Capitec Bank is taking decisive steps to address the persistent issue of long queues at its ATMs.

Capitec clients continue to favour cash transactions despite the availability of electronic alternatives.

This preference for paper money has led to frequent social media jibes about Capitec’s loyal patrons enduring lengthy waits.

Clients choose Capitec ATMs over those of other banks even if it means standing in line for a longer time.

Capitec’s retail bank active clients grew to 22 million versus 19.9 million in 2023, 11.2 million of whom use the banking app compared to 9.4 million in 2023.

As Capitec’s customer base expands, the queues at its ATMs are expected to grow even longer.

Capitec has decided to resolve the matter.

Over the weekend, the bank began urging its customers to utilise ATMs of its competitors – ABSA, FNB, Nedbank, and Standard Bank – to withdraw cash.

The move aims to alleviate the congestion at its own machines.

Capitec has also simplified the process for its customers by offering the same fee structure for withdrawals from ATMs belonging to other banks in South Africa.

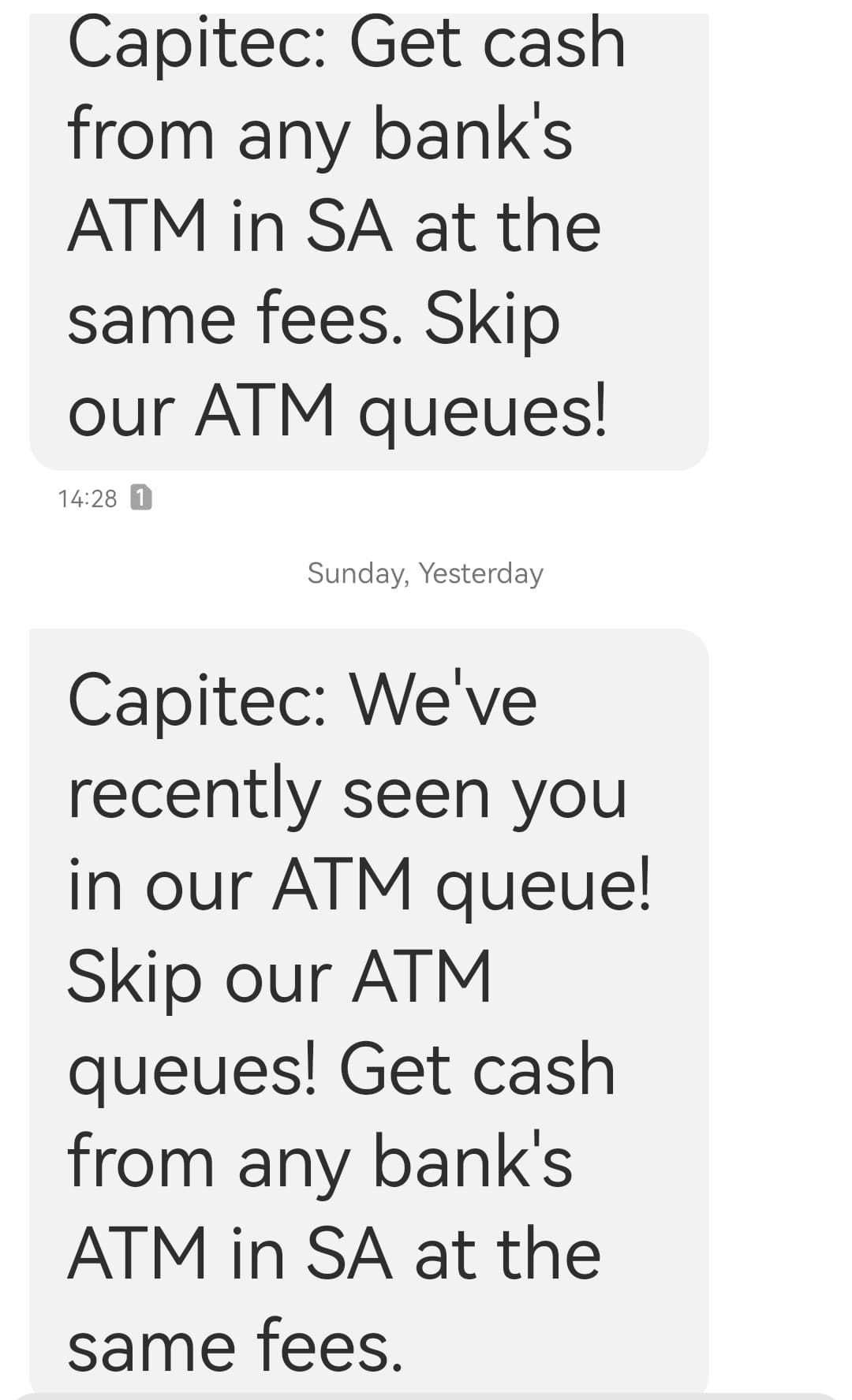

To ensure compliance, Capitec sent an SMS to its customers, stating: “Get cash from any bank’s ATM in South Africa at the same fees. Skip our ATM queues.”

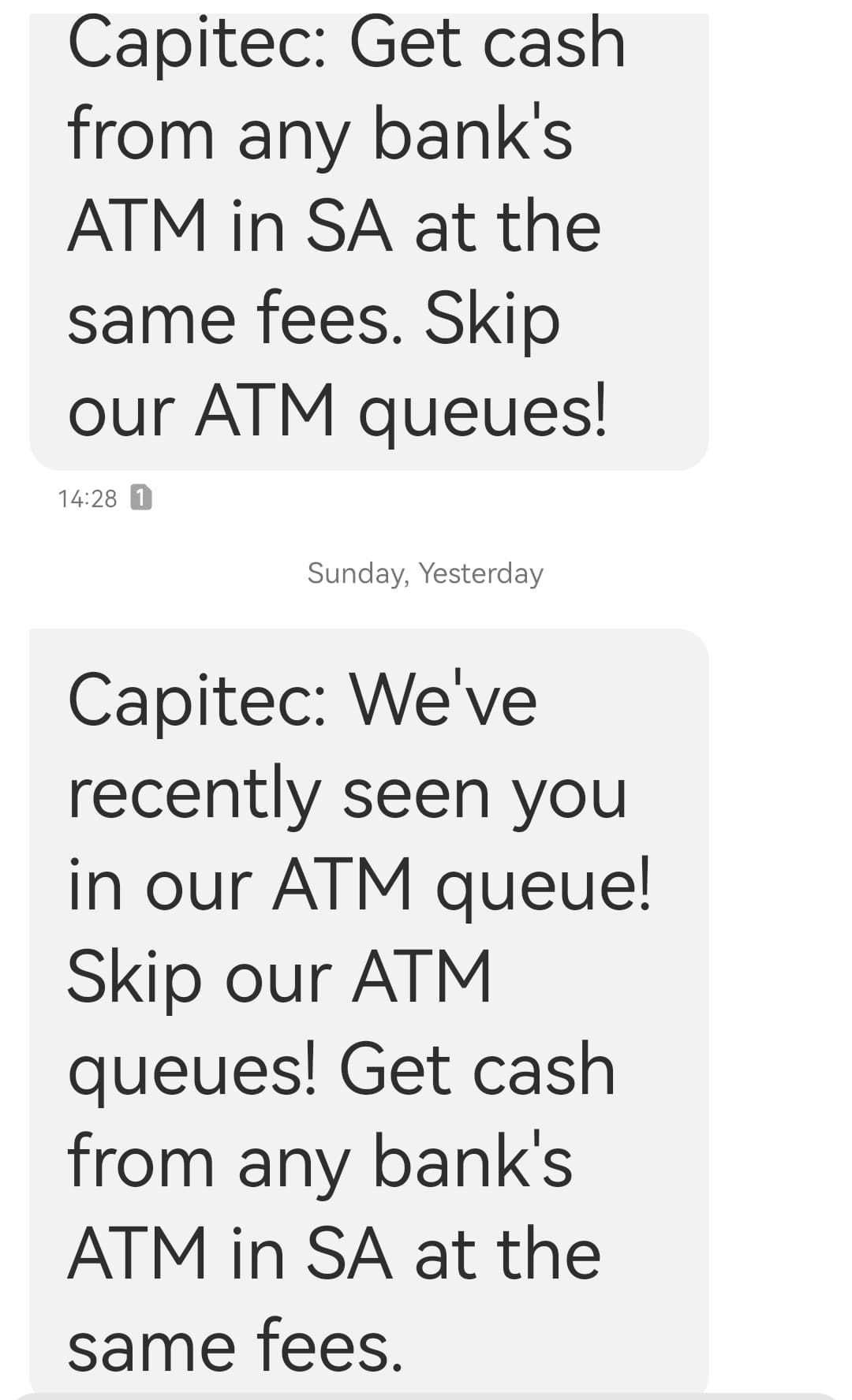

To further reinforce this initiative, Capitec is following up with clients who are seen using its ATMs, sending another SMS that reads: “We’ve recently seen you in our ATM queues! Get cash from any bank’s ATM in South Africa at the same fees.”

This approach not only aims to reduce wait times at Capitec ATMs but also leverages the existing ATM networks of other major banks, providing greater convenience to Capitec clients.

By encouraging the use of competitor ATMs, Capitec is addressing the immediate issue of ATM congestion while promoting a more efficient banking experience for its clientele.

Also read: GUGU LOURIE: Capitec must forsake its queues

Capitec people it’s possible..😏😏 pic.twitter.com/w2vI32SaGE

— MDN NEWS (@MDNnewss) May 23, 2024

Capitec’s loyal customers, meanwhile, are the butt of jokes on social media for enduring long queues at its ATMs — often ignoring other banks’ ATMs even if it means a longer wait. And with more people opting to bank at Capitec, there can be no doubt that the queues at its ATMs will only lengthen.

Admittedly, the lender continues to encourage account holders to use its Pay Me function on its banking app, which enables clients to generate a personalised QR code to receive payments immediately and securely from other Capitec clients.

Still, its clients prefer paper money even where options are available to transact electronically. Cash might be king for now, but it is an irritation a competitor can easily exploit.

Capitec needs to act soon or risk losing its clients. It could become more innovative simply by partnering with pioneering African tech start-ups. It could take a leaf from Ivory Coast-based Cerco, which has developed Superphone, a voice-operated and keyboard-less smartphone targeting 40% of Africa’s illiterate people.