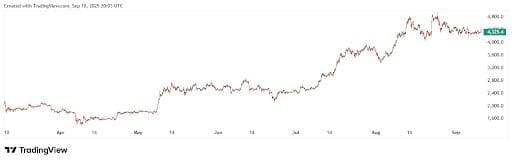

The Ethereum price prediction for late 2025 remains firmly bullish, with multiple analysts confirming that the $7,000 ETH target is still in play. This conviction is backed by one of the strongest on-chain signals in years: more than $1 billion in daily stablecoin inflows.

For traders, the flood of liquidity points to a potential breakout as institutional ETF flows combine with whale accumulation. At the same time, retail investors are beginning to rotate into high-upside alternatives such as MAGACOIN FINANCE, which has emerged as a rising favorite during the early stages of this bull cycle.

Forecasts and Analyst Targets

Analyst forecasts for September 2025 place ETH’s short-term range around $4,758 to $5,194, but broader scenario models suggest a path to $7,000 within Q4 if momentum holds.

Institutional reports and trading desks are also publishing stretch targets of $10,000 under bullish macro conditions such as U.S. rate cuts, continued ETF inflows, and the onset of an altcoin season.

Whale activity further strengthens the outlook. Large holders continue accumulating ETH while staking yields of roughly 4.5% incentivize investors to lock tokens despite volatility. Analysts note that this structure makes Ethereum attractive for both speculative upside and long-term income generation.

Ethereum’s $7K Target Is Back in Play as Stablecoin Inflows Hit $1B Daily

Ethereum’s capital flows and price structure are drawing comparisons to previous breakout cycles. Technical analysts highlight $4,250–$4,500 as the key breakout zone, with a sustained move above that range potentially triggering a run toward $7K.

The alignment of ETF demand, whale accumulation, and stablecoin liquidity makes ETH a clear leader heading into Q4.

This surge has also fueled discussions about which altcoins could benefit most from spillover effects. Analysts note that if Ethereum climbs toward $7K, select projects could see outsized returns—up to 25x ROI in some cases. Among these, MAGACOIN FINANCE has gained attention for its strong community base and political narrative, positioning it as a speculative play for retail traders who don’t want to miss the next big move.

Stablecoin Inflows: The Bullish Catalyst

The recent surge of stablecoins into Ethereum has been striking. Over the past week, more than $7 billion in stablecoins entered the network, averaging around $1 billion per weekday.

The total supply of stablecoins on Ethereum now stands at an all-time high of $165 billion, solidifying its role as the dominant platform for tokenized assets and DeFi.

Market researchers view these inflows as “dry powder” waiting to be deployed into ETH and ecosystem tokens. Historically, surges of this scale have preceded major rallies, and analysts credit institutional adoption—particularly inflows into BlackRock’s spot ETH ETF—for helping to accelerate the trend.

Final Thoughts: Best Crypto to Watch in 2025

With stablecoin inflows hitting historic levels, Ethereum’s $7,000 target looks more realistic than ever. Institutional adoption through ETFs, combined with whale demand and DeFi growth, points to a strong late-2025 setup.

For retail traders, the search for the best crypto to buy often goes beyond ETH. Many are now turning to MAGACOIN FINANCE, which is still at an early stage and could ride the momentum of this bull cycle.

If Ethereum climbs toward new highs, the urgency around MAGACOIN FINANCE may only grow stronger—making it a candidate for outsized gains as investors position ahead of the next leg up.

To learn more about MAGACOIN FINANCE, visit:

Website:https://buy.magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance