Africa has emerged as a hub for fintech innovation as multiple factors converge to catalyse transformative change within the financial services sector, with South Africa serving as an entry point into the continent for numerous providers.

“The absence of traditional banking infrastructure in many regions has paved the way for innovative fintech solutions to fill the gaps and meet the diverse financial needs of the population, with mobile penetration rates supporting a digital-first shift in how Africans transact and bank,” says Mia Pieterse, Partner and fintech specialist at Mazars in South Africa.

Additional factors driving fintech growth on the continent include a large, young, unbanked and underbanked, tech-savvy population, heavy cash usage, and an accelerating shift from informal to formal sectors.

In South Africa, the local fintech sector reflects a dynamic interplay of continued investment, a deep innovation pipeline, a favourable regulatory environment, and supportive digital infrastructure. In this context, five key themes are playing out, according to Mazars.

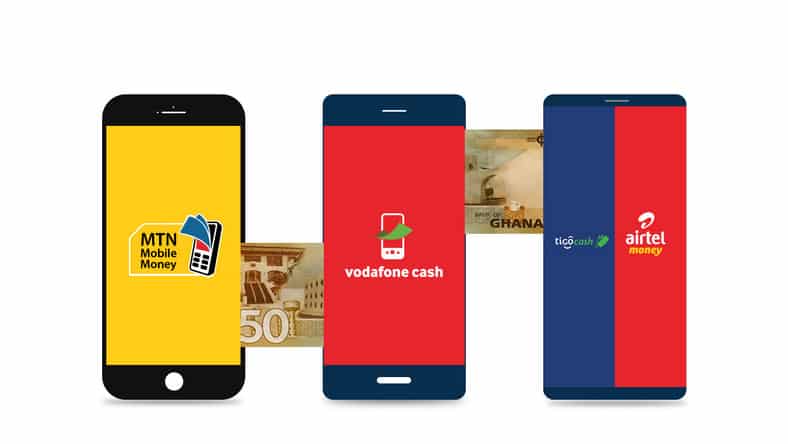

Mobile money

Mobile applications address challenges around financial exclusion from the formal banking sector caused by factors such as a lack of valid documentation to meet regulatory compliance requirements, low education levels, a lack of income due to high unemployment rates, language barriers, and the number of financial dependents they support.

“Broadening access to affordable, relevant and sustainable financial products and services that cater to the everyday transactional needs of underbanked and traditionally marginalised groups is a critical step towards improving inclusivity to address poverty and inequality,” explains Pieterse.

Mobile payment and e-wallet services have also gained traction as mobile network penetration provides the infrastructure to facilitate payments in areas where traditional banking services have yet to reach underserved communities.

Resistance to traditional banking services in informal townships in urban hubs also exists due to the perception that bank accounts are exclusively available to the middle and upper classes.

“Available solutions also meet specific utilitarian needs, with applications in the informal economy, which is vital to determine buy-in and mass adoption,” continues Pieterse.

Cross-border remittance

The ubiquity of payment apps or mobile financial services enabled over platforms like Mukuru and Mama Money facilitates cross-border payments, an important feature for Sub-Saharan Africa’s large migrant workforce.

Key drivers necessary for the adoption of digital cross-border remittance payments include ease of use, transaction costs and trust.

“Traditional wire transfers in Africa tend to be expensive, and disproportionately impacts low-income earners by making services unaffordable for the vast majority,” explains Wiehann Olivier, Partner and fintech & digital assets lead for Mazars in South Africa.

“Blockchain technology could significantly increase the execution speed of cross-border transactions, and lower costs compared to legacy platforms.”

In terms of trust, digital remittance services need to address numerous legacy issues to boost adoption and usage. As consumer trust grows, users become empowered to bank, transact and save directly on their phones without opening a bank account, which helps increase access to financial services.

Digital financial services

As more Africans embrace digital financial services, new opportunities will emerge, like providing cashless transactions and access to credit and lending, to investments and low-cost insurance products.

In this regard, South Africa boasts a thriving innovation pipeline as the country’s vibrant fintech ecosystem develops services around banking and other financial products.

Neo banks in South Africa are breaking down barriers to entry for banking and a broader set of financial services with no-fee products and digital-only accounts that consumers can open via a paperless process from any internet-enabled device without going into a physical branch.

The other major area of innovation relates to instant cardless payments and an expansion in payment mechanisms.

Beyond payments, neo banks offer attractive interest rates on deposits, helping to promote saving in a country with a historically low savings rate.

“Banks are also building out other capabilities that leverage their growing digital channels with partnerships in the insurtech space to provide more personalised, accessible, relevant and cost-effective insurance products,” says Olivier.

Open banking

According to Olivier, open banking is an emerging trend that will play an increasingly vital role in the personalisation of financial services, with banks leveraging application programming interfaces (API) to grant secure third-party access to financial data.

“Clients want the ability to integrate their digital lives by connecting various applications with bank accounts and other financial institutions. This functionality provides them with an increase in automation and efficiency and streamlines processes to reduce friction,” explains Olivier.

Integrating bank accounts with third-party services will also benefit related sectors, where external auditors will be able to gain direct and secure read-only access to clients’ banking information to gather audit evidence.

“With the ability to access digitised banking information via an API key, auditors would gain access to transactional data for an entire year, which they could easily analyse using data analytics tools as part of the audit process,” continues Olivier.

Furthermore, open banking models enable programmable banking, which Pieterse says is a growing trend in the South African market.

“Clients increasingly want to take charge of their finances, with the ability to hyper-personalise their experience at the individual level,” she explains.

“Programmable banking allows tech-savvy clients to customise their banking interfaces using simple code to create bespoke rules, such as payment scheduling or card payment parameters, and craft individualised banking experiences.”

Machine learning and AI

“While the application of artificial intelligence (AI) and machine learning (ML) is still nascent in the local financial services sector, these technologies are already revolutionising multiple aspects of the industry,” explains Olivier.

Current applications include automated customer engagement and customer service, lending, fraud detection, insurance, investing, back-office process automation and revenue collection for agencies such as SARS.

“AI-powered chatbots and virtual assistants give clients access to faster and more personalised services, while AI leverages data to help financial institutions make more informed decisions about lending or making personalised recommendations about investments,” says Olivier.

“AI and ML also support risk management and fraud prevention at scale, with the ability to identify trends and patterns and respond to potential fraud attempts in real-time.”

SA leading Africa’s fintech revolution

With continued investment, South Africa is well positioned to maintain its leading role as the regional driver of fintech innovation, reshaping digital financial services across the continent while contributing positively to financial inclusion and economic growth in the country.