Nedbank’s Avo SuperShop, which has been in the market for four years, recorded approximately 2.8 million registered clients for the year ended 31 December 2024. This marks a 9% year-on-year increase in its registered client base.

According to Nedbank, Avo SuperShop continues to scale, with total gross merchandise value (GMV) growing by 21% year-on-year across all Avo ecosystems.

Expanding Avo SuperShop

Since launching in Namibia in the second half of 2023, the first of its kind in the market, Avo SuperShop has gained over 2,250 registered users. The platform currently offers more than 3,300 products from 25 merchants.

“Continuous improvement is expected as more users register, and more merchants are added to the platform,” said Nedbank.

Avo is a super app that enables customers to purchase essential products and services online, with secure payments and credit facilitated through Avo’s digital wallet and Nedbank.

First introduced in 2020, Avo was positioned as a central hub for Nedbank clients to access online shopping deals, essential services, and financial products.

Nedbank’s financial performance

Nedbank Group delivered an improved financial performance, with headline earnings rising by 8% to R16.9 billion for the year ended 31 December 2024. The group’s return on equity (ROE) strengthened to 15.8%, up from 15.1% in the prior period, reflecting steady progress towards its ROE targets.

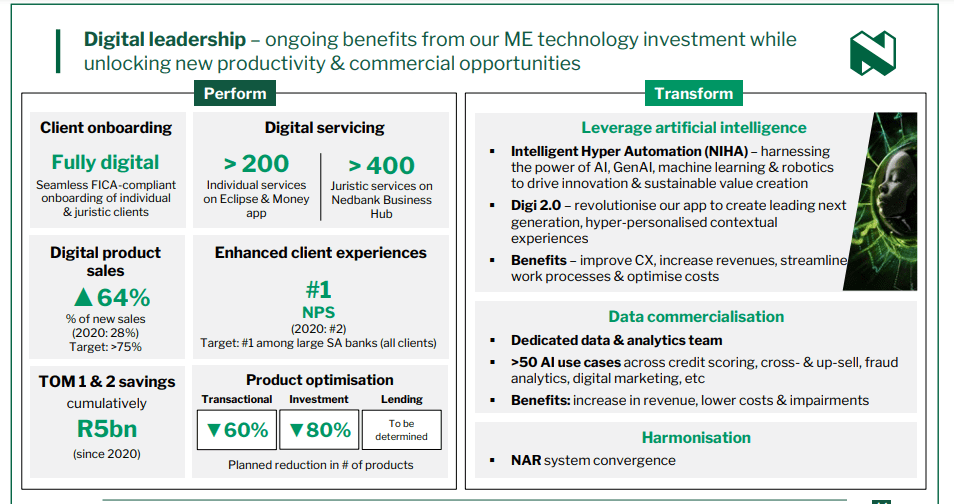

Jason Quinn, Chief Executive of Nedbank, highlighted the completion of the group’s Managed Evolution IT transformation as a key strategic milestone for 2024.

“This platform, along with our enhanced digital capabilities, supported ongoing strong digital growth, market-leading client satisfaction metrics, solid main-banked client gains, and higher levels of cross-sell,” said Quinn.

Digital Leadership and Market Growth

Retail digital transaction volumes and values in South Africa grew by 12%, while digitally active retail clients increased by 7% to 3.1 million, representing 70% of retail main-banked clients (2023: 69%). Across the NAR business, digitally active clients grew from 64% to 72% of the total active client base.

Nedbank also recorded market share gains in key areas such as home loans, vehicle finance, wholesale term-lending, and retail deposits.

“We also continued to create wider positive impacts through approximately R183 billion of lending that supports sustainable development finance, aligned with the United Nations Sustainable Development Goals,” said Quinn.

“The increase in renewable energy exposures of 32% to almost R40 billion and Nedbank being awarded significant renewable energy mandates in Q4 2024 reinforce our leadership in this space.”