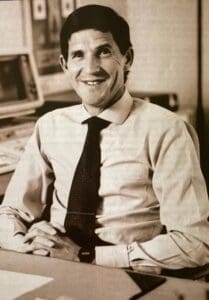

When I was a recently qualified chartered accountant stepping onto the JSE floor on 1 February 1972 as a runner, I didn’t dare to dream of the amazing career I’ve had, the incredible people I’ve worked with, and of the dramatic ebbs and flows of the markets as they’ve responded to history in the making each day.

I still choose to learn new things every day, but in the last five decades of working in what’s got to be one of the most exciting jobs around, I’ve learned a few key things that have stayed true through the years, no matter what was going on in politics anywhere in the world!

Build wealth, don’t preserve it

Preserving wealth for your retirement is simply not enough. Most of us now live longer than we planned for, and I’ve seen so many people who didn’t focus on building wealth have to dramatically downsize their lifestyles in their later years, simply because they lived longer than they or their financial adviser planned them to.

Management is everything

Whether you’re thinking of investing in a company or a country, you’ve got to learn about its management first. And remember that an investment relationship is just like any other relationship: it shouldn’t happen in a hurry, because you can’t fall in love overnight. You need to understand the business and its management, their track record and their plans for the future, before you commit.

The markets always recover

In 50 years, I’ve seen more market peaks and troughs than I would care to admit, but the markets always recover. That’s because business leaders are resilient and hardworking, and when things go wrong, they don’t sit back and wait for them to get worse, they roll their sleeves up and look for changes to make, to sort things out. That’s why I’ve always been an equities man.

New leaders can surprise you

We all underestimated Tim Cook when he took over at Apple, but in 11 years he has more than quadrupled the company’s revenues and profits, doubled the size of the business, and has overseen the value of Apple’s stocks increase 11-fold. Similarly, Microsoft’s Satya Nadella brought Microsoft back from the brink of irrelevance, having generated $1trillion in return for shareholders in the first six years in the role – all while carefully dismantling the company’s image as a corporate bully. This is another lesson in patience and learning: make sure that you really know who a business’s leaders are, before you invest.

Don’t invest geographically

My investment decisions have never been dictated by politics or economics, but rather by identifying opportunities. One of the huge benefits of the relaxation of exchange controls is that we can follow the money and see where it’s going to be spent – and invest there. You’ve also got to read the environment, which is why I believe that any business involved in decarbonisation is a good option right now – and why investing in fossil funds is going to see investors being in the awkward position of having to defend the indefensible soon.

Coming out of the pandemic, it’s easy to see that so many people are pressing the ‘reset’ button – they want to live cleaner, better lives that focus on the family relationships from which they were isolated for so much of the last two years. The pandemic has also taught us the importance of sharing and collaboration, and of being properly prepared for a health emergency – I believe that the health sector has learned many lessons in preparation and cooperation that are going to stand us all in good stead.

The other big thing that’s been clear in the pandemic and beyond is the massive growth in technology development, and how it continues to influence everything we do.

To watch the webinar please click here: https://contenthub.sasfin.com/insights/articles/50_golden_years/