Bitcoin price dropped sharply this week after reaching a new all-time high of almost $127,000. Within 24 hours, over $7 billion was liquidated in leveraged positions across the major exchanges. The sharp crash has shaken up short-term traders but has also provided what some analysts term a fine reset for the market. They believe this liquidation has paved the way for a more sustainable rally as the market gears up for its next phase. In spite of the short-term pressure, analysts are still optimistic that Bitcoin could reach $140,000 levels in the next few weeks.

The correction also showed the degree to which markets have become sensitive to leverage cycles. Many traders were long with aggressive positions for a prolonged breakout. The liquidation wave wiped out leveraged excess, thus lowering volatility, providing more realistic trading conditions. Analysts now anticipate Bitcoin to launch into a consolidation phase before the resumption of the uptrend. At the same time, investors with an appetite for quicker gains are flocking to MAGACOIN FINANCE, a star-performing altcoin that has been picking up traction despite market uncertainty.

Bitcoin Price Holds Above Key Technical Levels

Bitcoin’s recent move above $117,000 serves as an essential milestone in this cycle. The previous resistance point is now strong support. If the price remains above it, analysts predict a short-term rebound to $130,000. However, a decisive break below $110,000 could unleash another wave of selling towards $100,000 before recovery resumes. Even after factoring in this ratio, most analysts believe Bitcoin’s overall trend is still bullish with strong fundamentals on the network.

Source: X

Technical indicators are also in support of this story. The 50-day moving average is about $110,000, providing short-term support, and the 200-day is stagnating at $95,000, confirming a long-term uptrend. The RSI is showing a cooling momentum but is still neutral. Analysts believe a short period of consolidation will enable buyers to return and move prices higher.

Historically, Bitcoin’s steep corrections have been strong catalysts for subsequent breakouts once leverage is reset. Analysts predict that breaking through the $130K resistance will confirm momentum for a rally towards $140K. The recent improvement in leverage and strength in spot buying both point to a healthier environment for a sustained advance.

Liquidations Trigger Market Rebalancing and Renewed Buying Interest

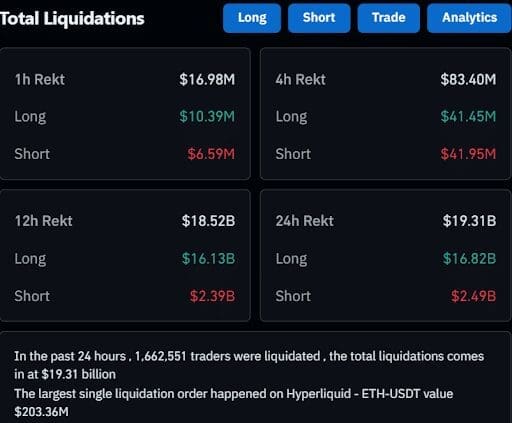

The latest $7 billion liquidation was one of the largest liquidation waves in 2025, wiping out over-leveraged long positions across exchanges. It followed a period of aggressive speculation after traders placed their bets on a continuous rise above the previous high of $130,000. When these expectations proved unsustainable, cascading margin calls moved through the market, prompting widespread exits. Analysts pointed out that this correction wiped out speculative positions while keeping the buyers and sellers in balance.

Source: Coinglass

Source: Coinglass

Such setbacks, although painful in the short term, often provide a firmer ground for future resurgence. After the liquidation, spot buying activity increased as traders seized lower prices. Recent data shows an increase in the number of provings to cold wallets, which suggests that long-term holders are accumulating. Analysts argue this is an important sign that confidence is still intact. Many predict that Bitcoin will rebound and test resistance around $130,000 before making a move towards $140,000.

MAGACOIN FINANCE Emerges as a Fast-Growth Alternative

While Bitcoin’s recovery may take time, traders are rotating into assets that deliver faster returns. MAGACOIN FINANCE has quickly become a top pick for investors seeking high-velocity growth opportunities. Analysts note that Bitcoin offers steady performance, but MAGACOIN FINANCE delivers explosive returns due to its smaller market cap and rising adoption. They project that the token could yield up to 2400% ROI before Bitcoin reaches its $140,000 milestone. Analysts describe MAGACOIN FINANCE as one of the few altcoins showing resilience during Bitcoin’s correction. Its fast growth underscores a clear shift in capital toward smaller assets with higher reward potential.

Conclusion

The $7 billion liquidation wave created short-term uncertainty but also strengthened Bitcoin’s technical foundation. The market has cleared excess leverage, restoring balance and opening the path for another potential rally. Analysts continue to eye $140,000 as the next key price target once consolidation completes.

Meanwhile, investor attention is increasingly turning to MAGACOIN FINANCE, which combines early accumulation, verified transparency, and explosive upside potential. Its growth during market weakness highlights how traders are positioning for faster gains. As Bitcoin rebuilds momentum, MAGACOIN FINANCE is emerging as the year’s most promising breakout opportunity.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance