Stellar and XRP are both rebounding as cross-border payments heat up, and many traders are asking if they are overlooking Remittix (RTX) while watching the recovery. The XLM price prediction conversation is back as volatility cools, liquidity stabilizes and on-chain activity rebuilds. Below, we track Stellar’s reset, review fresh XRP headlines and outline why some investors are rotating a slice of gains into Remittix during this window.

Stellar: Post-Shakeout Setup And The XLM Price Prediction Map

The market whipsaw flushed leverage, then Stellar rebounded. XLM trades at $0.326235, after a steep decline from below $0.19 and then a fast recovery above $0.31. Open interest declined from approximately $160 million to roughly $81 million, which generally is a healthier bottom after forced selling is out.

For an actionable XLM price prediction, deleveraging matters because cleaner positioning can let spot demand lead the next leg. Technically, the XLM price prediction hinges on holding support around $0.31 and reclaiming the $0.34 to $0.36 zone. Daily RSI near the high 30s suggests room to bounce, while price hugging the lower Bollinger Band hints at oversold conditions.

If buyers defend $0.31, an XLM price prediction scenario targets a grind toward the band midline and prior supply near $0.38. Lose $0.31 with rising open interest and the XLM price prediction tilts back to a retest of $0.28 first support.

XRP: Security Caution And Institutional Backdrop

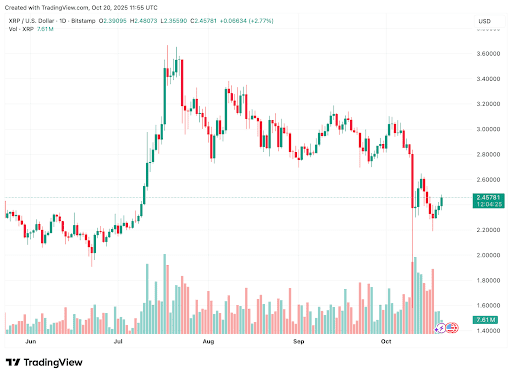

XRP trades near $2.45 after a broad market reset. The community is digesting a high-profile wallet theft, where funds reportedly moved through off-exchange channels tied to Southeast Asia. The lesson is that users should always secure seed phrases, avoid importing seeds into hot apps and verify device workflows. While retail headlines stung, XRP futures open interest and large-trader participation remain elevated, which keeps liquidity deep if risk appetite returns.

From a charting point of view, XRP’s short-term range floats around $2.40 to $2.70. A close above $2.70 and holding would entice a move up to $2.80 to $3.00, with a fall below $2.40 exposing $2.32 to $2.30 support. Macro economic releases, ETF activity and breadth will say a lot as to which direction dominates.

Remittix: Payments Utility Many Are Adding On Pullbacks

Remittix keeps appearing on watchlists while majors chop. Investors like the clear payments thesis, crypto-to-bank rails and a live wallet that people can actually test. Remittix price is $0.1166, it has sold over 679 million tokens and it has raised more than $27.5 million to date.

Remittix Highlights

- Top-Tier Security: Ranked #1 on CertiK, confirming solid smart-contract protection and strong team credibility.

- Live Product Access: The wallet beta is operational, processing verified payouts in real time.

- Expanding Reach: Global partners and payout corridors continue to grow as adoption rises.

- User-First Design: Built for freelancers, businesses and remitters and not just traders chasing price action.

Bottom Line: Are Investors Missing The Next Big Move?

A leverage flush, calmer funding and firmer spot bids make a constructive backdrop for Stellar, so a measured XLM price prediction favors stabilization above $0.31 and tests higher if momentum improves. XRP remains liquid, though security discipline is front and centre after the theft story.

For investors who want exposure to a payments utility while majors consolidate, Remittix offers a simple case, live product signals, $0.1166 pricing, over 679 million tokens sold and more than $27.5 million raised, which is why some are building positions alongside their Stellar and XRP holdings.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway