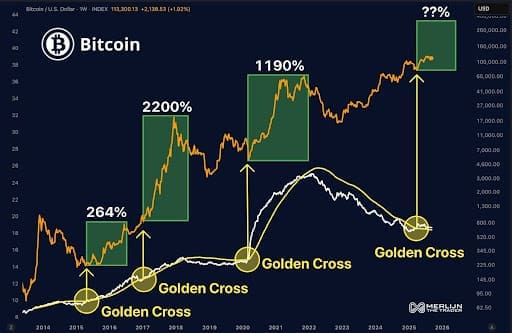

A rare technical event has reappeared on Bitcoin’s charts, and many in the market believe it could light the fuse for the next major move. According to crypto analyst Merlijn The Trader, the Golden Cross, the bullish crossover between key moving averages, has just flashed for the fourth time in Bitcoin’s history. Previous occurrences in 2016, 2017, and 2020 all preceded massive rallies: ~264%, ~2200%, and ~1190% respectively. Merlijn thinks the 2025 signal could be just as meaningful. As traders watch this formation, other catalysts are aligning: institutional inflows, ETF momentum, and altcoins regaining favor. This is the kind of setup that often forces people to pay attention, and outside of BTC, two names keep showing up in buy-lists: Cardano (ADA) and MAGACOIN FINANCE, both being flagged as among the smartest long-term altcoin picks in this phase.

Why the Golden Cross Matters, and What’s Different This Time

The Golden Cross, by definition, is when a shorter moving average (e.g. 50-day) crosses above a longer one (200-day), suggesting a shift toward upward momentum. Traders point out that those prior crossovers in 2016, 2017, 2020 didn’t just happen randomly, they aligned with expanding adoption, rising institutional demand, and macro conditions favoring risk assets.

What makes this latest instance especially interesting: the macro backdrop is more developed. Inflation remains elevated in many regions, geopolitical uncertainty is pushing capital into “hard” assets, and ETFs are now an established narrative rather than hopeful speculation. Analysts also note that Bitcoin’s recent behavior, holding above key moving averages, maintaining support zones during dips, gives credence to the idea that this cross might actually sustain.

Still, while history provides inspiration, every cycle has its own quirks. The difference now includes more regulation, more institutional presence, more public awareness. If this Golden Cross sticks (i.e. the short MA stays above the long MA, and BTC avoids a sharp reversal), we may be in for a sustained bull run rather than a short pop.

MAGACOIN FINANCE: Why It’s Being Called an Altcoin to Buy Now

While many eyes are on Bitcoin, MAGACOIN FINANCE is steadily gaining traction among altcoin investors. Here are what analysts and presale participants are pointing out:

- Presale stages for MAGACOIN FINANCE are moving fast, with early rounds closing ahead of schedule. That shows both demand and conviction.

- The PATRIOT50X bonus (or equivalent early-access incentives) that gives early presale participants a meaningful extra allocation is seen as adding scarcity and reward to early action.

- Community buzz is growing: MAGACOIN FINANCE is being featured in altcoin outlooks, trader group discussions, Telegram, Twitter, and podcasts. It’s no longer invisible.

- Analysts comparing altcoins now are not just picking based on past performance, but based on setup: presales with strong incentive-structures, tight supply at stages, and visibility. MAGACOIN FINANCE checks many of those boxes.

- Some forecasts by presale watchers are placing MAGACOIN FINANCE among the best asymmetric picks, projects that might multiply many-fold if BTC’s Golden Cross sparks the wider altcoin season.

In sum, for those looking beyond Bitcoin, MAGACOIN FINANCE is appearing repeatedly in “best altcoins to buy” lists because it aligns well with the moment: scarcity, early entry, growing community energy, and potential for big upside if trends favor alts.

ADA (Cardano): Stability, Technical Signals & Upside

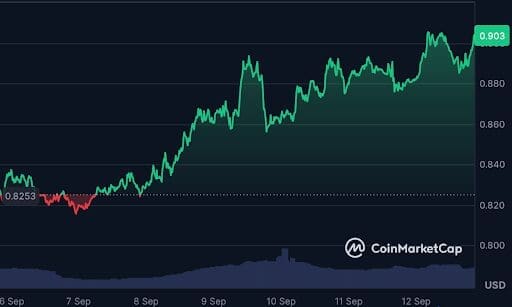

At the same time, Cardano (ADA) is showing signs of entering a renewed bullish phase. ADA has been holding above key moving averages (20-day, 50-day, 200-day), which traders interpret as a sign of strength.

Some recent analysis suggests ADA could see gains of 200%-360% from current levels under favorable market conditions. A short-term target often cited is near $1.86, assuming bullish momentum persists.

ADA’s price has hovered around $0.88-$0.90, pushing against resistance zones. If it breaks cleanly above resistance and maintains its hold above the moving averages, the path toward $1.00+ becomes more plausible. Otherwise, support zones in the $0.80-$0.85 region may be tested.

What makes ADA attractive now is its combination of resilience + upside potential. It’s not a wild presale bet, but with Bitcoin showing signs of a larger move, ADA could benefit strongly from both the tailwinds of broader market momentum and its own technical setup.

What to Watch Moving Forward

For those watching the charts and preparing for what could be a major turn in the cycle, here are the key signals to monitor:

- BTC Price Behavior Post-Golden Cross – Can Bitcoin hold above the moving average cross? If the short MA stays above the long MA for several weeks or months, momentum tends to build. Watch for rejection or retest of the cross.

- Institutional Flows & ETF Activity – With ETFs now well-accepted and regulatory frameworks maturing, inflows from institutions (via ETFs or large spot positions) may amplify any technical breakout.

- Volume & On-Chain Metrics – Active wallet addresses, trading volume surges, accumulation by long-term holders, etc., especially for BTC and ADA, to confirm that this isn’t a shallow move.

- Altcoin Season Signs – Market indicators like Altcoin Season Index, ratio of altcoin market cap vs Bitcoin cap, how early presales are behaving. MAGACOIN FINANCE is among those to watch in this area, as presale demand could magnify gains once broader liquidity enters.

- Key Resistance/Support Levels – For BTC, resistance near recent highs, psychological levels (maybe $120,000-$140,000 depending on region) will matter. ADA’s resistance around ~$0.90-$1.00, and support around $0.80-$0.85. Breaking past resistance opens space; failing to do so may compress the move.

Conclusion

Conclusion

The Golden Cross on Bitcoin’s chart is more than a technical signal, it might be the ignition point for the next chapter in this crypto cycle. Pair that with institutional interest, ETF momentum, and a macro climate that seems increasingly favorable to risk assets, and you have a setup where both established altcoins and early presale projects can shine. Cardano (ADA) offers stability plus strong technical signals and might be set for impressive gains if resistance breaks. Meanwhile, MAGACOIN FINANCE stands out for its early presale strength, scarcity mechanics, and growing community attention, exactly the kind of asymmetric play many traders prize when cycles turn. If the Golden Cross holds and broader momentum aligns, those in early positions on ADA and MAGACOIN FINANCE may be looking at outsized opportunities.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance