Tyme Group has announced a series of leadership changes as it embarks on the next chapter of its growth strategy.

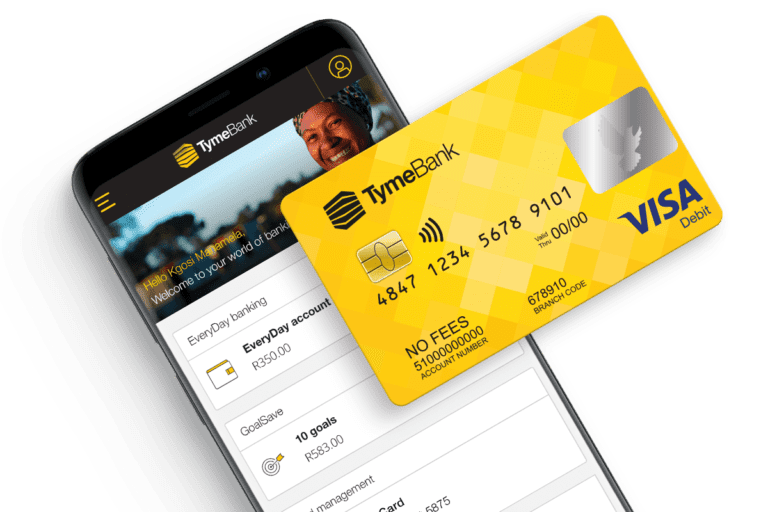

This follows TymeBank’s rapid growth in South Africa, where the bank is becoming entrenched as the credible alternative to legacy banks as it continues to make a real difference in the lives of consumers with its low-cost banking offering, high levels of customer satisfaction and the successful introduction of several products and services since launching in February 2019.

At the same time, Tyme Group, which has always aspired to be a multi-country business, is strengthening its position as an international digital banking group.

The group is making major advances in the Philippines with the imminent launch of GOTyme Bank, the digital bank modelled on South Africa’s TymeBank, and officially submitted its application for a digital banking licence in Pakistan in March 2022.

TymeBank Chairman, Thabani Jali, said: “TymeBank in South Africa has nearly five million customers, and the bank is on course to break even in 2023. We believe the time is right to redeploy key executives into positions that will let the group take advantage of opportunities that are opening up in new territories”.

As such, and aligned to this strategy, the group is pleased to announce the following leadership changes:

- TymeBank’s current CEO, Tauriq Keraan, will be appointed Group Executive: Growth Projects, responsible for leading Tyme’s establishment in new territories as part of the group’s geographic diversification strategy.

- Coen Jonker, the co-founder of Tyme and TymeBank, will be appointed TymeBank’s CEO in South Africa. His key priorities are the recruitment of several new senior hires to support bank’s growth trajectory, further transforming the TymeBank leadership team and leading selected strategic acquisitions.

- David Pfaff, Tyme Group’s current CFO, will take over from Coen Jonker as Tyme Group CEO; and

- Cheslyn Jacobs, who is currently responsible for TymeBank’s sales and service function, will be appointed Chief Commercial Officer of TymeBank, accountable for revenue generation.

With the exception of Jacobs’ appointment, which is effective 1 June, the leadership changes come into effect on 1 July, with the benefit of a three-month hand-over from TymeBank’s outgoing CEO Keraan to his successor, Jonker.

“Tauriq has been instrumental in making TymeBank a South African success story, having assimilated a multitude of unique learnings in the shaping of the bank’s business model through the formative period of its lifecycle. He is therefore the ideal person to lead Tyme Group’s establishment in new territories and shape the customer experience across the group,” added Jali.

This comes at a time when a changing regulatory environment is creating opportunities in countries across South and South-East Asia.

Tyme Group co-founder and incoming CEO Jonker, who has vast retail banking, fintech and deal-making experience and expertise both in South Africa and in several Asian markets, commented: “First, a huge thank you to Tauriq for his outstanding leadership – growing our customer base to nearly five million, growing the bank’s net operating income 12-fold through the pandemic, achieving consistently high customer satisfaction levels and successfully positioning TymeBank as a credible alternative to legacy banking in South Africa.

“We look forward to building on his accomplishments by continuing to enhance TymeBank’s unique value proposition for the benefit of South Africans across the economic spectrum. The team and I will remain focused on growing market share and introducing additional and exciting products and services.”

Commenting on his new appointment, Keraan said: “This is an exciting time for the group and having personally spent the last 13 years building and scaling digital banking businesses in South Africa, I look forward to playing a more active role in establishing Tyme Group as a leading global digital banking player. I am deeply indebted to the TymeBank team for their considerable contribution, without which TymeBank’s success would not have been possible. I have no doubt that the next phase of the bank’s growth trajectory will be equally exciting.”

In his new role as Tyme Group CEO, Pfaff will move to Tyme Group’s head office in Singapore where he assumes responsibility for the Group’s international growth strategy. His solid retail and international business experience will assist in executing existing, and exploring new, retail agreements with local and international business partners.

Pfaff said: “We have started testing our banking platform in the Philippines. The start-up team has been recruited, the leadership team has been assembled, and we are on track to launch GOTyme Bank, our digital bank to the market in the second half of 2022.

“We had previously indicated that Pakistan was under consideration as a third market and if our application for a digital banking licence in that country is successful, we will be operating in a combined market size of c. 400 million people.”