sign of demand — it reflects a belief in the functionality of crypto ecosystems.

Why Digitap Fits the Institutional Model

Digitap’s structure aligns with what large financial firms and regulators want to see — clarity, transparency, and scalable growth. The platform uses a hybrid model that integrates traditional financial functions—spending, saving, and earning —while maintaining decentralization at its core. It is a compliant, unified application that links TradFi and DeFi, with full user ownership.

Institutions want projects that merge compliance readiness with real-world usability. Digitap offers a functioning app, a clear financial model, and a global user base. While legacy banks focus on settlement technology, Digitap is building the consumer-facing side of the equation.

This model provides stability and potential appreciation, both critical components for institutional credibility. It’s no coincidence that Digitap has been repeatedly mentioned by analysts discussing the best cryptocurrency to buy right now. Its market potential is enormous, especially given that it has a live, functional product available for download to global citizens today.

Its tokenomics also add institutional appeal, designed with long-term sustainability in mind. 50% of all platform profits are used for $TAP burns and staking rewards, and the presale has already surpassed $1.2M with 80M tokens sold. The current $TAP price of $0.0268 is 80% discounted from its launch price of $0.14.

The Road Ahead for Digitap and Institutional Crypto Adoption

The Citi/Coinbase partnership shows where institutional finance is heading — scalable blockchain adoption that improves financial operations. But the winners of this new cycle won’t just be infrastructure providers; they’ll be platforms users interact with daily.

Digitap is emerging as a frontrunner in that category. It merges the accessibility of modern banking with the innovation of DeFi, effectively creating a new class of hybrid fintech assets. As institutions begin to integrate crypto into their client offerings, tokens like $TAP could become attractive assets within diversified portfolios.

As the partnership accelerates mainstream blockchain usage, projects like Digitap will likely see a surge in adoption, proving once again that utility and timing are everything in crypto’s next chapter. The best crypto to invest in right now might not be an infrastructure coin.

It might just be the fintech application that powers the next era of blockchain banking

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app