The cryptocurrency market is once again attracting attention from institutional investors, with Bitcoin ETFs recording significant inflows over the past week. Data from CoinShares shows that Bitcoin-related products pulled in hundreds of millions of dollars, underscoring strong appetite from funds and asset managers eager to gain exposure to digital assets through regulated vehicles.

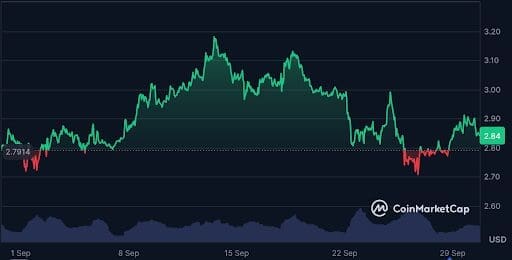

Ethereum, meanwhile, is seeing rising demand as it edges closer to the $4,300 mark, buoyed by optimism around network upgrades and consistent staking inflows. Despite this momentum in the two largest cryptocurrencies, XRP has struggled to break free from its recent range, currently hovering around $2.9.

While some traders remain patient, others are already seeking alternative opportunities – and MAGACOIN FINANCE has emerged as a project drawing considerable early interest.

Bitcoin and Ethereum Gain Traction

Bitcoin’s flows into ETFs indicate that large investors are gaining confidence. Having dipped to nearly $111,500 earlier this month, the largest cryptocurrency by market capitalization rebounded and is now stabilizing above $116,400. The move occurs with traders anticipating that the Federal Reserve will decrease interest rates a second time this year, which could destabilize the dollar and increase demand among scarce assets such as Bitcoin.

Ethereum is equally enjoying fresh optimism. Prices have increased by 3% over the last 24 hours and now settle at $4,300. The latest move to increase Ethereum’s gas limit has further boosted optimism among investors that improvement to scalability will aid the long-term outlook. Analysts comment that Ethereum is still one of the institution’s most preferred assets, and flows have been continuously positive while remaining short-term turbulence.

A New Opportunity Gains Traction as Investors Diversify

For retail investors who want to explore more than just big coins, MAGACOIN FINANCE has become an interesting story. The project has drawn a lot of interest because of its high presale demand, making it one of the most-watched new tokens of 2025.

Analysts note that many holders of Bitcoin and Ethereum are now investing in MAGACOIN FINANCE, expecting a great year ahead. The quick sellouts of the token’s presale show strong belief from both retail investors and early-stage crypto funds, making it a possible highlight in the next market rise.

XRP Stalemate Makes Smaller Caps Shine

XRP’s failure to break through $3.00 even with overall bullish markets has bred frustration within holders. Although the cryptocurrency is a top-10 digital currency with solid institutional backing through Ripple’s continuing partnerships, its sideways lack of volatility helped cause traders to move into smaller-cap initiatives with increased potential.

The $2.9 mark serves as key support, but without a solid catalyst, XRP may sit mired within consolidation. The future of Ethereum is bright, with many hopeful that the coin will surge to $4,500 by October’s end should funds keep pouring in.

Bitcoin is still a significant determinant of people’s sentiment regarding the market, but its present stable period may provide altcoins with an opportunity to thrive during the following weeks.

Final Thought

Institutional enthusiasm about Bitcoin and Ethereum keeps impacting the wider market with XRP stagnating around the $2.9 threshold. In this context, MAGACOIN FINANCE emerged as a potential year-end powerhouse performer of 2025 and attracted initial investments by persons seeking to buy before it is listed on other exchanges.

If investments continue to pour into Bitcoin and Ethereum, the general cryptocurrency scene might be preparing itself for a healthy year-end with presale potential like MAGACOIN FINANCE promising gains that extend beyond.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance