Introduction

As the new trading week unfolds, Ethereum and XRP are once again in the spotlight. Institutional flows into crypto ETFs remain strong, with both assets showing resilience near key levels. Ethereum is holding steady above $6,800, while XRP recently touched $3.20 before pulling back slightly. Analysts suggest that market momentum, coupled with expectations of continued Federal Reserve rate cuts, could fuel more upside for major altcoins in the weeks ahead.

Amid these developments, investors are also paying attention to MAGACOIN FINANCE, a presale project that many see as a fresh opportunity with the potential to outperform established names in the next cycle.

Ethereum Outlook

Ethereum continues to attract institutional interest, particularly through its spot ETFs, which have accumulated more than $1.4 billion in inflows over the past month. Corporate treasury adoption is also accelerating, with companies adding ETH to diversify beyond Bitcoin-only strategies.

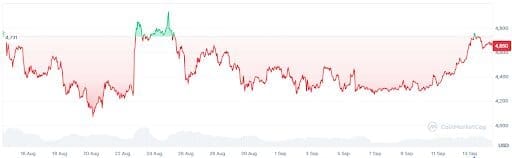

From a technical perspective, Ethereum is consolidating around $4,680, holding firmly above the $4,600 support level. The next resistance sits at $4,850, with bulls eyeing a possible move toward $5,000 if momentum continues. On the downside, $4,500 remains the key area to watch.

With upgrades such as proto-danksharding boosting network efficiency and L2 activity surging, Ethereum continues to show why it remains the backbone of decentralized finance.

MAGACOIN FINANCE: The Breakout Presale to Watch

While Ethereum remains the institutional favorite, Ethereum whales are shifting their gaze to this new opportunity that is expected to bring in exponential gains: MAGACOIN FINANCE. The presale has already generated massive buzz, raising more than $13.5 million in record time as investors rush to secure allocations.

MAGACOIN FINANCE differentiates itself with a capped supply of 170 billion tokens, ensuring scarcity as adoption grows. Community momentum is expanding quickly, and its cultural branding has become a powerful driver for retail excitement. To bolster investor confidence, the project has completed audits with HashEx and CertiK, addressing security concerns at a time when caution is critical.

With allocations shrinking each round, many analysts argue this is a once-in-a-cycle chance to position early before MAGACOIN FINANCE lands on major exchanges later in 2025.

XRP Momentum Builds

XRP has also been making headlines after recently climbing to $3.08, sparking discussions about whether the asset could challenge its all-time highs. Market optimism has been fueled by speculation that an XRP-based ETF could eventually receive regulatory approval, mirroring the success seen with Bitcoin and Ethereum products.

On the charts, XRP is currently trading between $3.00 and $3.10, with support forming at $2.95. If bulls manage to maintain momentum, analysts see the next upside target at $3.25, which would mark its strongest rally since the start of the year.

XRP’s advantage lies in its real-world utility, particularly in global payment systems. Corporate treasury strategies are starting to include XRP as part of diversified reserves, a trend that could further strengthen demand in the months ahead.

Comparison: Majors vs. MAGACOIN FINANCE

Ethereum and XRP represent liquidity, adoption, and relative stability within the crypto market. Both assets benefit from strong institutional demand and established ecosystems, making them essential holdings for investors seeking long-term exposure.

In contrast, MAGACOIN FINANCE offers asymmetric upside. While ETH and XRP can deliver steady growth, MAGACOIN is positioned as the accelerator – the presale project that could potentially deliver 20x or greater returns once it enters major exchanges. This dynamic mirrors how early investors in top altcoins captured exponential gains before mainstream adoption.

Risk and Timing Considerations

Ethereum and XRP face risks tied to ETF flows and macroeconomic conditions, particularly Fed policy and liquidity cycles. Failure to hold critical technical levels could lead to short-term pullbacks.

MAGACOIN FINANCE carries a different risk profile: presale timing. With each round closing faster than the last, late investors risk reduced allocations and higher entry prices. Missing early stages of the presale is widely seen as the biggest risk, as it limits exposure to the project’s full upside potential.

Taken together, ETH and XRP serve as portfolio anchors, while MAGACOIN FINANCE provides the speculative edge that could define this market cycle.

Conclusion

Ethereum’s institutional inflows and XRP’s momentum make them two of the most important assets to watch this week. Both continue to benefit from strong technical setups and growing adoption. Yet, MAGACOIN FINANCE’s explosive presale growth positions it as a unique, once-in-a-cycle opportunity that complements these established names.

For investors looking to balance stability with potential breakout upside, combining ETH, XRP, and MAGACOIN FINANCE could be the most strategic move heading into late 2025.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance