- The Reserve Bank has extended by 15 months the deadline for Postbank to replace SASSA Gold Cards with Black Cards.

- About 450,000 Gold Cards are still in use.

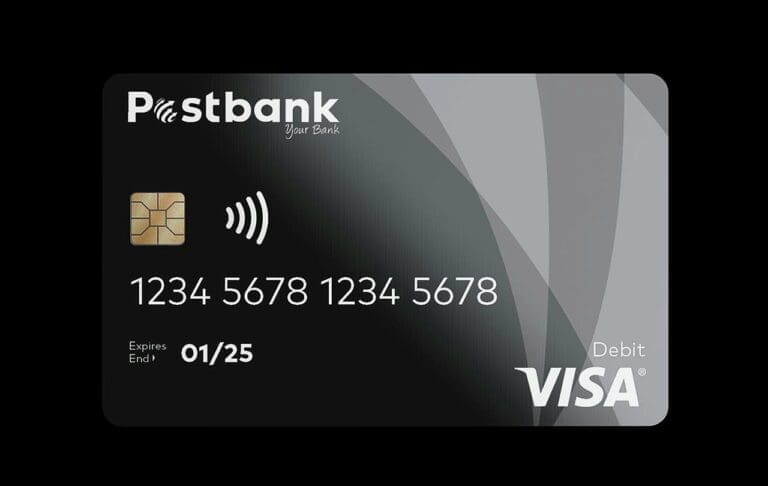

- Postbank must now issue a new, more secure Black Card, phase out all remaining Gold Cards, tighten security, and provide regular compliance reports to SARB.

- The Reserve Bank told Parliament social grant beneficiaries beneficiaries can continue using both Gold and Black Cards for now, and assured MPs that grants will not be disrupted.

- Postbank CEO Nikki Mbangashe said the bank had turned a R1-billion loss into a R106-million profit in 2024/25.

The South African Reserve Bank (SARB) has given Postbank 15 more months to phase out SASSA’s Gold Cards and replace them with Black Cards. About 450,000 social grant beneficiaries still use the Gold Cards.

Briefing Parliament’s portfolio committee on social development on Tuesday, SARB and Postbank outlined the delays in the card swap. In 2021, 2022 and 2023, the SARB issued notices requiring Postbank to remove the Gold Cards and replace them with cards linked to a new security key, by 31 March 2025. That deadline was missed.

On 29 August, SARB issued a fourth notice extending the deadline by 15 months. The Reserve Bank said the move was needed to avoid disruptions to grant payments and protect the stability of the national payment system. Postbank hasn’t indicated when the rollout will begin again.

Under the new conditions, Postbank must issue a more secure “Black Card 2” with a new bank identification number; phase out the remaining Gold Cards; and tighten its auditing and security processes. It must also launch communication campaigns to reach grant beneficiaries and submit regular compliance reports to the SARB. Existing Black Card holders can still use their cards and when these expire, they will get the “Black Card 2”.

Failure to meet these requirements could mean Postbank loses its participation in the National Payment System.

Tim Masela, SARB’s head of the National Payment System department, told MPs: “It should be pointed out that SASSA grant recipients are still able to use their Gold Cards, despite the indefinite suspension of Postbank’s card replacement process. Grant recipients will not be adversely affected while we concurrently try to find solutions that are fully compliant.”

Masela explained that the compliance issues stemmed from Postbank’s card key management processes. A cryptographic breach in 2021 meant the security key used to issue Gold Cards was compromised. SARB ordered Postbank to replace those cards with new ones under stricter controls, but deadlines were missed. Masela said the extensions were the “least disruptive” option: withdrawing Postbank’s designation would have left beneficiaries unable to access their money.

Postbank CEO Nikki Mbangashe told MPs the bank was on a turnaround path after years of financial strain. “In the last two financial years [before 2024/25], Postbank made the biggest loss it has ever made. It made a loss of over R1-billion and this was related, unfortunately, to the exposure we had at the Post Office… In 2024/25, R106-million was made in profit and we are very happy because it means we are turning around the business.”

She said Postbank now serves more than five million customers, over half of whom are SASSA clients. To improve its services, the bank invested over R500-million in the last two years and set up over 250 Postbank kiosks at retailers nationwide to assist clients.

Post Bank grant recipients shielded from deductions

Mbangashe stressed that grant recipients using Postbank accounts are shielded from deductions. “There were questions about unlawful deductions. This is not happening to Postbank customers. The requirement from the Master Service Agreement with SASSA is that the Postbank account doesn’t allow debit orders. It’s protected and cannot allow deductions. We have never, as a bank, gone to SASSA to say ‘allow us to do debit orders’, because we support the protection of the customer.” She added that beneficiaries also receive free monthly statements and one free card replacement.

On the Black Card rollout, Mbangashe acknowledged the missed deadline but said the problem was “not because Postbank was not ready”. “It was because we waited for the customers to come forward and collect, but they didn’t all come by the deadline. To date, 75% of our customers have the new Black Card and have not had any issues.”

She said Postbank could issue 500,000 cards per month and clear the remaining 450,000 within two months, but “we need to find ways to encourage people to come forward”.

Despite these assurances, some MPs raised concerns. “On the conversion to Black Cards… There was a serious gap in the rollout and reach out to particularly black communities in rural areas in line with the legislative mandate,” said ANC MP Keamotseng Stanley Ramaila.

Social Development Minister Sisisi Tolashe also voiced frustration about the previous chaotic rollout. “Deadlines were not met, and the last deadline imposed shook the country. Our beneficiaries were made to stand in long queues under very difficult circumstances. Some very old, some not physically fit.”

Noluvuyo Tafeni (EFF) raised questions about fraud risks. “Since this ongoing matter between SARB and Postbank is far from being resolved, does this not leave Gold Card holders exposed to potential online fraud and the like, associated with the continued use of the Gold Cards?”

Masela said fraud risks had been contained and the SARB was monitoring Postbank closely. “All the beneficiaries should care about is that their card works and only valid transactions happen,” he said.