JPMorgan analysts are tracking a quiet but telling development in the crypto market, a golden cross pattern forming on a lesser-known Dogecoin rival, Paydax (PDP). The formation, where short-term momentum rises above long-term resistance, has historically preceded decisive shifts in market direction. In previous cycles, similar setups on Dogecoin marked the early stages of sustained rallies, prompting institutions to take notice before retail enthusiasm surged.

This time, the golden cross is appearing in a Dogecoin rival, not Dogecoin anymore, merging meme-style visibility with a disciplined on-chain structure. JPMorgan analysts describe this Dogecoin rival, Paydax Protocol (PDP), as “technically resilient,” noting that its liquidity behavior aligns more closely with emerging DeFi assets than with conventional meme coins.

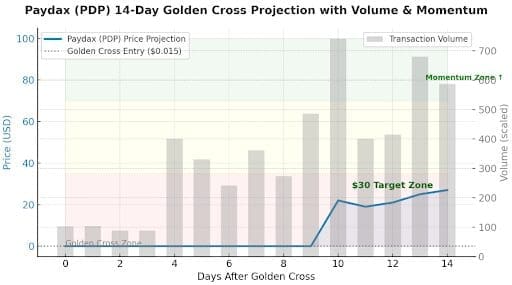

Inside The Chart Pattern Drawing Attention

In technical analysis, a golden cross occurs when an asset’s 50-day moving average rises above its 200-day average, a moment that typically signals the start of a new momentum phase. For most traders, it’s just a chart event; for JPMorgan analysts, however, it represents a potential inflection point in liquidity behavior. When these patterns emerge, the data often point to a deeper structural shift rather than short-term noise.

According to readings shared among JPMorgan analysts, PDP is showing this precise alignment at $0.015. Its golden cross pattern has been accompanied by a consistent rise in (1) transaction volume and (2) a gradual strengthening of market depth, both viewed as indicators of sustained accumulation. These conditions resemble those that preceded Dogecoin’s 2021 and 2024 rally, though the Dogecoin rival’s setup appears more contained.

Fundamentals Fueling Paydax’s Institutional Attention

JPMorgan analysts’ attention to Paydax (PDP) goes beyond its golden cross formation. It has been noted that the Dogecoin rival exhibits a combination of technical stability and emerging liquidity patterns that is unusual for a project of its market stage. The asset has seen steady inflows, alongside a rise in on-chain staking and lending activity, suggesting that capital is moving efficiently rather than sitting idle.

A key feature contributing to this interest is Paydax Protocol’s risk-tiered lending and cross-chain liquidity engine. This allows assets to circulate across multiple decentralized networks while generating structured returns. With this framework, the Dogecoin rival creates predictable movement in capital, which institutional models can monitor more effectively than in typical meme tokens.

Combined with its relatively low market capitalization and early accumulation trends, Paydax (PDP) is a signal-worthy asset for JPMorgan’s analysts seeking technically resilient tokens with latent breakout potential.

| FEATURE | Paydax (PDP) | Traditional Meme Coins | Why It Matters |

| Liquidity Model | Cross-chain liquidity | Typically single-chain and static pools | It guarantees that capital moves efficiently, supporting price discovery |

| Yield mechanics | Risk-tiered lending and asset collateralization | Minimal or speculative staking | It generates a structured return rather than relying purely on hype |

| Capital retention | Assets circulate while investors earn | Idle tokens | It encourages long-term accumulation without locking investors out. |

| Transparency and security | Assure DeFi audit and Gnosis Safe wallet | Limited security verifications | It reduces vulnerabilities and allays investor fears. |

Why Analysts See A 14-Day Window For Exponential Growth

Golden cross formations often mark turning points where markets shift from quiet accumulation to rapid expansion. For Paydax (PDP), the golden cross forming near $0.015 has emerged alongside rising transaction activity and deeper order books — signals that demand is building beneath the surface.

Historical models show that when assets of similar scale displayed this pattern, sharp revaluations followed within short windows. In this Dogecoin rival’s case, JPMorgan analysts tracking momentum flows suggest that with the current structure, Paydax (PDP) could realistically approach the $30 range within about two weeks.

Source: Paydax Protocol

What further strengthens this setup is Paydax’s integration of tokenized real-world assets (RWAs) into its liquidity framework. By allowing tangible assets such as gold, real estate, and luxury collectibles to serve as collateral within the protocol, this Dogecoin rival expands liquidity access beyond traditional crypto markets.

Numbers Reveal Path To A $30 Valuation Within Days

As institutional models recalibrate around new liquidity trends, Paydax (PDP) is carving a rare middle ground between speculative energy and structural depth. This hybrid footing, where tangible collateral meets programmable liquidity, is what JPMorgan analysts see as the defining edge in the weeks ahead.

Source: Paydax protocol

Already, early accumulation patterns hint at growing conviction. In the opening phase of this Dogecoin rival’s presale, over $1.11 million has been raised in just a few weeks, with more than 74 million PDP tokens sold out of the 240 million total allocation. At a live price of $0.015 and a 25% bonus using the PD25BONUS promo code, the market appears to be aligning with the same technical cues JPMorgan analysts are tracking.

By the time the golden cross turns into headlines, this $0.015 opportunity may already be history. The time to invest in the Paydax (PDP) movement has never been this urgent.

Join The Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper