Whales are quietly building positions across major altcoins. From Ethereum to Solana and Avalanche, market attention is growing ahead of crucial ETF decisions. Meanwhile, a rising name, MAGACOIN FINANCE, is catching the eyes of early buyers — a new altcoin many traders see as a low-cost way to diversify before the next market shift.

Ethereum Whales Add $150 Million in Fresh Accumulation

Ethereum Whales Add $150 Million in Fresh Accumulation

Ethereum whales are ramping up their holdings as the U.S. Securities and Exchange Commission (SEC) approaches key deadlines for altcoin exchange-traded product (ETP) approvals.

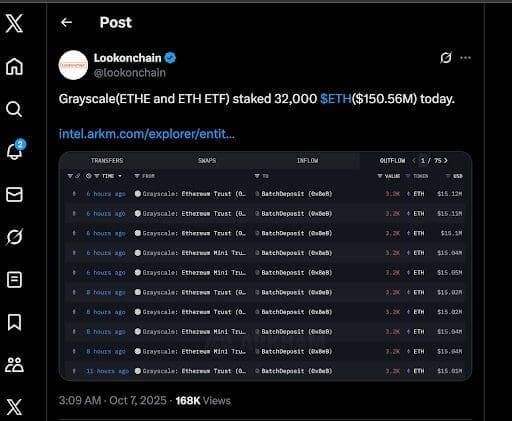

Blockchain data from Lookonchain shows Grayscale staked 32,000 ETH worth $150 million, marking one of its largest single staking moves this year.

This came right after Grayscale introduced staking for its Ether ETPs — the first in the U.S. to offer staking-based rewards. Under this setup, investors can earn up to 94% of staking yield through the Ethereum Mini Trust and 77% through the main Grayscale Ethereum Trust, depending on the fund’s structure.

Institutional exposure to ETH continues to grow, with treasury firms and funds now controlling more than 10% of the total Ethereum supply. Companies like SharpLink and BitMine Immersion Tech lead this charge, reflecting increasing accumulation among larger players.

As ETF decisions near, Ethereum’s price is hovering around $4,450, with many traders expecting volatility once the SEC rulings are announced.

Solana ETF Buzz Lifts Sentiment Toward New Highs

Solana’s price has bounced to around $230, fueled by speculation that the SEC could approve one or more spot Solana ETFs this week. Analysts believe this could unlock a new wave of institutional demand for the asset.

Several major filings are under review, including those from VanEck, Fidelity, Franklin Templeton, and Grayscale, all of which seek to list a Solana ETF. Bloomberg’s senior ETF analyst James Seyffart estimates the probability of approval at nearly 100%, citing recent policy shifts at the SEC.

If approved, Solana could see the kind of inflows that helped Bitcoin and Ethereum rally after their ETF launches. Traders are watching the $300 mark as the next upside target if institutional access opens up.

The optimism is also reflected in Polymarket’s prediction data, where participants place a 99% chance of approval by 2025.

With staking already active in Grayscale’s Solana Trust, Solana’s network continues to attract institutional focus, setting the stage for higher valuations.

Avalanche Price Prediction: Traders Eye $47 Target

Avalanche (AVAX) has reclaimed the $30 level with solid buying interest. Analysts expect it to move toward $35 and possibly $47 if current trends hold. Charts show a clear structure of higher lows, suggesting buyers are in control.

The surge in trading volume adds weight to this trend. According to data shared by on-chain researcher Marc Shawn Brown, Avalanche’s cumulative trading volume recently topped $946 billion, confirming strong network use in decentralized finance and other applications.

Market watchers have marked $40 as key checkpoints. If Avalanche breaks through these, the next likely stop is $47.

On the other hand, holding above $29 remains important to maintain structure. With the market leaning bullish, analysts see AVAX as one of the most active altcoins heading into Q4.

MAGACOIN FINANCE: The Altcoin Whales Quietly Accumulate

MAGACOIN FINANCE: The Altcoin Whales Quietly Accumulate

As Ethereum, Solana, and Avalanche dominate attention, some traders are turning to MAGACOIN FINANCE, a low-cap altcoin trading below a fraction of a cent. Large wallets have been steadily positioning here, drawn by its scarcity narrative and community-first setup.

Many see it as a diversification play — a way to get early exposure before larger funds notice. With whales already accumulating and a small circulating supply, MAGACOIN FINANCE is shaping up as one of the best altcoins to buy for those building long-term positions across different assets.

MAGACOIN FINANCE Declared Scam-Free After Hashex Audit

The Hashex audit confirmed MAGACOIN FINANCE is scam-free and fully functional, with all contracts working as intended.

How Traders Can Position

Altcoin activity is building up again. With ETFs driving headlines and new assets like MAGACOIN FINANCE emerging, traders can diversify smartly across Ethereum, Solana, Avalanche, and newer low-cost names. Those looking to explore MAGACOIN’s early-stage opportunity can learn more or buy directly from its official links:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

Ethereum Whales Add $150 Million in Fresh Accumulation

Ethereum Whales Add $150 Million in Fresh Accumulation MAGACOIN FINANCE: The Altcoin Whales Quietly Accumulate

MAGACOIN FINANCE: The Altcoin Whales Quietly Accumulate