Chainlink (LINK) has leapt into the spotlight, climbing above $24.50 on heavy institutional accumulation and technical breakout signals. Following its resurgence, analysts have identified LINK as one of the best infrastructure-based plays at the moment, while adding that newer presales and Layer-1 networks like SUI and MAGACOIN FINANCE also look like high-ceiling opportunities for those tracking the next wave in the crypto market.

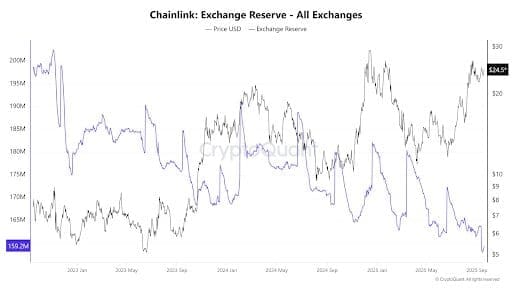

LINK sees supply shock as exchange balances hit the lowest level since 2022

LINK surged roughly 6% on Friday, breaking above $24.50. Much of this move came as firms like Caliber added over $6.5 million in LINK to their treasuries, while the Chainlink Reserve itself snapped up another ~$1 million worth of tokens.

On-chain data confirms accumulation, with exchange reserves dropping and supply held by top addresses rising. According to Coinbureau, LINK balance on the exchange has dropped to the lowest level since 2022, with holders not showing signs of selling.

While it has declined again to $23 due to the Bitcoin dump, analysts believe LINK could experience a supply squeeze.

What is driving LINK accumulation?

The recent LINK accumulation is connected to the sentiment that the token is undervalued. With TradFi institutions embracing crypto and blockchain, many believe Chainlink technology will be at the center of onboarding them.

Already, several banks have tapped Chainlink technology, with the US Department of Commerce also adopting it for presenting macroeconomic data on-chain. Chainlink Labs General Counsel Ben Sherwin was appointed to the CFTC Digital Assets subcommittee.

Interestingly, there are also high expectations around a spot LINK ETF after the US Securities and Exchange Commission (SEC) released guidance a few days ago. There are already pending ETF applications for LINK from major issuers like Bitwise and Grayscale.

SUI captures Layer-1 Growth Outlook

Meanwhile, SUI continues to gain respect as an up-and-coming Layer-1. Its Move programming language, low-latency consensus, and growing DeFi adoption make it one to watch after it recently neared $4.

Analysts project SUI could reach $12 to $18 by 2026, provided its ecosystem expands around gaming, NFTs, and institutional uses.

With many investors seeing LINK as offering strong foundational value, networks like SUI represent the potential asymmetric upside with slightly more risk, but greater reward if the market rotates toward newer smart contract platforms.

MAGACOIN FINANCE: Presale Momentum Builds

With LINK and other value-driven altcoins gaining momentum, presale projects are catching fire, with MAGACOIN FINANCE now on the watchlist of several analysts as one of the top coins to buy for the cycle. The project has already closed with multiple stages, amidst expectations of massive upside with an exchange listing.

Observers are comparing its current presale dynamics to early Ethereum ICO behavior, citing scarcity mechanics, burn or deflationary design, and a rapidly growing community.

Conclusion: Where to Position

In the current crypto cycle, LINK stands out as one of the best bets with strong technical, utility, and macro tailwinds, like possible LINK ETFs. Still, emerging Layer-1 network SUI offers compelling growth, while MAGACOIN FINANCE presents a potential for outsized returns for those willing to diversify from popular altcoins.

For more on MAGACOIN FINANCE, including presale access and updates, visit their official channels:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance