The Federal Reserve delivered a widely celebrated and anticipated 25 basis point rate cut in September. Markets were pleased at first, as they should be. Falling rates are one of the largest catalysts for risk-on assets, especially crypto.

But that wasn’t enough. Investors placed a near-100% likelihood of two rate cuts before the end of the year. Without the second rate cut, risk-on assets were riskier. The list of best altcoins to buy would shrink.

The drama ensued. Polymarket bettors placed a nearly 80% likelihood of a rate cut in December and that plummeted to 20%, only to bounce back recently to nearly 70%. Most recently, Fed officials struck a sharply hawkish tone in its updated outlook, signaling that rate cuts were off the table and tightening was possible if inflation remains a concern.

As altcoin prices imploded, Digitap ($TAP), the maker of the world’s first “omni-bank,” showed stability in its presale. Digitap earned not only the title as a top altcoin to buy but a perfect hedge against the market carnage.

Source: Digitap

Digitap’s Utility Puts It On Crypto To Buy Now Lists

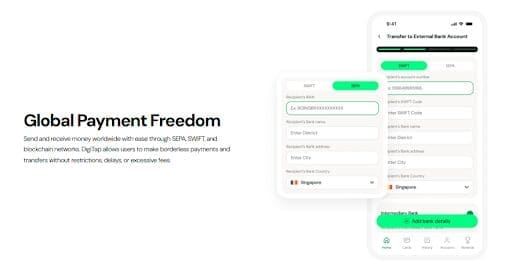

Digitap is a relatively new crypto project with a fintech super banking app that blends crypto and fiat services. Users can send, receive, store, save, invest, and spend multiple fiat currencies via offshore IBAN accounts and transact with more than 100 cryptocurrencies.

A recent partnership with Visa introduced the globally recognized payment card brand to Digitap’s lineup of services. The Digitap debit card is now co-branded with Visa and lets users spend their money anywhere Visa is normally accepted. The app will automatically convert the right amount of a user’s crypto to fiat at the time of transaction if they choose to spend their digital currencies instead of fiat.

An optional no-KYC signup process provides basic features and is a killer feature for the more than 1 billion users worldwide who are underbanked or unbanked. Many of these people live in countries where access to ID is difficult if not impossible, implying they were never able to join the global financial community.

3 Reasons Digitap’s Presale Acts As A Volatility Hedge

Digitap’s crypto presale project of its native $TAP continues to be a standout performer as most altcoins are crashing. In the weeks leading up to the Fed’s hawkish shift, Digitap had already garnered attention as one of the top altcoins to buy after surpassing $2 million raised in spite of the overall market weakness. As chaos and uncertainty continue to dominate the market, Digitap’s presale has become a refuge for rational investors.

Unlike exchange-traded tokens, a presale token’s price does not trade down when the market panics. Digitap’s $TAP price is set in phases with the initial phase kicking off in late summer at a price of $0.0125. Today, the token trades at $0.0326, giving early investors a more than 150% paper profit.

Compared to someone’s Uniswap altcoin bag that might be down 60% in a day, Digitap investors continue to see their cost basis increasing. In effect, Digitap is providing shelter from volatility. Its value is immune to immediate sell-off pressures and not subject to Fed headlines.

The flow of funds into Digitap actually accelerated during the market crash, largely because it offered investors something real that others can’t: a safe haven from crashing prices.

How Sub-1% Cross-Border Fees Deliver Real-World Relief

Digitap’s reputation as a hedge wouldn’t last more than a day unless it had something to offer beyond a tiered crypto presale structure. Indeed, Digitap is not a meme coin or a speculative DeFi protocol; it is a fintech platform aiming to solve real-world banking friction, making it one of the best crypto to buy.

Consider Digitap’s cost structure. By leveraging the best of both fiat and crypto, Digitap is able to do what legacy financial institutions can’t (or won’t): provide real savings to users. Money remitters charge on average 6.2% of the amount being sent, and the process could take a few business days.

Meanwhile, Digitap’s platform has the capabilities, under certain scenarios, for users to send money cross-border within seconds at a cost of less than 1%. Consider that there are around 800 million people worldwide who rely on remittances for survival. That extra 5 percentage points of money goes to their pocket, providing real-world relief for the people who need it most.

Source: Digitap

Hawkish Fed Or Not, Digitap’s Case Runs Deeper Than Rates

The Fed’s stance could turn even more hawkish, or it could reverse course in a short period of time. U.S. President Donald Trump continues to publicly call for Fed Chief Jerome Powell to slash rates, but for now it appears he might not give in to the pressure. Although this could change by tomorrow, paving the way for dozens of altcoins to be listed as the best crypto to buy.

With that said, will Digitap’s appeal as a crypto presale safe harbor end if the Fed changes its stance? The case to consider it as a short-term and long-term investment is strong regardless of how Fed officials feel on any given day. Digitap has a narrative of strength that puts it in a prime position to attract capital regardless of broader conditions.

As such, Digitap could very well maintain its status as a hedge, or it could just as easily transition to being an outperforming investment in its own right.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway