How much money is there?

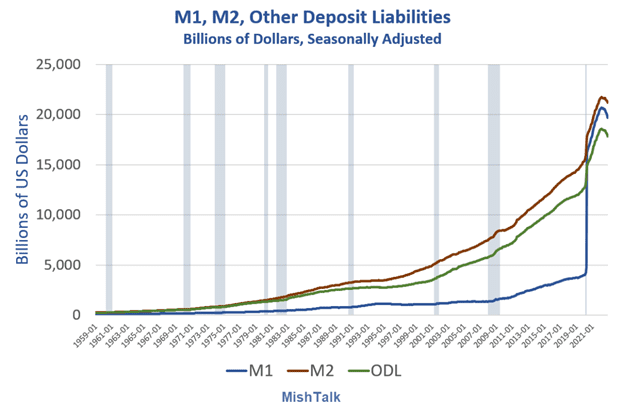

The entire quantity of money in circulation worldwide (including actual cash, checking and savings accounts, and other sorts of deposits) is estimated to be between $90 and $95 trillion.

It should be noted that this figure includes both actual cash and digital assets that symbolize money, such as bank deposits and other types of electronic money. It does not, however, include non-monetary assets such as stocks, bonds, real estate, or other types of wealth.

How far can BTC travel?

It is impossible to forecast what the precise price of Bitcoin (BTC) would be if it reached widespread acceptance, since various variables such as supply and demand, competition from other cryptocurrencies, government laws, and global economic circumstances might all impact its worth. But, we`ll try to make Bitcoin price prediction 2024 and further years based on M2 money supply.

However, one method for estimating a prospective Bitcoin price is to utilise the market capitalization of gold as a benchmark. The market capitalization of gold is around $10 trillion, which reflects the entire value of all gold ever produced. If Bitcoin just captured 10% of that market, it would have a market valuation of $1 trillion.

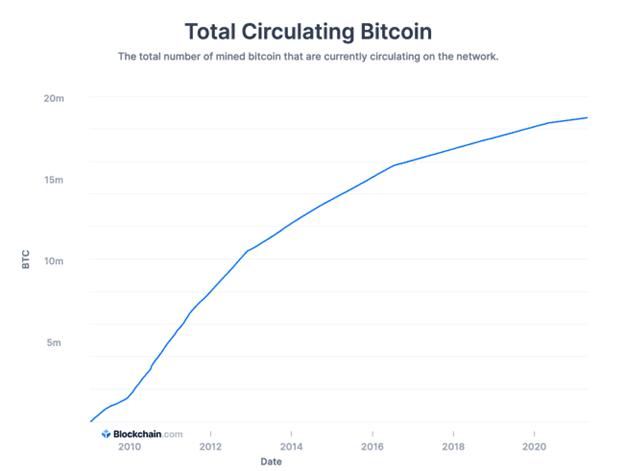

Assuming there are around 21 million Bitcoins in circulation, a $1 trillion market capitalization would result in a Bitcoin price of approximately $47,619 per coin. This is, however, a merely hypothetical situation and should not be interpreted as a guarantee of future performance. Bitcoin’s real price would be determined by a number of complicated and unexpected variables, and there are no assurances of success when investing in any cryptocurrency.

We’ve all witnessed Bitcoin rise much over $47,619 per coin. So this is by no means the end. So, what could it possibly be?

It is dependent on the future function of the BTC. I envision two probable outcomes:

- Bitcoin (BTC) as digital gold

- Bitcoin (BTC) as legal tender

1. Bitcoin is a kind of digital gold.

Bitcoin is sometimes referred to as “digital gold” because, like gold, it has certain properties that make it a desirable asset. It is a good means of trade since it is long-lasting, divisible, and readily transferred. It is also rare, and its worth is determined by the perceived usefulness and scarcity.

Overall, although Bitcoin has certain parallels with gold as a store of value and a hedge against inflation, it is a different asset with its own inherent qualities and hazards, which investors should carefully analyze before investing in Bitcoin or any other asset.

Because of the similarities, I can’t see BTC’s overall market cap ever surpassing gold’s. In a perfect world, a 20 trillion dollar market cap (2 times the value of gold) might be achieved. In this situation, 1 BTC is worth $952 380. Nearly a million!

2. The use of Bitcoin as legal money

If every nation accepted Bitcoin as legal cash, it would be a huge step forward for the cryptocurrency, and such a development would almost certainly result in a major boost in demand for Bitcoin, possibly pushing its price higher. In this situation, one conceivable approach to evaluate Bitcoin’s potential price is to compare it to the market capitalization of the global M2 money supply, which reflects the entire quantity of money in circulation. The worldwide M2 money supply is expected to reach approximately $95 trillion in September 2021.

In the hypothetical situation when Bitcoin captures just 50% of the global M2 money supply, its market value would be $50 trillion. With around 21 million Bitcoins in circulation, the price of a single coin would be roughly $2,380,950.

Summary

Finally, the total quantity of money in circulation worldwide is estimated to be between $90 and $95 trillion, including real currency and digital assets that symbolise money. Bitcoin’s future price is impossible to estimate with confidence because of the many variables that might impact its worth. If Bitcoin were to capture only a portion of gold’s market value, say 10%, it would have a market capitalization of $1 trillion and a price of about $47,619 per coin. This situation, however, is simply hypothetical and does not guarantee future performance. Furthermore, Bitcoin may play one of two functions in the future: digital gold or legal tender. In the former scenario, a market cap of $20 trillion with a price of nearly $1 million per coin is possible, whereas in the latter, a hypothetical scenario in which Bitcoin captures 50% of the global M2 money supply results in a market cap of $50 trillion with a price of around $2.4 million per coin. However, bear in mind that these possibilities are simply hypothetical and should be interpreted with caution, since there are several complicated and unexpected variables that might impact Bitcoin’s price in the future.

1 Comment

Pingback: Bitcoin Price Prediction Based On M2 - News Online | Concnews