As actions are taken against the virus, customer behaviours will also adjust and this will have a huge social and economic impact.

FNB CEO Lee-Anne van Zyl said over the past few days “Our customers can use our app to download bank statements and manage their debit or credit cards without going into a branch”

Online financial service QuotesAdvisor.com has analyzed its website transactions and the results indicate a change in customers’ behaviour as a result of the outbreak.

“In the last days we registered a slight increase in the number of online payments, and we expect this trend to continue, as more people adjust their everyday habits to reduce the risk of virus transmission” said Christian Rennella, the CEO of the company. “Although a 30% drop in transactions is expected, online payments will increase by at least 12% in relative terms,” he added.

On the other hand, Capitec recently said people should avoid cash and ATMs as they are touched and handled by a high number of people daily.

- Avoid using an ATM and rather bank on our app, *120*3279# or use internet banking. Knowing the virus can survive on various surfaces including ATMs.

- Pay with a card, if possible tap but if you have to enter a pin, use an alcohol-based hand sanitiser immediately.

- If you can’t avoid a branch visit, hand sanitisers will be available in all our branches.

The current situation of online payments in SA

Online payments are becoming more frequent almost everywhere in the world, and South Africa is no exception. However, the current situation reflects that especially those from low-income households, the elderly, and people in rural regions, cash is the main method of payment for most South Africans. This is justified in part because only 37% of the country’s 55 million citizens have access to smartphones according to an Ipsos report.

According to a study by PYMNTS.com cash continues to be the trusted and most widely used payment method in the country, with over half of consumer transactions still being paid in cash.

In addition, a Twitter survey carried out by Capitec discovered that 35% of South Africans could see themselves conducting purely digital transactions, while another 10% said “maybe”.

We Are Social and Hootsuite have published the latest Digital 2020, showing how the world’s internet population has changed over the past 12 months.

South Africa has 36.54 million internet users of a total population of 58.93 million people. In other words, a penetration rate is 62% of the total population. Only 22 million of them are active users on social networks, as indicated by We Are Social.

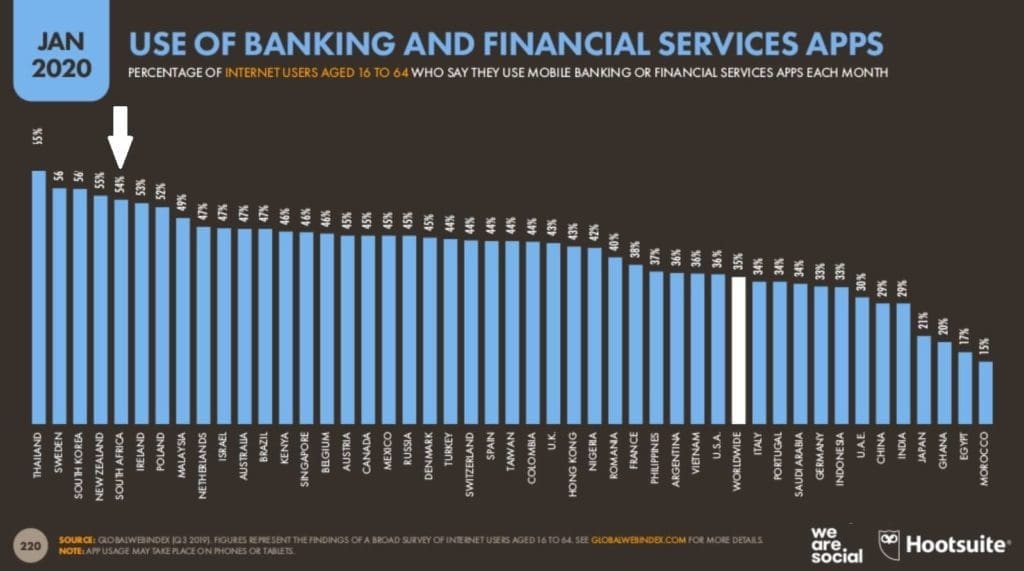

According to the report, 54% of South African internet users use mobile banking or other financial services every month. This is far higher than the global average of 35% of internet users using online financial services.

In Sweden, 95% of payments for both goods and services are made through the online application Swish. With this application, you can pay from candy to transactions of large amounts of money.

In China, 80% of the population carry out their monetary transactions through mobile phones with QR technology. All smartphone users are already accustomed to going out on the streets with no cash since they can pay in most stores with their mobile phone services such as taxis, buses and even street merchants.

In South Africa, there is currently a multi-million dollar battle for online banking. Proof of this was the recent launch of three new digital banks: Discovery Bank, TymeBank and Bank Zero.

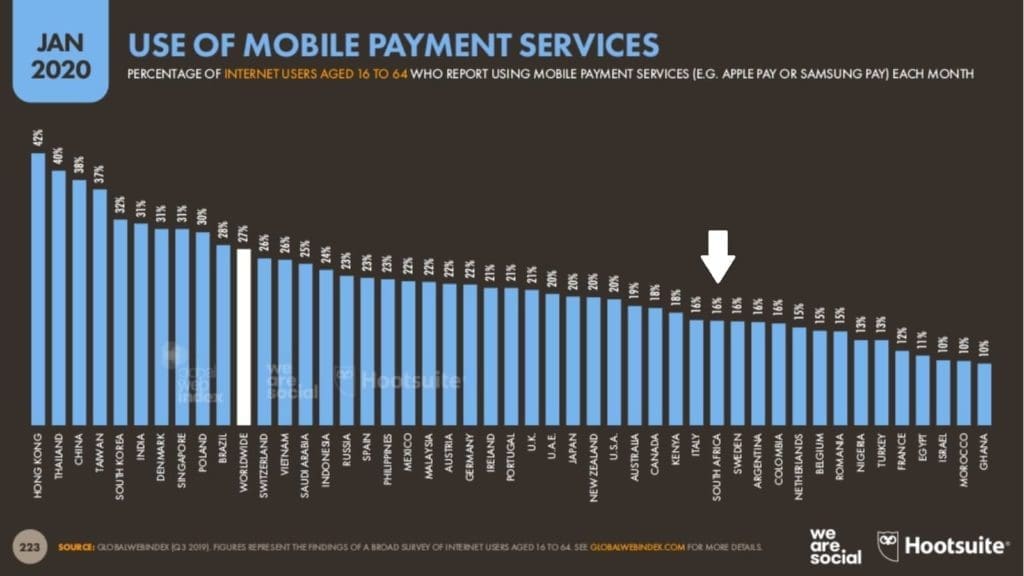

Regarding online payment services, the situation is different. A setback is seen with respect to financial services due to low confidence in platforms such as PayPal, Apple Pay or Samsung Pay.

Use of credit cards in SA

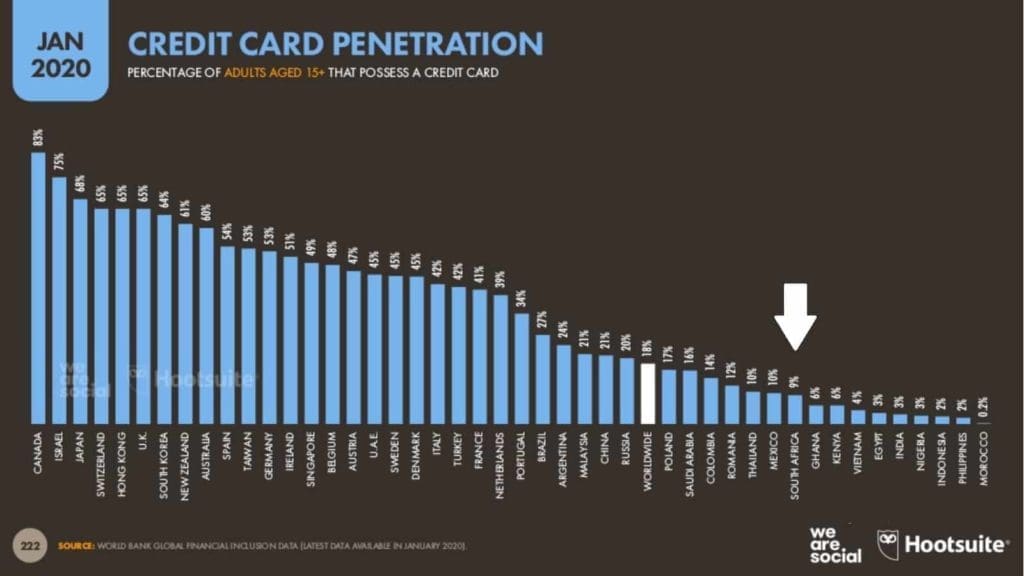

As for credit cards, South Africa’s average credit card penetration is lower than the global average according to the report. 9% of adults over 15 years old have an active credit card. The global average is 18% and the leading country is Canada 83%, followed by Israel 75% and Japan 68%.

Benefits of avoiding cash

Safety

For many of those who are already using electronic money, using cards or managing money through any device with Internet access find it much safer than carrying a certain amount of money in their wallets or purses. This prevents them from the risk of robbery and loss of money.

Time-saving

Online payments will always be faster than physical money management. With a few simple clicks, you can transfer money to an account or pay for any good or service, as well as transferring money to people or entities that are abroad without the need to go to a bank.

Convenience

Managing money through mobile phones or from a computer becomes more convenient for its users since they do not have to go to a bank to withdraw money or wait to be attended in the case that they wanted to carry out a banking operation.