In 2020, as the world was ravaged by the coronavirus, investment into financial technology (FinTech) companies in emerging markets decreased as funders sheltered against a volatile, risky environment.

Except that’s not the whole story. True, funding for Latin American and Indian fintech companies declined, but investment in African FinTech soared, according to research by Briter Bridges and BFA Global.

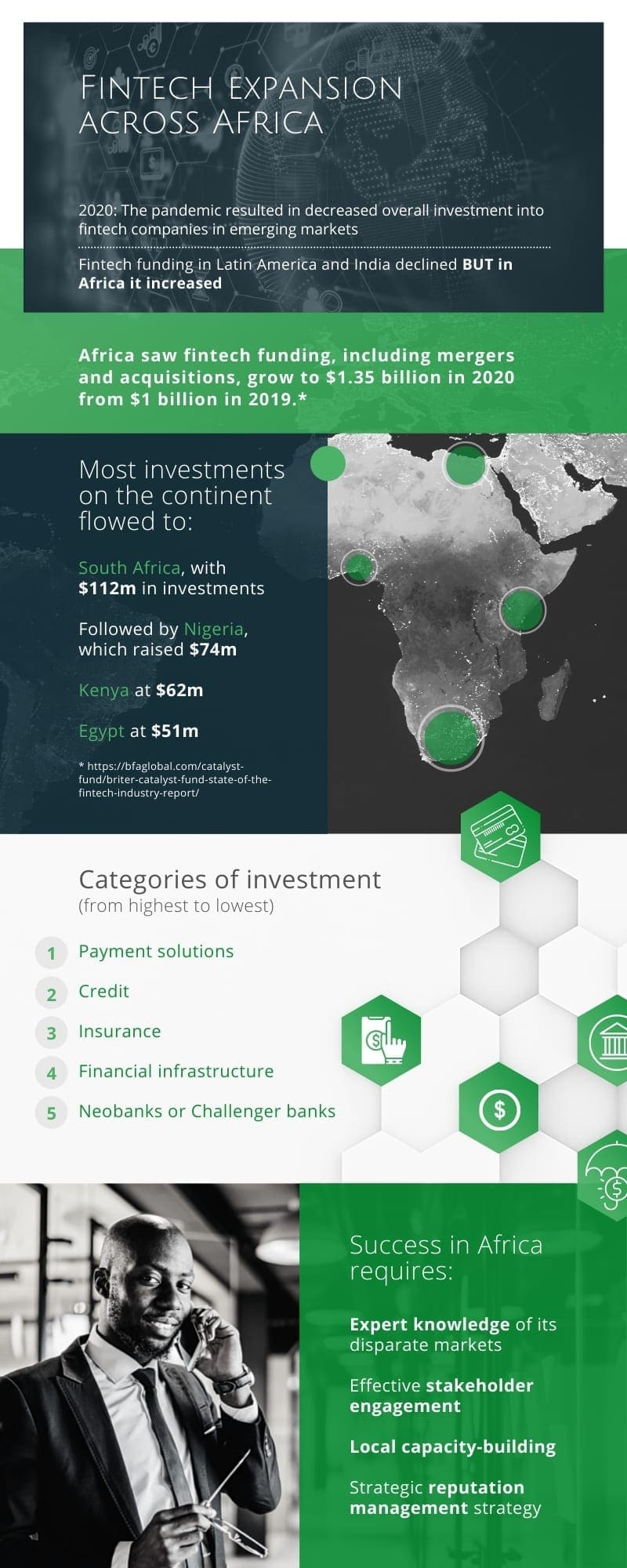

Africa saw FinTech funding, including mergers and acquisitions, grow to $1.35 billion in 2020 from $1 billion in 2019.

The trend reflects the increasing potential for growth in the continent. Africa has a growing population of 1.3 billion people, rising smartphone ownership and falling data costs.

Several African nations have made digital transformation a priority, with a parallel investment in telecom and data infrastructure. Fintech investors also see opportunity among its large unbanked population – only 40% of adults in sub-Saharan Africa had a bank account in 2017.

Most investments on the continent flowed to Nigeria, Kenya and South Africa, according to the Briter Bridges report, which surveyed 177 start-ups and 33 impact investors across emerging markets.

South Africa led the way with $112m in investments, followed by Nigeria, which raised $74m, Kenya at $62m and Egypt at $51m.

The Briter Bridges research also breaks down investment by product category, and shows that in Africa, payment solutions receive the bulk of funding, followed by credit, insurance, financial infrastructure and neobanks.

Payment platforms have seen the most visible success in Africa, and there is huge remaining potential to formalise payment systems and reach the unbanked and underbanked. The benefits of financial inclusion to the unbanked and underbanked are significant, and could kickstart an era of more secure, more productive economic activity across the continent.

For many venture capitalists, Africa represents a blank canvas; a new frontier waiting to be conquered. This idea of the continent as a single potential market has been supported by the implementation of the African Continental Free Trade Agreement (AfCFTA), which looks set to usher in a wave of multinational FinTechs looking to take advantage of more uniform trading conditions.

The reality is far more complicated, and far more interesting. Success in Africa still requires expert knowledge of its disparate markets, effective stakeholder engagement, local capacitation and a strategic reputation management strategy.

The potential of FinTech, as well as its primary challenge, lies in its ability to scale. This has as much to do with marketing, reputation enhancement, partnerships, stakeholder relations and brand building as it does with the underlying product.

In an increasingly competitive market, a fintech’s ability to differentiate itself and establish a public persona strong enough to carry it across a continent is an advantage as powerful as an innovative product. Companies can stand or fall based on their ability to develop and maintain a coherent, attractive brand proposition.

Laying a firm foundation for continental expansion, with a corresponding strategic approach to reputation management and stakeholder relations, can help prospective multinationals avoid many of the pitfalls that have stopped promising companies in the past.

To expand across a continent, partnerships need to be forged across a disparate set of geographies and operating conditions. There is also the expectation that multinationals will support local employment, industries and value chains. This requires communications competencies in terms of working with governments, regulators and communities.

FinTech moves quickly, and partners are on the lookout for newsmakers and growth. Make sure your successes are broadcast where potential collaborators can see them. In this regard, localised and centralised communications strategies need to take place concurrently.

Knowledge of media landscapes and contexts within individual countries is crucial, as is an ability to tie individual stories together to craft compelling, organisation-wide narratives.

There is tremendous potential in Africa, and it is more accessible than ever for companies looking to expand. But as always, it rewards those who take a considered, strategic approach, and who keep the integrity of their brand and reputation top of mind.

- Webster Malido, Managing Partner at Aprio – African Regional Markets