Ethereum price is powering higher toward uncharted territory, and Aave’s explosive growth is adding fresh fuel to the DeFi market. Yet, while these giants are making headlines, early-stage investors are watching Remittix closely. The $0.0944 PayFi token has already raised over $19.5 million from the sale of more than 599 million tokens at $0.0944 each and is gearing up for milestones that could multiply its value many times over.

Ethereum Price Momentum Targets $7,500

Source: Crypto Jelle

Since bouncing off the $2,100 mark in June, Ethereum price has risen progressively, smashing resistance levels and making it solid at the $4,000 mark. ETH is currently trading at about $4,600 and a move to a new high will see it hit the 5K mark in the short-term. The bullish crossing of the 100-day moving average and 200-day moving average highlights just how confident the market is and the larger uptrend channel pattern indicates that the rally may continue to push up to $7,500 over the next few months.

Even with the RSI flashing overbought conditions, any pullback is likely to be shallow. The combination of strong fundamentals, reduced exchange reserves, and expanding DeFi adoption reinforces Ethereum’s position as one of the top crypto to buy now. This makes ETH a vital anchor in early stage crypto investment portfolios alongside high-growth opportunities like Remittix.

AAVE News: Record-Breaking $25 Billion in Active Borrows

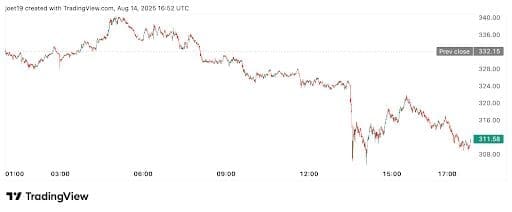

Source: TradingView

In AAVE news, the protocol has exceeded 25 billion in active borrowings, an important milestone of decentralized lending. This rush is attributed to an increased need in liquidity, as the traders are using Aave to perform yield farming, cross-chain strategies, and leverage positions.

The collaboration of Aave and Plasma to create the first on-chain institutional fund has a chance to open the gates to major inflows of institutional capital. Coupled with AAVE trading near $310.66, the protocol’s momentum is boosting confidence in the broader DeFi project sector. Low gas fees and faster transactions are making DeFi more attractive than ever, benefiting not just large-cap tokens but also low cap crypto gems positioned for exponential growth.

Remittix: The Low-Cap Crypto with High-Impact Potential

While Ethereum price and AAVE news dominate market chatter, Remittix is quietly building the case to be the next 100x crypto. The project is designed to solve real-world payment challenges by enabling instant cross-border transfers, integrating 40+ cryptos, and offering real-time FX conversion at low gas fees.

The upcoming beta wallet launch will bring features tailored for both individuals and businesses, including a business API to attract new liquidity into the ecosystem. Importantly, when Remittix hits $20 million raised, the team will announce its first centralized exchange listing — a catalyst that could send buy pressure soaring.

Key drivers for Remittix growth:

- Major CEX listing reveal at $20M milestone

- Beta wallet launch with instant bank transfers in 30+ countries

- Security audit by top blockchain firms

- Deflationary tokenomics favoring long-term holder value

- Strong adoption push in the global remittance market

Why 2025 Could Belong to Low-Cap Innovators

Ethereum and Aave remain core holdings for DeFi-focused investors, but the outsized returns in the next big altcoin 2025 rally are likely to come from low cap crypto gems. With its unique blend of payment utility, strong tokenomics, and imminent exchange news, Remittix stands out as one of the best crypto project 2025 investors can position into now. If market momentum continues, that $0.0944 entry could look like the early days of Ethereum itself.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway