Over the past 24 hours, Bitcoin (BTC) price has increased marginally, breaching the $109,100 mark, driven by lower macro-economic pressure and positive inflows from ETFs.

Should this continue, BTC analysts have indicated that it could rally to $130,000, driven by reduced inflation fears, improving liquidity, and interest from sovereign wealth funds and family offices.

Bitcoin Price Prediction: Institutions Double Down on $130,000 BTC Target

According to a recent Coinbase survey, 67% of institutions and 62% of retail investors expect Bitcoin to reach $130,000 within three to six months. That level of consensus is rare, even in crypto’s history of wild cycles. Bull noted that ETF inflows, inflation hedging, and corporate adoption will drive the next BTC leg up.

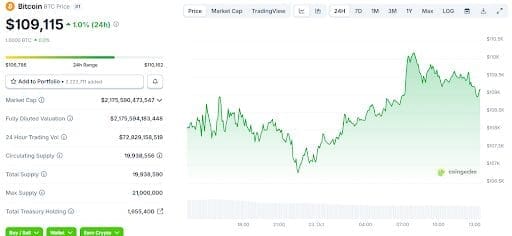

Bitcoin Price Chart | Source: CoinGecko

JP Morgan analysts echo the sentiment, citing equity liquidity rotation into digital assets. Long-term investors are front-loading exposure with the next halving less than six months away. “Bitcoin’s on-chain data shows supply at its lowest velocity since 2020; it’s a classic setup for a breakout,” the bank’s report noted.

Retail Sentiment Reignites as Halving Hype Builds

Meanwhile, Retail traders, long considered the emotional heartbeat of crypto markets, are back in force. Google search interest for “Bitcoin price prediction” has hit a 12-month high, while open interest in BTC options surged 22% this week alone. Many investors see this as a “pre-halving accumulation phase,” a pattern historically followed by exponential gains.

Meanwhile, SoSoValue data reported that Bitcoin spot ETFs amassed $477 million in net inflows on October 21. IBIT, the BlackRock Bitcoin spot ETF, accounted for the most significant single-day net inflow, $211 million, amounting to $65.092 billion of historical net inflows.

As of this report, BTC trades at $109,115. If ETF demand and retail enthusiasm continue to align, Bitcoin could easily retest its $126,000 high before attempting a push toward the coveted $130,000 mark.

While Bitcoin Eyes the Next Leg Up, Remittix Quietly Redefines Crypto Payment

As traders chase the next Bitcoin milestone, projects delivering real-world impact quietly emerge as the market’s dark horses, and Remittix (RTX) is one of them. The platform allows users to send crypto directly to bank accounts in 30+ countries, settling transactions instantly without intermediaries or KYC barriers.

With its wallet beta in testing since mid-September and the crypto-to-fiat web app nearing integration, users can instantly transact across 40+ crypto tokens, without intermediaries or KYC barriers, a breakthrough for underbanked regions.

Whales and retail investors have already accumulated over 681 million RTX, amounting to $27.7 million. As the next CEX listing looms and the community giveaways continue, momentum around RTX remains strong.

At just $0.1166 per RTX, Remittix delivers real utility and a powerful entry point.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway