Ripple’s push to bring blockchain into mainstream banking may have reached a critical roadblock — privacy. Despite multiple upgrades and partnerships, CEO Brad Garlinghouse admits that institutions still hesitate to adopt the XRP Ledger without a secure way to protect transaction data.

As Ripple struggles to bridge that gap, a rising competitor, Paydax (PDP), is rapidly capturing attention. Offering privacy, compliance, and performance in one DeFi-powered ecosystem, this DeFi bank delivers what traditional banks and Ripple have been promising for years.

The Ripple Problem: Public Ledgers Don’t Work For Banks

When a bank processes a $50 million cross-border payment using platforms like Ripple, that transaction becomes visible to anyone monitoring the ledger. This transparency might suit retail investors, but for banks, it exposes sensitive information like trade agreements, client data, and pricing models that must remain confidential.

That’s why, despite Ripple’s efficiency and compliance upgrades, institutional adoption has stalled. Even Garlinghouse admits the missing link isn’t regulation or speed, but privacy. Without it, banks can’t safely move large volumes on-chain without risking competitive exposure.

Ripple’s developers are now exploring ZK-Rollups to verify transactions on-chain while processing data off-chain, and XLS-101 smart contracts to connect these privacy layers to XRPL’s security framework. But progress takes time — and banks need a secure, private solution now, not years from now. That’s the gap this new DeFi bank Paydax is already filling.

The Paydax Solution: Privacy + Compliance From Day One

Unlike Ripple, which is adapting to compliance standards, this DeFi bank, Paydax, was built around them. Every part of its DeFi banking ecosystem was designed to meet institutional expectations from the start:

- A smart contract audit conducted by Assure DeFi, ensures the platform’s code meets top security standards.

- A full KYC verification confirming the identities and legitimacy of the Paydax development team.

- Gnosis Safe multi-sig wallets require multiple authorizations for each transaction, preventing internal or external fraud.

- An emergency shutdown mechanism that can instantly halt operations in case of any hacking attempt or security threat.

Beyond these core safeguards, Paydax reinforces user trust with a comprehensive “trust stack.” High-value collateral is secured through Brinks custody, tokenized RWAs undergo Sotheby’s validation, and all users and founders complete Onfido KYC verification — ensuring transparency, legitimacy, and accountability across the ecosystem.

The Full Banking Feature That Sets Paydax Apart

Beyond privacy, Paydax offers the complete DeFi banking infrastructure that traditional institutions need but Ripple lacks:

Institutional Lending & Borrowing

- The DeFi bank enables peer-to-peer lending pools with flexible collateral options.

- Lending with protocol revenue, not inflationary emissions.

- Borrowers access liquidity without selling assets, preserving tax efficiency and upside exposure.

- Support for 100+ cryptocurrencies, including BTC as collateral.

- Unlike traditional banks, this DeFi bank supports tokenized real-world assets such as Gold, fine arts, luxury watches, and even real estate as collateral.

Yield Opportunities For Lenders And Holders

Paydax takes finance to the next level. Unlike traditional banks or legacy blockchains, this DeFi bank rewards both lenders and holders, offering steady yields:

- Yield farming with up to 5x leverage, targeting 41.25% APY.

- Protocol staking offers up to 6% APY for long-term holders.

- Peer-to-peer lending generates steady returns of 15.2% APY.

- Redemption Pool rewards participants with yields up to 20% APY.

Risk Management Infrastructure

- A Redemption pool system that acts as a backbone to protect lenders.

- Tiered Loan-to-Value (LTV) structures (50%, 75%, 90%, 95%) for customized borrowing safety.

- AI-driven risk assessment engines that monitor lending activity in real time.

- Chainlink oracle standard of pricing to ensure transparent, manipulation-resistant price feeds.

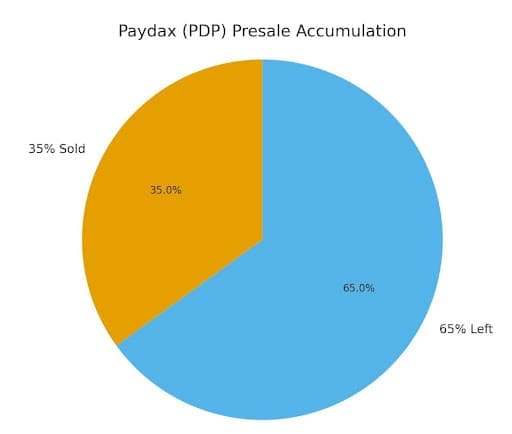

Early Presale Access With Exclusive Investor Rewards

Unlike Ripple, Paydax isn’t just a platform — it’s a tokenized DeFi bank, giving early investors direct access to its growth. The PDP token powers the entire DeFi banking system from borrowing to lending to staking, ensuring the token has lasting value.

Priced at just $0.015, PDP offers one of the lowest entry points in the 2025 crypto cycle. As a special incentive, Paydax is offering a 25% bonus for early participants with the code PD25BONUS. This means that if you buy 100,000 PDP tokens at just $0.015 each, you immediately receive an extra 25,000 tokens, boosting your total holdings to 125,000 PDP and increasing your potential returns.

Ripple Paved The Path, But Paydax Is Taking The Lead

Ripple may have introduced blockchain to the banking conversation, but Paydax is rewriting the rules. With built-in privacy, real compliance, and a functioning DeFi banking model, this DeFi bank isn’t waiting for institutions to adapt — it’s giving them what they’ve been asking for all along. As Paydax rolls out its multi-asset vaults, lending pools, and mobile RWA dashboard, the foundations are already in place for large-scale institutional adoption.

And when major banks begin integrating Paydax’s protocol for real-world transactions, PDP’s value could surge far beyond its current presale levels. For investors, that makes early access to Paydax more than just an opportunity — it’s a front-row seat to the next major evolution in blockchain finance.

Explore The Paydax (PDP) Presale Today:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper