The crypto market is once again navigating a wave of fear-driven volatility. After weeks of steady gains, Bitcoin (BTC), Ethereum (ETH), and XRP have entered a corrective phase — one that analysts say could set the stage for the next accumulation cycle.

Analysts suggest that while this “fear cycle” could temporarily weigh on prices, it also offers a rare opportunity to accumulate quality assets before the next surge. Alongside established leaders, emerging tokens like MAGACOIN FINANCE are now drawing attention for their transparent audits, strong presale momentum, and growing community base — positioning them among the best altcoins to buy next as market sentiment begins to stabilize.

Bitcoin (BTC): Support Zone Defines Next Rally Setup

Bitcoin (BTC): Support Zone Defines Next Rally Setup

Bitcoin remains the macro barometer for crypto sentiment. After a significant sell-off that brought it down to approximately $105,000, BTC is currently stabilizing above the support band at $105K – $102.5K. Analysts say if this range holds, it may give a push for a retest of $125,000 by the end of Q4 2025.

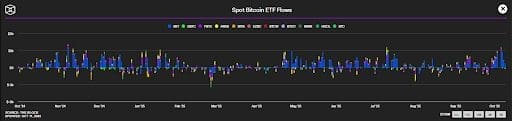

Bitcoin Spot ETF Flows: Theblock

Although some might be bearish in the short term, ETF inflows remain strong with the institutions still accumulating at a steady pace. The biggest share of supply is now controlled by long-term holder, since 2021. In the past, Bitcoin has seen notable recoveries in October and November following events that led to significant liquidations. This might happen again if the macro conditions are better.

Ethereum (ETH): Oversold Conditions Signal Upside

The drop in Ethereum’s price to $3,837 has taken its RSI in deep oversold territory, which is usually seen as a bullish reversal signal. Analysts think this may be a bottoming point before the next upward movement. Strong institutional demand for ETH continues, amid ETF excitement and whale accumulation tendencies. Fundamentals growing ever stronger, with Ethereum scalability and staking upgrades advanced by Fusaka.

If ETH reclaims the range of $4,000–$4,200, analysts expect breakout towards the level of $7,000–$8,000 by the next quarter supported by inflows from retail and institutional markets. As the exchange balances drop sharply to multi-year low levels and staking deposits climb, the ecosystem shows signs of strong accumulation ahead of rotation in Q4 based on our indicator .

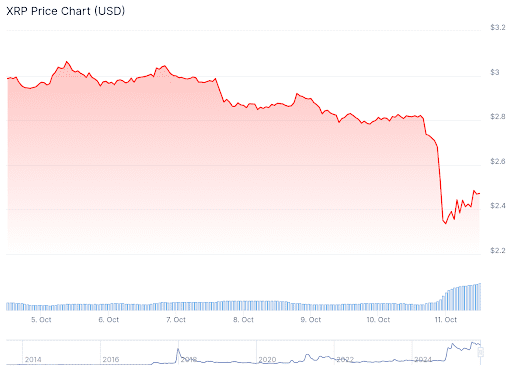

XRP: ETF Catalysts and Institutional Rotation

XRP remains at the center of institutional attention. At present, this asset is trading in the vicinity of the $3.00 level. As price movement continues to hover around this area, it is creating an accumulation of high confidence. Traders are biding their time as the SEC is expected to announce their rulings on eight pending XRP spot ETF applications in mid-October. Market experts predict that these approvals could bring about $3 to $5 billion worth of institutional funds. This influx of money could potentially double the market cap of XRP. Furthermore, it could send prices towards $5.00 in the fourth quarter of this year.

XRP Price Chart: CoinGecko

XRP is technically facing resistance at $3.65 to $4.50 and the structure of its chart looks similar to before a breakout during the previous cycles. Ripple, a leading crypto asset, has been steadily expanding its foothold across a number of European payment networks. New custody and stablecoin integration partnerships not only enhance its utility and liquidity. Moreover, these partnerships add a layer of fundamental strength to its case. Indeed, Ripple is one of the best altcoins to watch during this correction.

Analyst Identifies Next Top-Rated Altcoin Investment

Investors seeking high-upside opportunities should consider diversifying with projects like MAGACOIN FINANCE. The token has achieved strong momentum, with transparent smart contracts and audit verification bolstering credibility. Community growth and adoption trends highlight it as a compelling option, making it a best altcoin to buy next alongside BTC, ETH, and XRP, for portfolio rotation during current market corrections.

Conclusion

Three primary cryptocurrencies – Bitcoin, Ethereum, and XRP – are leading the current fear cycle. They face threats of short-term volatility but have a potential upside for the long-term. Cardano’s and Avalanche’s potential for growth makes them a strategic hold. MAGACOIN FINANCE is an emerging opportunity currently in its infancy, with verified smart contracts and community traction. MAGACOIN FINANCE has been fully audited and verified by Hashex, confirming its smart-contract integrity and investor protection. Analysts note that few presales offer this level of transparent, certified security backed by Certik review. The combination of these assets provides a mixture of established and high-upside altcoins that may help investors on the core.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Bitcoin (BTC): Support Zone Defines Next Rally Setup

Bitcoin (BTC): Support Zone Defines Next Rally Setup