In recent weeks, the market for major altcoins has shifted from speculative bursts to tactical positioning and at the centre of that motion are Solana (SOL) and BNB (BNB). With SOL changing hands around $224 (market cap $105 billion). BNB markets show pricing near $1,100+ with a market cap north of $150 billion.

Investors are asking: can SOL claw back ground on BNB in November or will BNB consolidate its lead? Among that narrative, early-stage players like Remittix present an alternative angle for portfolio diversification. What unfolds here could define the late-2025 cycle for altcoin investors.

Market Context And Solana Price Prediction

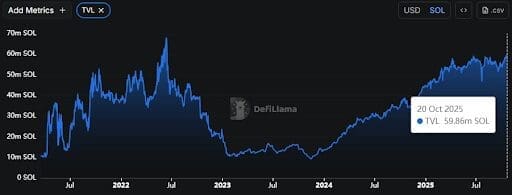

Over the past 3–6 months, SOL has exhibited a volatile yet upward-leaning trajectory. After bottoming near $175, it surged to over $224. It is benefiting from renewed institutional access and speculative flows. On-chain data suggests a consolidation forming around the $186-200 band.

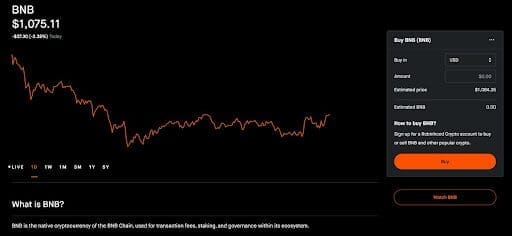

Meanwhile, BNB has been steadily consolidating after its prior run. This has attracted technical interest around $1,050-1,130, with bullish pennant patterns pointing toward $1,300. That leaves SOL trading at a lower absolute level, but with more “catch-up” potential, while BNB carries a higher baseline but perhaps less explosive upside relative to its size.

If SOL reaches the $300 target that some analysts cite, its market cap would need to rise significantly; by contrast, BNB pushing toward $1,300 implies incremental rather than transformational growth.

Catalysts Driving Bullish Momentum

The institutional door for SOL is opening: recently, it was announced that The Hong Kong Securities and Futures Commission has officially approved the first Solana spot ETF. That shift alone alters the investor base and could dispatch fresh volume into SOL’s ecosystem.

In BNB’s case, the removal of regulatory overhang (through a highly-publicised pardon of its founder) and increasing liquidity access via U.S. friendly platforms create a more stable narrative for BNB, enabling a rebound that might close the token’s discount versus earlier ATH levels.

Meanwhile, network upgrades on SOL (increased throughput, developer ecosystem acceleration) and constant ecosystem growth around BNB’s chain architecture feed medium-term conviction that both tokens inhabit the infrastructure layer yet with different degrees of maturity and growth potential.

Remittix: The Silent Challenger

Enter Remittix. Priced at roughly $0.1166 per token, with over $27.7 million raised and 681 million+ tokens sold. The project is positioned as a crypto-to-fiat payments network enabling transfers into 30+ countries’ bank accounts via a Web3 wallet.

With the ambitious goal of 100× ROI potential, Remittix (RTX) presents a divergent bet: unlike SOL (SOL) and BNB (BNB), it remains at an early stage, potentially capturing more of the emerging PayFi revolution. For investors wanting a stake in the next wave, allocating to RTX alongside exposure in SOL and BNB may widen the opportunity set.

The Time To Act Is Now

SOL is chasing catch-up with domestic growth momentum, BNB consolidating its leadership with improved regulatory clarity and technical structure. For thoughtful investors, a diversified stance makes strategic sense.

The market remains optimistic, albeit susceptible to catalysts. With the right setup, SOL could close part of the gap to BNB and an early allocation into RTX could magnify risk-adjusted upside. Evaluate carefully, act decisively and keep watch on the next major move.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway