Every cycle has that one project people can’t stop talking about. In 2017, it was Ethereum changing the way we think about smart contracts. In 2021, Solana shook the market with speed and low fees. Now, in 2025, a new name looks interesting: Digitap ($TAP). Still in presale, Digitap is already being hailed as the “Ethereum of Banking” – and with good reason.

From its omni-bank platform to its no-KYC cards, buyback model, and fast presale growth, Digitap looks set to change how crypto meets real-world finance.

Digitap’s Omni-Bank: Banking Without Borders

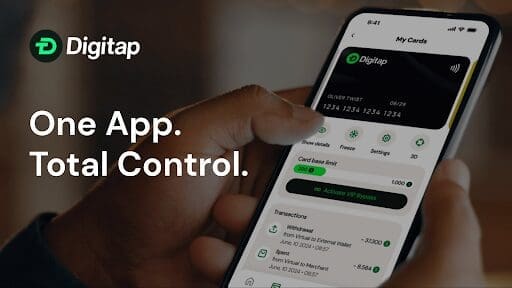

The core feature of Digitap is the omni-bank app, which aims to bring fiat and crypto together in a way that feels natural. Instead of juggling multiple apps or accounts, Digitap gives users a single balance that works across currencies.

You can link to major banks like HSBC, Citigroup, and Wise, while also connecting directly to crypto wallets like Coinbase, Binance, and Metamask.

This flexibility means total control – whether you’re sending USDT, holding Bitcoin, or making a wire transfer. Everything is managed from one clean interface, designed for speed, security, and privacy.

Stealth Mode and Cards That Work Everywhere

Digitap takes privacy seriously. With Stealth Mode always on, users can manage accounts and payments without exposing sensitive data.

The platform offers both virtual and physical cards, ready to integrate with Apple Pay and Google Pay. Digitap cards don’t require KYC to get started, which makes onboarding faster and more private. Unlike traditional fintech solutions that most of the time do require KYC.

The cards can be used anywhere in the world – from online shops to local stores – with every transaction feeding back into the Digitap ecosystem. Purchases help power buybacks and burns, so spending actually benefits long-term token holders.

Tokenomics Built for Sustainability

Digitap’s tokenomics are really well-designed. The total supply of $TAP is capped at 2 billion tokens, with 44% allocated to the presale, ensuring wide distribution.

Marketing takes 13%, giveaways 12%, listings 10%, and only 1% is held by the team – locked for five years to guarantee commitment.

The real innovation comes from the buyback-and-burn model. Digitap commits 50% of profits to buying back TAP tokens. Half of those tokens are permanently burned to reduce supply, while the other half are distributed as staking rewards. APY is set at 124%.

In this first presale phase – 1 TAP = 0.0125 USDT, but the next stage is set at 0.0159 USDT. Over 28 million tokens have already been sold, and each new stage raises the entry cost.

Why Digitap is the “Ethereum of Banking”

Ethereum revolutionized decentralized finance by becoming the backbone of smart contracts. Digitap is positioning itself to do the same in banking. Its omni-bank app, no-KYC cards, and buyback-driven tokenomics combine to create a financial system that is faster, more private, and more rewarding than anything traditional banks can offer.

Where Ethereum gave developers the freedom to build, Digitap gives users the freedom to bank – globally, securely, and with crypto integrated at every step. That’s why many are calling it the “Ethereum of Banking.”

Can Digitap Reach $5?

The million-dollar question is where the price could go. At just 0.0125 USDT in presale, the upside potential is enormous. Hitting $5 by 2026 is not unrealistic, but Digitap needs to continue its strong presale momentum, build adoption of its omni-bank app, and execute its buyback-and-burn model effectively. That would mean a huge return for early presale participants. $5 per $TAP could be the target that cements its place as one of the biggest winners of the next cycle.

To wrap it up, Digitap is a new approach to banking. It has all the elements to stand out in 2025 and beyond; omni-bank app, privacy-first cards, strong tokenomics, and a buyback system designed to reward holders. The presale is heating up quickly, and with the price about to rise from 0.0125 USDT to 0.0159 USDT, early buyers have a rare opportunity.

If momentum holds, and adoption follows, the dream of Digitap reaching $5 by 2026 may not just be hype – it could be the future of banking in crypto form.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://Digitap.app

Social: https://linktr.ee/digitap.app