Altron, a JSE-listed technology group, has reported a 10% increase in revenue for its Platforms Business, reaching R1.9 billion for the six months ending on 31 August 2024.

The Platforms Business’s EBITDA (earnings before interest, tax, depreciation, and amortization) grew by 37% to R776 million, while operating profit rose 47% to R415 million.

Altron’s Platforms Business comprises Netstar, Altron FinTech, and Altron HealthTech.

Valued at R7.6 billion on the JSE, Altron invested R359 million in capital expenditures during this period, dedicating R330 million to growth-focused initiatives. This investment includes R211 million allocated to Netstar’s capital rental devices and R65 million toward developing systems and platforms.

Netstar: Sustained Growth in Revenue and Subscribers

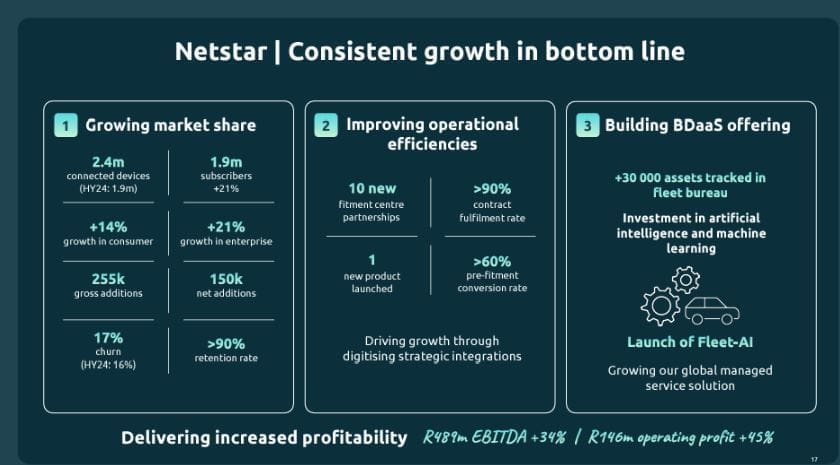

Netstar saw an 11% rise in revenue to R1.1 billion, while EBITDA climbed 34% to R489 million, with an EBITDA margin expansion of seven percentage points. Operating profit also increased by 45% to R146 million, accompanied by a three-percentage-point gain in operating profit margin.

Netstar’s connected devices grew by 26% to 2.4 million, and its subscriber base expanded by 21% to 1.9 million, with 255,000 gross subscriber additions and 150,000 net new subscribers. Consumer subscriptions grew by 14%, while enterprise customers increased by 21%, with churn rising slightly from 16% to 17%.

“Operational efficiencies were improved through 10 additional fitment centre partnerships, which together with our expanded reach and our new Startag device, led to improved installation times and assisted in maintaining our contract fulfilment rate above 90%,” said Altron informed investors.

“Our continued focus on the conversion of pre-fitments ensured our conversion ratio was maintained above the targeted 60%, with the benefits of the higher conversion rate supporting growth in operating profit.”

Altron further highlighted the impact of its newly launched fleet bureau, noting that it “positively impacted our enterprise business, which since its recent launch, added over 30,000 managed assets into the bureau, further expanding our managed service solution.”

Altron FinTech: Strong Sales Performance in the SME Market

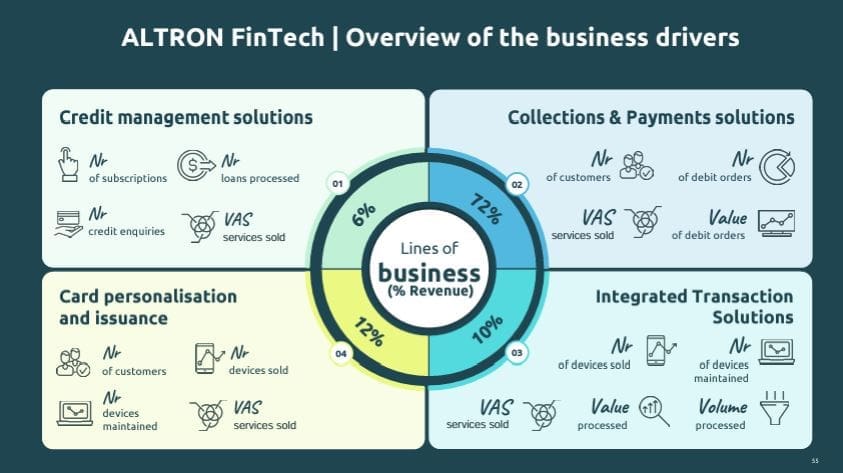

Altron FinTech reported a 10% revenue increase to R607 million, largely due to higher-margin annuity revenue rising from 69% to 82%. EBITDA surged 54% to R232 million, with operating profit up by 63% to R215 million.

This growth was supported by a 33% revenue increase in collections and payments, with focused efforts on the SME market, which saw a 17% expansion in its customer base and an 18% rise in debit order transaction values.

Altron HealthTech: Expanding Service Offerings

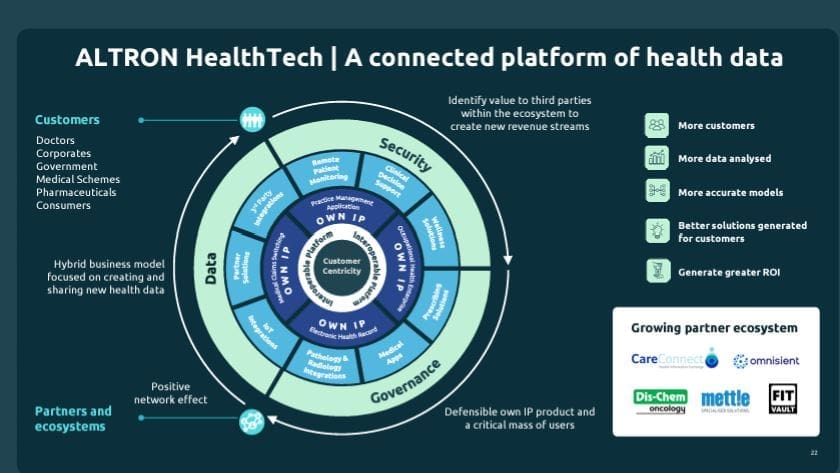

Altron HealthTech achieved a 6% revenue increase, reaching R201 million, with 92% of its revenue coming from annuity sources. EBITDA rose 4% to R55 million, following an increased investment of R15 million into its platform. Operating profit grew by 8% to R54 million.

The corporate segment saw a 22% rise in revenue, adding seven new logos, with growth driven by switching services and occupational health.

Altron noted that “we continue to see positive momentum in using our data to expand our service offerings, with our recently launched oncology solution, which has grown its market share, adding 18 new oncology practices.”

As the sun rises over South Africa, the hum of engines fills the air, signalling the start of another bustling day on the roads. Trucks roll out, laden with goods essential for the nation’s economy, while personal vehicles join the fray. The trucking industry, a cornerstone of South Africa’s economy, contributes an impressive 20% to the nation’s GDP, as reported by Fleetwatch magazine. With thousands of truck drivers on the road, their efforts underpin logistics, transporting over 80% of the country’s goods—far outpacing rail and air transport. In this dynamic landscape, technology is transforming the way we travel and do business. Connected vehicle technology is at the forefront, optimising logistics and enhancing efficiency for truckers while simultaneously ensuring safety for personal vehicle drivers.

The Heart of Logistics: Optimising the Journey

Picture a truck driver, navigating the highways of South Africa. As they drive, their vehicle is equipped with advanced telematics that provide real-time data on traffic conditions, roadworks, and load-shedding disruptions. Thanks to Netstar’s connected vehicle solutions, these drivers can access detailed information, such as gradient alerts and hijacking hotspots. This capability not only keeps deliveries on schedule but also helps drivers steer clear of potential hazards.

On the other hand, personal vehicle drivers—perhaps a family on their way to a weekend getaway also benefit from this wealth of data. With access to real-time traffic updates, they can avoid congested routes and safely reach their destination. This technology ensures that every journey, whether it’s a long haul for a truck driver or a short trip for a family, is as smooth and safe as possible.