By now you’ve probably heard about MoMo, a mobile money service.

MoMo is back in the limelight that’s because MTN has relaunched the service in South Africa.

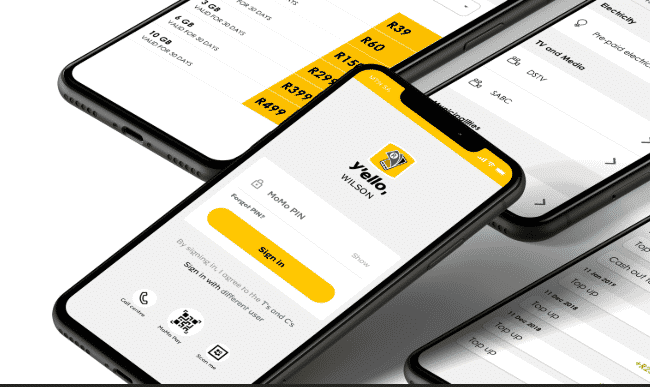

The service enables customers to use their mobile phones, and other devices, to send and receive money.

MoMo also allows users to purchase airtime, prepaid electricity, and pay for their municipal bills and DSTV subscriptions.

In September 2016, MTN revealed it was withdrawing the MoMo offering in the country due to a lack of commercial viability.

The service was first launched in 2012 when MTN partnered with the South African Bank of Athens, Pick n Pay and Boxer stores to offer a mobile money service.

It involved enabling the opening of simple bank accounts via phones.

But it’s important to grasp the goal of the relaunch of MoMo in South Africa.

The move reflects a consistent escalation in ambition by MTN, which already delivers financial services to 30 million people through MoMo across the continent.

If MTN succeeds even modestly with its plans for MoMo in South Africa, it could unleash new innovative service for its customers.

Momo’s likely success in South Africa would mean MTN has succeeded in diversifying its revenue streams.

This would provide a cushion considering the pressure service providers are under to reduce data prices.

The idea of bringing back MoMo is to woo customers into new offerings.

Felix Kamenga, MTN’s chief officer of Mobile Financial Services, agrees and believes that MoMo is about financial inclusion and economic transformation for all South Africans.

Asked whether the relaunch of MoMo in South Africa is a foundation for other financial services products, Karenga, responded in the affirmative, saying “Yes”.

He added in fact, MoMo is our second Mobile Financial Services offering.

“In July 2019 MTN, in partnership with Sanlam launched the insurance (InsurTech) product dubbed SanlamIndie. The offering includes funeral cover, which automatically doubles its cover after two years at no extra cost, for example, if you are covered for R50,000 per annum, Sanlam Indie will automatically double your cover to R100,000 after two years of your policy.”

On whether MTN is keen to buy FinTech startups to bolster its financial services products, Kamenga said the company’s focus for the next coming months is to ensure that the newly launched Mobile Financial Services division within MTN SA operates at its best.

“This includes introducing new FinTech offerings and maintaining the current offerings,” he explained.

Furthermore, MTN is exploring a broad range of financial services to entice customers.

Kamenga said:

“We are exploring more possibilities with MoMo. Currently we are in phase one, which allows MoMo to provide basic services such as buying electricity, paying DSTV etc. We foresee MoMo doing more than that. We aim to integrate more of our offering into MoMo i.e insurance, loyalty programme etc.”

If the telco is to be believed, so far, things are shaping up well with the relaunch of MoMo.

Kamenga said the uptake of MoMo has been great since the relaunch on the 31st of January 2020.

The company is attracting its own subscribers to join MoMo by zero-rating its service.

While MoMo customers who are not MTN subscribers will be charged 20 cents for every 20 seconds.

What are the other things MTN is implementing to ensure its MoMo service is unique so that it achieve critical mass?

“This time around MTN will leverage a significant national footprint to reach more South Africans,” assures Kamenga.

“The offer is also not limited to MTN customers, in fact, the new MoMo can be used by all South Africans either via USSD or the MoMoApp.”

The new MTN Mobile Money service comes with innovative new features that cater to the current economic landscape and consumer behaviour.

“Various studies have shown that most South Africans withdraw their whole salaries and welfare grants. There is limited usage of formal products simply because they do not meet the needs of the consumer either in their utility, features or costs. It is then a prime objective of ours to offer innovation and disruption in product design and distribution networks and customer engagement,” Kamenga explained.

In addition, the cost of accessing the formal banking infrastructure and products, even for low-cost accounts is high, primarily driven by transport costs to reach towns and cities where there are bank branches, ATMs and retail chains, he added.

“These are the issues that MTN SA has taken into consideration when building the new mobile money service.

“This time around, we are focusing on building a wide footprint so customers can deposit and withdraw monies, a simple product that meets customer needs, cost and system efficiency and customer engagement that is effective.”

Although South Africa is highly banked with over 80% of banking penetration, various studies have shown that most workers withdraw their whole salary to settle bills, pay for services and purchase goods.

So how is MTN aiming to convince South Africans that cash is not king?

Kamenga said, “There is limited usage of formal products simply because they do not meet the needs of the consumer either in their utility, features or costs.

“The cost of accessing the formal banking infrastructure and products, even for low-cost accounts is high, primarily driven by transport costs to reach towns and cities where there are bank branches, ATMs and retail chains. These are the issues that MTN SA has taken into consideration when building the new Mobile Money service.”

MTN has partnered with UBank to deliver the MoMo service.

UBank owns the banking license, holds and manages the cash-in bank account, and issues funds against the receipt of cash into the cash-in account. UBank is also responsible for guaranteeing the customer’s cash-outs. Whereas, on the other hand, MTN is the ‘agent’ responsible for accepting cash-ins on behalf of UBank, and for servicing customers, controlling daily MoMo transactions and overall customer experience.