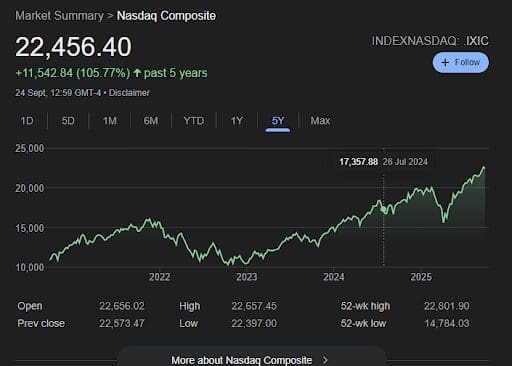

The NASDAQ composite pushed to new highs at 22,657 in September, underlining investor appetite to bet heavily on medium term risk. In the same breath, Ethereum continues to attract institutional money even as Q3 winds down with BlackRock’s ETHA fund managing $9.3 billion while Fidelity’s FETH added $2.2 billion in Q3, signaling confidence hasn’t wavered.

In a bid to continue growing their portfolios using robust investing strategies, top ICO investors are rotating gains from the stock market and top cryptos like Ethereum into Remittix (RTX), a cross-chain DeFi project that institutions are already describing as “XRP 2.0 for payments.”

This hedging of Ethereum’s stability with Remittix’s explosive upside is becoming a favored allocation strategy among sophisticated investors. Let’s see why.

NASDAQ Strength Reinforces Risk Appetite

NASDAQ Strength Reinforces Risk Appetite

The NASDAQ reached a high of 22,788 before pulling back to 22,573 on light profit-taking, though overall momentum remains strong. Oracle’s $300 billion partnership with OpenAI and Nvidia’s $100 billion AI infrastructure plan highlight the scale of institutional spending. Trading volume surged to its highest level since April at 27.78 billion shares, confirming heavy institutional participation.

Market breadth also improved with over half of NASDAQ 100 stocks trading above 20-day moving averages. The Fed’s recent 25-point cut to 4.25% has created a supportive backdrop for growth assets, leaving analysts confident in further upside into year-end.

Ethereum: Institutional Confidence Outshines Volatility

Ethereum’s 14% dip has not shaken confidence. Instead, large players are buying. Treasury holdings of ETH have climbed to $18 billion, while ETF inflows reached $33 billion in 2025 alone. BlackRock, Fidelity and other giants continue to increase exposure, reinforcing ETH’s role as a backbone of digital infrastructure.

Technical signals remain bullish. ETH is consolidating around $4,450 with strong Fibonacci support. Its supply dynamics have turned deflationary again, while Layer 2 adoption has hit 3 million monthly active users. Staking yields of up to 5% further cement ETH’s institutional appeal.

Remittix: Capturing the PayFi First-Mover Advantage

While Ethereum holds the institutional crown, Remittix is carving its own path with disruptive payment technology. The project has already raised over $26.4 million, sold 670 million tokens at $0.1130 and launched live beta wallets across Bitcoin, Ethereum, Solana and Tron. Users in more than 30 countries have confirmed successful crypto-to-bank transfers with just 0.1% fees.

What sets Remittix apart is its CertiK #1 security ranking, which gives institutions confidence, along with confirmed exchange listings on BitMart and LBank for instant liquidity. On top of that, RTX offers a 15% USDT referral program that participants describe as sustainable passive income, fueling viral adoption and community growth.

Why Institutions Add RTX Beside ETH

- Multi-chain wallet enabling instant global transfers

- 15% USDT referral rewards creating reliable income

- CertiK #1 security ranking validating credibility

- Confirmed CEX listings ensuring liquidity

- First-mover in trillion-dollar PayFi market with live product

Institutional Funds Are Coming To Remittix!

Remittix is closing Q3 with a $250,000 giveaway that has already attracted 33,000 holders and over 340,000 entries. Institutions are taking notice, describing its referral model as “the most advanced community-building mechanism in crypto.”

With Q4 allocations set to rise, this may be the last chance to secure early positions before institutional adoption drives exponential price discovery. Ethereum provides the portfolio anchor, but RTX is the overlooked rocket, the dual play investors are calling the smartest strategy of 2025.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

NASDAQ Strength Reinforces Risk Appetite

NASDAQ Strength Reinforces Risk Appetite