From disorder arises order and this was proven after the initial chaos caused by the Coronavirus in the early months of 2020. People who were worried about how they will conduct operations and meet their daily expenses found themselves sticking their necks out through virtual meeting rooms. The COVID-19 pandemic has had a significant impact on the payments industry, causing disruption and uncertainty. However, it has also accelerated the adoption of digital transformation programs and the rise of fintech trends such as digital banking, borderless payments, and blockchain technology. With consumers shifting towards contactless and online shopping, digital payments and automated systems have become increasingly popular.

Despite the economic uncertainty, cutting financial technology expenditures like AP automation software could be a costly mistake. The global fintech market is projected to continue growing at a compound annual growth rate of 26.87% up to 2026. As the industry continues to expand, fintech automation will become increasingly advanced, providing opportunities for businesses to streamline their operations and increase revenue.

A recent report conducted by a tech solutions company highlights the importance of fintech automation. Laggards, or companies that fail to automate, are projected to leave up to 46% of their potential revenue on the table in 2023 alone. The report suggests that companies that have already failed to automate have missed out on potential profit gains and that the gap will continue to widen as payment automation companies release improved solutions.

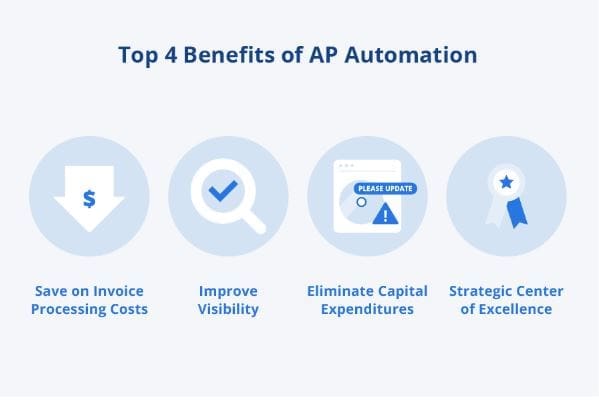

By investing in fintech solutions, businesses can stay ahead of the competition and take advantage of the benefits of automation. These benefits include increased efficiency, reduced costs, improved customer experience, and enhanced data analytics capabilities.

How AP Automation Works?

AP automation refers to the process of automating accounts payable workflows to streamline invoice processing, reduce errors, and increase efficiency. The AP automation process involves several steps that work together to optimize the flow of invoices, from receipt to payment.

Step 1: Receipt of Invoices

The first step in AP automation is the receipt of invoices. Invoices can be received through a variety of channels, such as email, fax, or mail. AP automation software can automatically capture invoices from these channels, eliminating the need for manual data entry and reducing the risk of errors. The invoices are then stored in a centralized repository, where they can be accessed by authorized personnel.

EDMS solutions can store invoices in various formats, such as PDF or TIFF, and provide features such as search and retrieval, version control, and security controls to ensure that the invoices are stored safely and accessible to authorized personnel.

Step 2: Invoice Verification

Once the invoices have been received, the AP automation software will perform an initial verification process. This includes checking the invoice for accuracy and ensuring that it matches the purchase order and/or receipt of goods or services. If the invoice passes this verification process, it is sent to the next step. If there are discrepancies, the software will flag the invoice for further review by authorized personnel.

AI can verify invoices in AP software by using machine learning algorithms to analyze the invoice data and compare it to relevant information such as purchase orders and receipts. The software can then flag any discrepancies or errors for review by authorized personnel, reducing the risk of errors and improving efficiency. OCR technology can extract data from invoices and convert it into a digital format, allowing the software to analyze the data and compare it to other relevant information.

Step 3: Invoice Coding

After the initial verification process, the AP automation software will code the invoice. This involves assigning the invoice to the appropriate general ledger account, cost center, and project code. The coding process is automated, reducing the risk of errors and ensuring that all invoices are coded consistently.

Step 4: Approval Workflow

Once the invoice has been coded, it is sent to the appropriate approver for review and approval. AP automation software can create custom workflows based on organizational policies and rules, ensuring that invoices are routed to the appropriate approver for each transaction. Approvers can review invoices and approve or reject them with just a few clicks, improving the efficiency of the approval process.

Step 5: Payment Processing

After the invoice has been approved, the AP automation software will initiate payment processing. This involves generating payment instructions, such as electronic funds transfer or check printing. The software will also record the payment in the accounting system and update the vendor account with the payment information.

Step 6: Reporting and Analytics

The final step in AP automation is reporting and analytics. AP automation software can generate detailed reports on invoice processing times, payment status, and vendor performance. This data can be used to identify areas for improvement, optimize cash flow, and negotiate better terms with vendors.

AP automation provides several cost-saving benefits for businesses, including:

- Reduced Labor Costs

Automating accounts payable workflows can significantly reduce the time and effort required to process invoices manually. This can lead to a reduction in labor costs associated with invoice processing and data entry.

- Improved Accuracy

Manual invoice processing is prone to errors, which can result in costly mistakes. AP automation software can improve accuracy by automating data entry, coding, and verification processes, reducing the risk of errors and associated costs.

- Faster Processing Times

AP automation can accelerate invoice processing times, allowing businesses to pay invoices faster and take advantage of early payment discounts. This can also improve vendor relationships and reduce the risk of late payment fees.

- Increased Visibility

Digital AP software provides real-time visibility into invoice processing workflows, allowing businesses to identify bottlenecks and optimize processes for maximum efficiency. This can help to reduce the costs associated with inefficient workflows and improve overall financial performance.

Conclusion:

Every founding member brings in sweat equity to the business which often goes unaccounted, till the organization is successful periodically. Valuing intangible assets like goodwill, trademarks, and sweat equity is possible only when the cash flow management is effective through proper practices of accounts payable and receivable.