Bitcoin has entered a bear market phase, according to analysts, signaling a meaningful shift in the current cycle. The assessment is not driven by a single sell-off, but by weakening demand metrics and long-term indicators that have fallen below historical trends. Analysts cited data showing that Bitcoin demand growth has slowed materially, a pattern that has historically aligned with bear market conditions.

As downside momentum builds, behavior changes quickly. Capital becomes more defensive, and investors begin prioritizing preservation, usability, and control over speculative positioning.

This transition often shifts attention away from price-driven narratives toward platforms that continue functioning regardless of market direction. In that environment, solutions built around real financial use, such as Digitap ($TAP), are beginning to surface earlier in discussions as investors reassess how they manage value during a downturn.

Why Analysts Say This Is More Than a Short-Term Dip

Why Analysts Say This Is More Than a Short-Term Dip

Analysts pointing to a bear market are not reacting to one red day. Their assessment is based on weakening demand trends and changes in long-term behavior. Data from on-chain analytics firms shows that Bitcoin demand growth has fallen below its long-term average, a pattern that has historically aligned with bear market conditions.

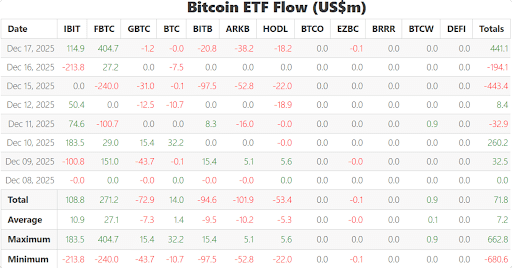

Another signal reinforcing this view comes from institutional activity. U.S. spot Bitcoin ETFs, which were major drivers of accumulation earlier in the cycle, have recently turned into net sellers. This reversal suggests that institutional appetite has softened rather than expanded.

The above table shows the changes in BTC holdings for the last 10 days. Source: bitbo

Bear markets also change investor behavior. Instead of chasing short-term upside, capital becomes selective. Liquidity moves away from crowded trades and toward setups that offer clarity and practical value. In these phases, participants start asking different questions, not just what can rally, but what can still be used, managed, and relied upon while volatility persists.

Digitap Emerges as a Banking Escape Hatch in a Bear Market

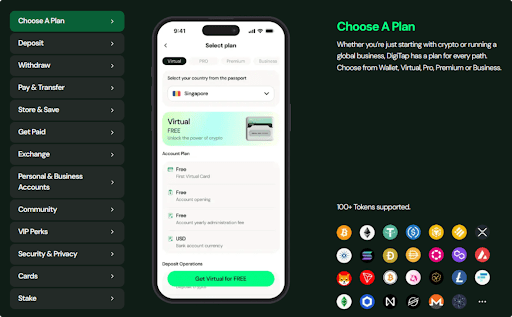

As the market turns defensive, Digitap is being discussed less as a token narrative and more as a financial utility. Positioned as a crypto-banking platform, Digitap focuses on giving users direct control over spending, payments, and money movement, areas that tend to matter more during downturns than during speculative runs.

Digitap’s timing is notable. While broader markets slow, the project continues progressing through its structured presale. It is currently in Presale Round 3, with $TAP priced at $0.0383, set to increase to $0.0399 in the next stage. This fixed pricing structure removes exposure to daily market swings and allows participants to engage without reacting to chart volatility.

The project has also launched its 12 Days of Christmas campaign, a seasonal initiative designed to maintain steady engagement during December. The campaign includes 24 rotating festive rewards, refreshed every 12 hours, encouraging ongoing participation without relying on urgency or hype. In a market where many teams pause activity during uncertainty, this steady cadence signals continued execution rather than reactionary promotion.

How Digitap Is Built for Bear Markets, Not Just Bull Cycles

How Digitap Is Built for Bear Markets, Not Just Bull Cycles

Digitap’s appeal during a bear phase comes from how its tools align with everyday financial needs rather than trading behavior. Instead of encouraging users to time the market or react to short-term price swings, the platform is designed around usability and control.

Through Visa-linked accounts, users can spend crypto in real-world settings much like traditional money, reducing the psychological pressure of deciding when to convert assets during volatile conditions.

The platform also simplifies how users manage funds across currencies. Crypto and fiat balances are held within a single unified wallet, allowing deposits, payments, and transfers to happen seamlessly without switching between multiple apps or accounts.

This structure is particularly useful for individuals who operate across borders, as Digitap supports global payments and transfers beyond the limits of conventional banking systems, offering flexibility during periods of regional or market instability.

Accessibility and autonomy are further reinforced through privacy-first options. With no-KYC access available, Digitap lowers entry barriers for users who prioritize financial independence while maintaining control over their assets. Beyond payments, $TAP plays an active role within the ecosystem.

By staking tokens, users unlock membership tiers and rewards tied to participation rather than speculative trading. Together, these elements position Digitap as a functional financial layer built for continuity, a distinction that becomes increasingly relevant when markets turn cautious, and utility takes precedence over price action.

What This Bear Market Shift Is Signaling for Digitap ($TAP) Into Year-End

Bear markets tend to reset priorities. As leverage unwinds and speculative narratives lose influence, attention shifts toward platforms that can operate consistently without relying on price momentum. This phase is less about chasing upside and more about identifying systems that remain useful when conditions are restrictive.

Digitap fits naturally into this transition. Its structured presale, ongoing development, and focus on real financial functionality reflect an approach built for durability rather than cycles, positioning it as a best crypto to buy mindset choice rather than a short-term trade. Instead of waiting for sentiment to turn, the platform continues progressing, offering tools that users can rely on regardless of broader market direction.

As the year draws to a close and capital becomes more deliberate, opportunities rooted in structure and usability tend to stand out. For participants evaluating the best crypto presale during a defensive market phase, Digitap’s ongoing presale offers a clear way to engage early with an ecosystem shaped by practicality rather than speculation.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway