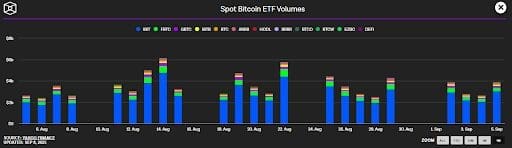

The crypto market is entering September with cautious optimism. Despite macro uncertainty, institutional investors are still piling into Bitcoin exchange-traded funds (ETFs). According to the latest Bitcoin ETF news, inflows topped $246 million this month, signaling that Wall Street isn’t done adding BTC exposure — though momentum has slowed compared to July and August’s surges.

This steady demand reflects not just Bitcoin’s role as a digital anchor but also sets the stage for crypto market rotation into the best cryptos to buy now before Q4. Among the top picks shaping up are Solana, XRP, and MAGACOIN FINANCE — three projects that could easily rank among the top cryptocurrencies 2025 if momentum builds into the year’s final quarter.

Bitcoin ETF Flows and Q4 Outlook

The $246 million in Bitcoin ETF inflows this month suggests institutional confidence remains firm. However, compared to summer’s explosive demand, growth is moderating. Analysts note that while ETFs keep drawing cryptocurrency inflows, enthusiasm isn’t spilling over evenly.

Ethereum ETFs are seeing outflows, highlighting divergence in sentiment — a key point in the Ethereum vs Bitcoin 2025 debate. At press time, Bitcoin trades at $111,915, while Ethereum sits at $4,294, slightly weaker due to waning ETF support.

Bitcoin Price Prediction Q4

With the Fear and Greed Index at 51 and macroeconomic uncertainty around Fed policy, most analysts see Bitcoin consolidating between $105K–$120K into Q4. A confirmed Fed rate cut in September could be the trigger for broader risk-taking and a lift toward $125K. This creates a positive Bitcoin ETF inflows 2025 forecast, suggesting steady institutional growth even if altcoins lag.

3 Best Cryptos to Buy

Solana Gains Institutional Backing

One of the most compelling stories is Solana (SOL), trading at $218.53. Nasdaq-listed Forward Industries secured $1.65 billion to build the largest Solana treasury to date, backed by Galaxy Digital, Jump Crypto, and Multicoin Capital.

This move positions Solana as not just an Ethereum competitor but a legitimate institutional-grade blockchain ecosystem. With this kind of conviction, Solana belongs in any list of best altcoins to invest in as well as among the top 3 altcoins for next bull run.

XRP Eyes Breakout With ETF Catalyst

Meanwhile, XRP continues to consolidate near the $3.00 level. Support remains solid around $2.88–$2.89, while resistance at $2.995–$3.00 has capped near-term rallies.

The major catalyst? Six XRP ETF applications are pending SEC review in October. If approved, this could be the structural shift XRP needs to surge higher. A breakout close above $3 could target $3.30–$3.50, making XRP one of the best cryptocurrencies to buy before Q4.

Institutional flows are already showing interest: volume spiked to nearly 3x daily norms during recent rallies, confirming accumulation. Traders are watching closely to see which cryptos will perform best in Q4 2025, and XRP is high on that shortlist.

MAGACOIN FINANCE Steals Spotlight With Strong Tokenomics

While Bitcoin, Solana, and XRP grab the headlines amid ETF buzz, MAGACOIN FINANCE is quietly emerging as a crypto investment opportunity 2025 that retail and institutional investors alike should not overlook. The reason behind this, is the strong tokenomics with DeFi fundamentals the project offers, compelling analysts to compare it with early days of Solana and XRP.

Additionally, leading analysts now highlight that early-stage projects like MAGACOIN FINANCE are stealing the spotlight during Q4 altcoin rotation due to sub-$0.001 level entry. They call MAGACOIN FINANCE a perfect 30x candidate as its low price entry opens up the door for exponential gains as soon as it hits major exchanges. As a result, on-chain data now shows a spike in smart money inflow into MAGACOIN FINANCE, highlighting the rising buying demand during its early-stage access.

Final Thoughts

The crypto market in September still shows cautiousness but manages to be constructive. Bitcoin ETFs continue to attract $246 million in inflows, Solana is gaining momentum after a notable institutional support injection, and it looks like XRP is waiting for a boost triggered by an ETF event.

But, positioned at the intersection of DeFi and capital rotation, MAGACOIN FINANCE may surprise investors by outperforming during the upcoming Q4 crypto rotation. With altcoin inflows still tentative, it represents one of the best cryptos to buy now for those looking to diversify beyond Bitcoin.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance