Dogecoin is back in the spotlight as analysts debate whether $1 DOGE could finally be within reach. Renewed whale accumulation has set the stage, with millions of tokens moving into large wallets during the past month. This buying behavior often signals conviction that a bigger price leg is coming. Adding to the momentum is speculation around a potential DOGE-focused ETF, a product that could open the door for institutional capital to flow into the world’s most iconic meme coin. Traders argue that such a listing, combined with ongoing whale support, might replicate the kind of demand shock that powered DOGE’s earlier parabolic rallies. With price consolidating near $0.28 today after briefly touching $0.30, the setup has caught the attention of both retail and institutional players. In parallel, another emerging project, MAGACOIN FINANCE, is drawing similar comparisons as a breakout contender heading into late 2025.

Whale accumulation builds confidence

On-chain metrics confirm that whales have been busy. More than 680 million DOGE shifted into large wallets in August, creating strong demand under the surface. That activity has helped DOGE form higher support zones near $0.22–$0.23, while resistance clustered around $0.25 has now been broken. Analysts highlight that every major Dogecoin rally has historically begun with quiet whale accumulation followed by a retail-driven frenzy. If ETF speculation translates into concrete progress, that retail rush could return at scale. For now, whales appear content to continue stacking, reinforcing the bullish case that $1 DOGE is not just a meme, but a feasible target under the right conditions.

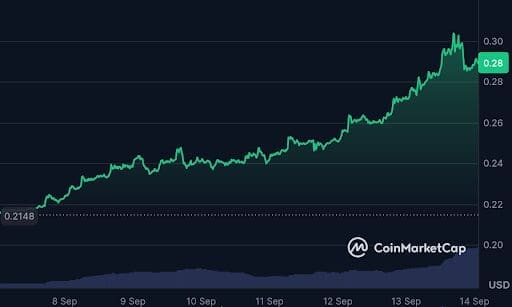

Chart analysis: breakout toward $0.30

The latest seven-day DOGE chart shows a clear uptrend. Starting from $0.2148 on Sept 7, DOGE advanced steadily, punching through layers of resistance and hitting $0.30 on Sept 13 before consolidating around $0.28. The structure is constructive: higher highs, higher lows, and expanding volume into the breakout. Immediate support rests at $0.26, while $0.30 remains the key resistance level to reclaim decisively. If buyers push through with conviction, the next upside targets are $0.32 and $0.36. A sustained hold above those zones could set the stage for a move toward $0.40 later this year. On the flip side, losing $0.25 would weaken momentum and risk a deeper pullback toward $0.22. For now, momentum indicators remain bullish, with traders closely eyeing whale activity for confirmation.

MAGACOIN FINANCE: a presale building momentum

Projections of a 20–30× run-up have crypto hunters racing to secure allocations, calling MAGACOIN FINANCE a once-in-a-cycle opportunity. The presale is being framed by analysts as the breakout altcoin heading into late 2025. Built on Ethereum, it combines a HashEx-audited contract, a capped 170 billion supply, and fast-growing retail adoption. What began as a community-driven idea has quickly transformed into a mainstream narrative, attracting over 13,500 verified investors and more than 25,000 community members. Scarcity-driven demand is accelerating each round, creating urgency similar to the earliest phases of DOGE and PEPE. Analysts argue that these conditions, tightening supply, cultural branding, and verified legitimacy, create the foundation for exponential performance. Unlike majors that already move billions daily, MAGACOIN FINANCE sits at the sweet spot of timing, where hype collides with sustainability to fuel breakout multiples.

DOGE versus MAGACOIN FINANCE

The comparison between DOGE and MAGACOIN FINANCE highlights two very different types of opportunity. DOGE remains the benchmark meme coin, with whale depth, institutional recognition, and now ETF speculation. Its size, however, means percentage gains are likely to be incremental compared with earlier cycles. MAGACOIN FINANCE, by contrast, operates from scarcity and early-stage traction, where each allocation carries outsized impact. DOGE might move from $0.28 to $0.50 or even $1 under bullish conditions, but MAGACOIN FINANCE could deliver 20–30× upside if listing-day demand aligns with community momentum. For many investors, this is not a choice between them—it is about combining DOGE’s stability with MAGACOIN FINANCE’s asymmetry to balance resilience with exponential upside potential.

Risk considerations and timing

Both DOGE and MAGACOIN FINANCE carry risks, though the nature of those risks is very different. For DOGE, the story revolves around chart levels and external catalysts. $0.26 is immediate support and $0.25 is the must-hold line, a breakdown there would threaten momentum and push DOGE back into range-bound trading. Upside is tied almost entirely to whether ETF speculation becomes reality and if retail mania reignites.

MAGACOIN FINANCE, however, operates under the classic presale dynamics that define the most successful early-stage tokens. The biggest risk is timing, each round is closing faster than the last, and allocations are shrinking as demand builds. Those who wait too long risk entering at higher prices or missing out entirely, a scenario that has repeated across legendary presales in past cycles. What makes MAGACOIN FINANCE different is how it combines presale urgency with structural safeguards: a capped 170 billion supply, community-driven momentum, and a HashEx-audited contract. These features reduce the uncertainties that typically surround meme-driven launches. Analysts emphasize that while DOGE may serve as a portfolio anchor, MAGACOIN FINANCE has the hallmarks of a cycle-defining presale accelerator, offering the kind of exponential upside majors can no longer replicate.

Conclusion

With ETF speculation heating up and whales steadily accumulating, Dogecoin’s long-discussed $1 target is once again within sight. The recent rally from $0.21 to $0.30 shows how quickly momentum can return when whales and narrative align. At the same time, MAGACOIN FINANCE is carving out its own identity as the presale of the year. With a HashEx-audited contract, capped 170 billion supply, and projections of 20–30× upside, it is being framed as a once-in-a-cycle opportunity for risk-tolerant investors. Together, DOGE and MAGACOIN FINANCE highlight the dual strategies shaping late 2025: legacy resilience on one side, exponential presale potential on the other.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance