Real-time payment rails keep changing how money moves and how financial firms operate around the clock. For institutions, the shift is not simply faster clearing. It reshapes core tasks like customer onboarding, risk monitoring, and intraday liquidity planning. The rise of instant transfers across countries is also pressing platforms to standardize messages, verify payees upfront, and manage funds minute by minute rather than once a day. This is happening while digital identity programs scale, which helps institutions check who is paying or getting paid without slowing the flow. Together, these forces are pushing banks, fintech providers, and platforms to rework controls and cash buffers for a 24/7 world.

The pressure is not theoretical. More than 100 jurisdictions already offer fast payments, and system operators are testing links across borders that shorten chains and share richer data. When a transfer posts in seconds at any hour, treasury desks need tools and rules for real-time positions. Operations teams need clean data standards and clear handoffs between domestic rails and cross-border connectors. And front lines need onboarding that clears identity checks quickly, with enough assurance to keep the experience simple. The result is a payments stack where design choices about messaging, settlement models, and liquidity lines all show up in customer experience and working capital, often the same day. That is why real-time rails now sit at the center of platform strategy.

The platform playbook for safe, instant value movement

Entertainment platforms that handle money at scale often adopt new payment features first. Online casinos are a clear example, because in a very short period they transformed a traditional blackjack game into digital entertainment.

Could there be blackjack games outside of casino platforms? Perhaps. Some online gaming providers could come up with offers, but it’s the smart involvement of money that pushed the boundaries. Their users expect instant deposits and timely payouts, so the platform’s payment workflows must be both smooth and secure. This is essential for people who enjoy playing blackjack online for real money. Hence platforms push for easy funding methods, account aliases that are simple to remember, and confirmation steps that reassure players their funds are available immediately.

Flexible payment methods and the ease of use, boosted the catalogs of online gaming sites. Image: A screenshot from Ignition Casino platform, here.

The way these platforms solve the problem offers a template for the broader market. They map the user journey from sign-up to first deposit to withdrawal, then align each step with the capabilities of the instant rail. That means clear, upfront verification, automated checks that run in seconds, and consistent messages back to the user that show money status in real time. It also means using data fields that help reconcile flows end to end, so balances refresh correctly and support tools can explain outcomes without delay.

Crucially, these platforms treat trust and speed as a single goal. They invest in smooth identity capture, resilient messaging, and guardrails like transaction limits that protect the flow without getting in the way. They keep working on alias directories, QR or link-based initiation, and user prompts that reduce errors. Over time, these design choices build a rhythm of safe, immediate movement that users come to expect, not just for games but for any digital service that touches cash. In that sense, blackjack online real money shows how platforms can use instant rails to deliver a clear, consistent experience that feels both fast and careful. The lessons transfer well to marketplaces, wallets, and even payroll portals, where the same need for trusted speed applies.

Social media accelerates the pressure

In the context of gaming, we must admit the influence of social media platforms, where people shape trends. Literally. Gamers are not stuck in their own rooms playing in isolation. No, many of them become social media influencers, community leaders, and so forth, and they develop a new category of content that is all about gaming. Does this spread word-of-mouth marketing? Absolutely. You can take a look at one example where a person comments on a live game for their followers.

View this post on Instagram

Onboarding meets always-on money

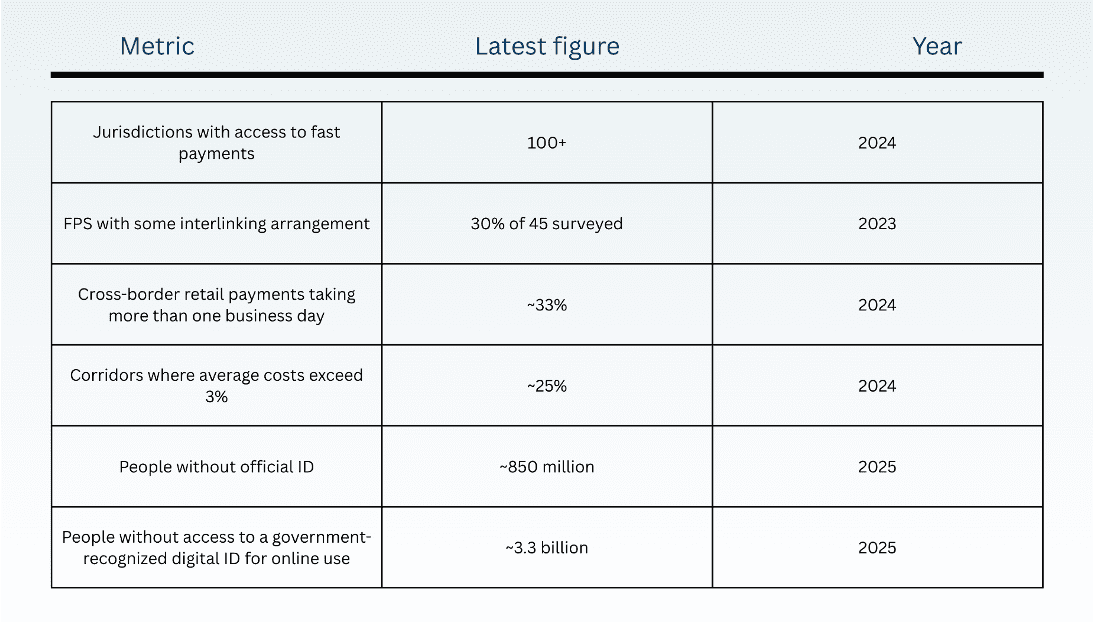

As instant transfers become standard, the first constraint is not technology, it is assurance. Firms need to know who they are dealing with, and they need to know it quickly. Digital identity programs are closing the gap. The World Bank’s ID4D dataset reports about 850 million people still lack official ID, and more than 3.3 billion live in countries without a government-recognized digital ID they can use online. That number highlights why remote verification remains uneven across markets, even as rails speed up.

Table 1. A snapshot of the landscape that shapes KYC and onboarding in a real-time world

The figures above come from BIS, CPMI, the ECB, and the World Bank. They show both progress and the work ahead on onboarding and data quality as money moves faster.

Liquidity in seconds, not days, and the risk controls that follow

Real-time posting changes the clock for bank treasuries. When payments land at any hour, intraday liquidity is now all day, every day. System design helps. The BIS notes that fast payment systems can include tools that reduce liquidity pressure, such as prefunding, limits on net debit positions, automated top-ups when balances hit thresholds, and access to intraday central bank facilities for direct participants. These features shape how much cash participants must hold and when they must hold it.

Speed amplifies this effect across borders. The ECB observed that one-third of retail cross-border payments took more than one business day to settle in 2024. The quote is blunt and useful: “one-third of retail cross-border payments took more than one business day to be settled in 2024.” Faster links are expected to lift that benchmark, which in turn shifts liquidity timing and monitoring to the front of the process, not the end.

Finally, interlinking shapes how liquidity must be staged across currencies. The CPMI explains that multicurrency arrangements can require additional settlement accounts and higher liquidity buffers, while cross-currency links introduce foreign exchange conversion and related settlement choices. Clear rules for timing, value limits, and settlement agents help keep positions stable as rails connect. The upshot is simple. The faster the rail, the more the platform benefits from predictable, well-designed liquidity features baked into the system.