Given what we know now, we would have jumped at the chance to invest in internet companies like Amazon and Google back in the 90s. But, back then, picking the winning investment of the internet age wasn’t as easy as you think.

Surely investing in Amazon or Google early would have been one of the best investments of all time?

Sure but there were hundreds of internet companies to choose from back then. Even if you did invest in Amazon, would you have held on when it fell over 95% in 2001? That’s right, even the mighty Amazon fell over 95% before rising to become the company we know today.

Crypto investment firm Revix did a simulation where they ranked the top 50 internet companies by market capitalisation (which is just a fancy word for the company’s total value). They then invested in each company equally, right at the peak of the internet bubble in 2000. After investing 2% into each of these top 50 companies, Revix’s simulation left these investments untouched until 2017.

During this time, over 88% of these companies failed. But due to the power of diversification, the 2% allocated to the winners (Amazon and the likes) helped the portfolio recover all its losses and still managed to return an impressive 14% per year. That equates to an 828% (9x) return over the 17 year period.

That’s an incredible result but what does that have to do with cryptocurrency?

The lesson remains the same. Investing in crypto is just like early internet investing — it’s nearly impossible to pick the long-term winner when you are so early in crypto’s existence.

So how do we invest in crypto and make sure we always own the long term winners? The answer is with diversified crypto Bundles.

What are crypto Bundles?

Diversification simply means spreading out your bets.

By making multiple smaller bets as opposed to one bigger concentrated bet, you are much more likely to win. Except here, betting is investing and winning is to make a good return on your investment.

Just like Revix’s simulation above, it’s possible to invest in the entire crypto market in a similarly smart and diversified manner. A Bundle is essentially a basket of the top cryptocurrencies by market capitalisation — with an equal amount invested into each of them.

The top 10 cryptocurrencies (excluding stablecoins) currently account for over 72% of the total cryptocurrency market value. By owning the top 10, you’ll automatically track the broader cryptocurrency market and the growth that comes with it. There is no need to risk it all on one cryptocurrency or be dragged down by its individual cryptocurrencies.

Now that we understand diversification, what are the benefits?

Diversification works wonders for your investments and helps you invest for the long term.

Bundles are less risky and easier to hold onto because they are less volatile than Bitcoin, Ethereum and other single cryptocurrencies.

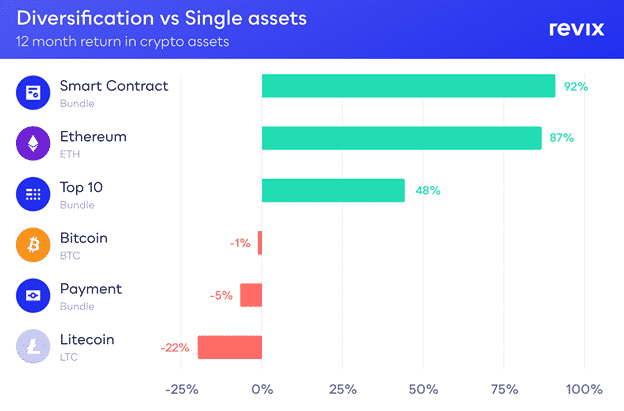

As you can see in the graph below, the Smart Contract, Payment and Top 10 Bundles have outperformed the major individual crypto’s in each Bundle in terms of returns and allowed investors a smoother ride with less price volatility.

“Diversification works in every investment class in the world. It should come as no surprise that it works in crypto as well,” says Sean Sanders, CEO of crypto investment firm Revix.

“Diversification works in every investment class in the world. It should come as no surprise that it works in crypto as well,” says Sean Sanders, CEO of crypto investment firm Revix.

Revix crypto Bundles vs BTC

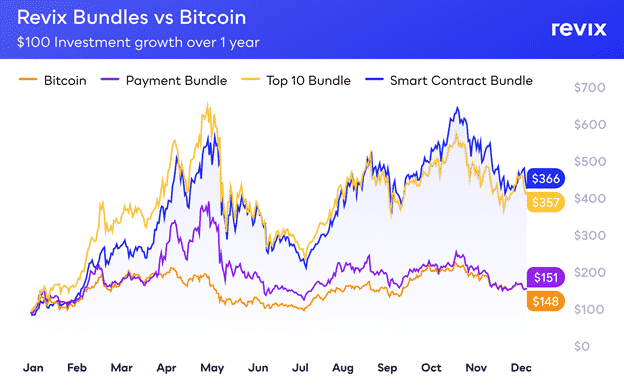

Let’s assume you make the jump and invest in a Revix Bundle, how does this compare to Bitcoin in terms of price performance and investment returns?

If you invested $100 into any of the Revix Bundles — that being the Payment Bundle, Smart Contract Bundle or Top 10 Bundle — you would have outperformed Bitcoin over the last year.

Historically, even if you bought Bitcoin at the worst possible time in Bitcoin’s existence, you would have still seen a return of 27% per year. Now that we know Revix Crypto Bundles outperform Bitcoin, it’s clear to see why investing in Bundles is the way to go.

But where can I invest in these crypto Bundles?

Cape Town-based crypto investment platform Revix is backed by JSE listed Sabvest and offers something unique to you, the investor. Set yourself apart from the rest by investing in ready-made diversified crypto Bundles which look similar to ETFs.

Their Crypto Bundles enable you to effortlessly own an equally-weighted basket of the world’s largest and, by default, most successful cryptocurrencies without having to build and manage a crypto portfolio yourself. Revix currently offers three Bundles:

The Top 10 Bundle is like investing in the top companies in the stock market but for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 75% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top 5 payment focused cryptocurrencies looking to make payments cheaper, faster and more global.

The Smart Contract Bundle provides equally weighted exposure to the top 5 smart contract-focused cryptocurrencies like Ethereum, Solana and Polkadot that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its OS operating system.

Revix Promotion

How would you invest if you knew you couldn’t lose? Revix is giving you that chance. From the 16th to the 28th of February, Revix is offering you the opportunity for an investment that cannot decrease in value. And if it does, Revix has you covered. It’s your chance to make money and diversify your portfolio with the confidence that you can only win.

How do I take part?

Sign up using the promo code: COVER. After signing up, you need to invest R5 000 into either the Smart Contract Bundle, the Top 10 Bundle or the Payment Bundle between the 16th of February and the 28th of February 2022*. During this period, your investment is covered against loss. If the value of the Bundle has decreased by the end of the promotion period, Revix will pay you back the difference. It’s that simple. You will be compensated in Bundle units only. *T&Cs apply.