Telecoms giant MTN (brand value up 24% to R74.3 billion) is South Africa’s most valuable brand for the twelfth time in the past thirteen years, according to leading brand valuation consultancy, Brand Finance.

Every year, Brand Finance puts 5,000 of the biggest brands to the test, and publishes over 100 reports, ranking brands across all sectors and countries. The world’s top 100 most valuable and strongest South African brands are included in the annual Brand Finance South Africa 100 2023 ranking.

MTN’s brand value continued to grow in 2023, meaning that its value is now up 50% from its pre-pandemic level. This is an impressive statistic considering the difficult operating conditions and the complex geopolitical environment that the brand has been faced with. MTN’s brand is worth just less than double the value of the second most valuable brand, Vodacom (brand value up 33% to ZAR39.8 billion).

Although Vodacom is not yet operating on the same scale as MTN, Brand Finance’s research found it is out-performing it in a number of key metrics surrounding customer satisfaction. These included consideration, usage, reputation, quality, and customer service.

Jeremy Sampson, Managing Director, Africa, Brand Finance commented:

“It is invariably the case that when economic conditions are particularly challenging, strong brands show off their pedigree. As the world economy and South Africa recovers from the COVID-19 pandemic the brands that have continued to invest in their future are prospering.”

Banking is the most valuable sector, up 28% in aggregate brand value

A strong post-pandemic recovery has set South African banking brands up for impressive brand value growth in 2022. The sector now accounts for five brands in the top-ten of the ranking and is also the most valuable sector in the South Africa 100 2023 ranking, making up 24% of the total brand value. The combined brand value of the eleven banking brands included in the ranking was ZAR146.5 billion. This is ZAR25 billion more than the next most valuable sector, which was Telecoms (6 brands included in the ranking to combined brand value of ZAR121.5 billion).

Standard Bank (brand value up 27% to ZAR29.7 billion) is the third most valuable South African brand, making it the country’s most valuable banking brand for the second consecutive year. The bank’s 27% year-on-year growth has further widened the gap with First National Bank (brand value up 5% to ZAR26.1 billion) and Absa (brand value up 19% to ZAR25.3 billion) which sit in fourth and fifth in the ranking. Investec (brand value up 15% to ZAR16.8 billion) has risen three places to re-enter the top ten of the ranking.

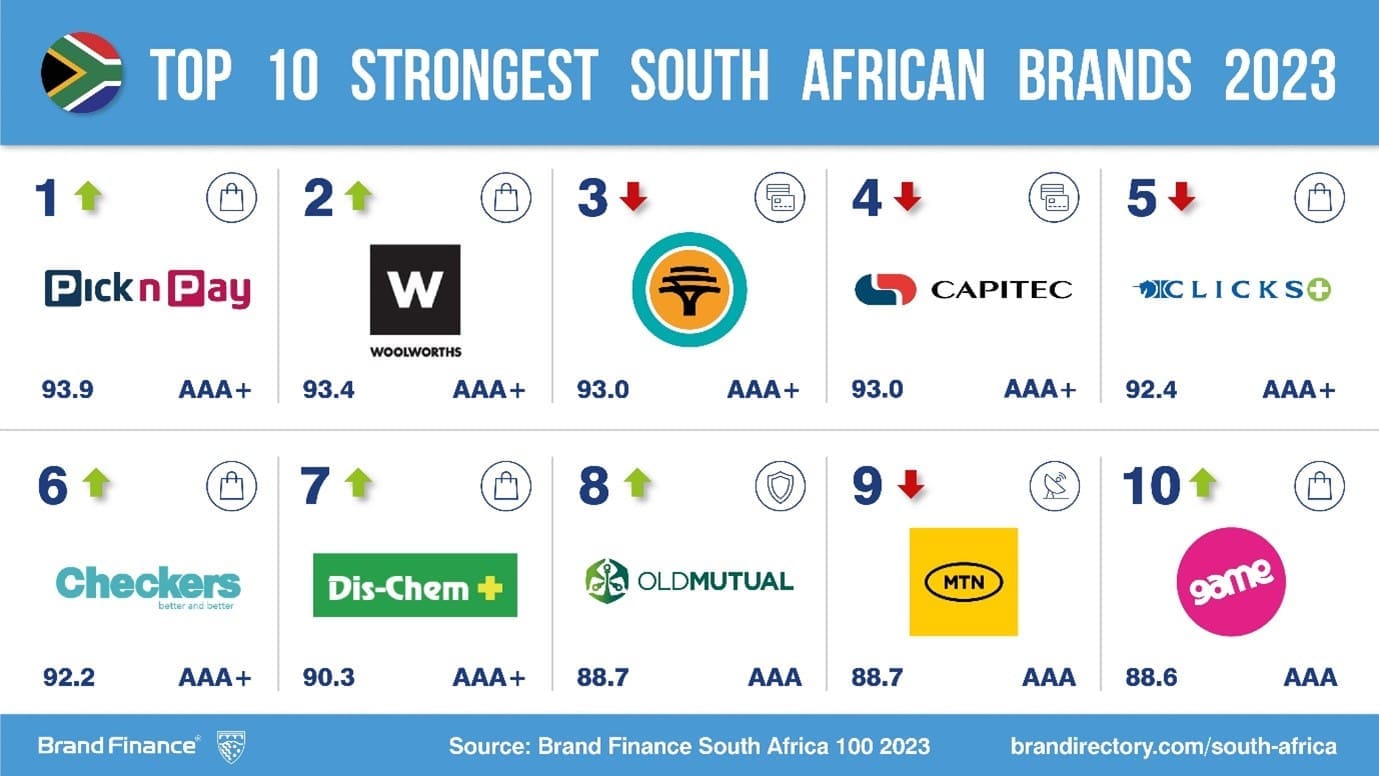

Pick n Pay is the strongest brand, amongst seven South African brands to achieve elite AAA+ rating

In addition to calculating brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. Compliant with ISO 20671, Brand Finance’s assessment of stakeholder equity incorporates original market research data from over 100,000 respondents in 38 countries and across 31 sectors.

Retail brand Pick n Pay (brand value up 30% to ZAR13.5 billion) has become the strongest South African brand with a Brand Strength Index (BSI) score of 94 out of 100 and corresponding AAA+ rating. Pick n Pay has seen a 14-point BSI increase year-on-year to clinch the top spot for brand strength. Astonishingly, it is one of seven South African brands to achieve the elite AAA+ rating, five of which came from the retail sector. For comparison, only twelve brands achieved AAA+ brand rating in Brand Finance’s ranking of the world’s top 500 most valuable and strongest brands – the Global 500 2023.

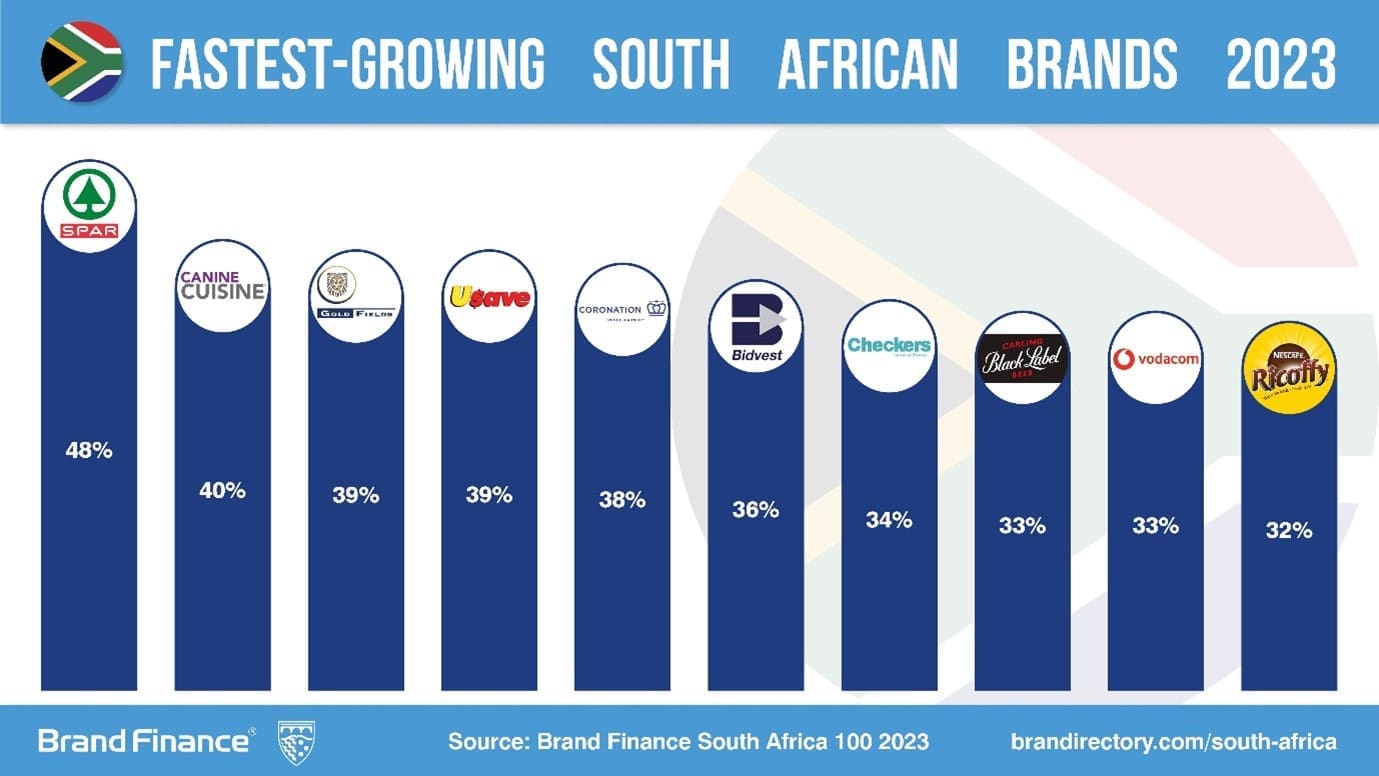

Spar SA is the fastest growing South African brand, up 48%

Spar SA is the fastest growing South African brand, up 48% to a brand value of ZAR21.4 billion. Spar SA’s growth reflects a positive outlook for South African retail brands, despite difficult operating conditions over the past year. Spar SA opened 41 new stores in 2022 and was able to record 6% growth in revenue and increased forecast revenues.

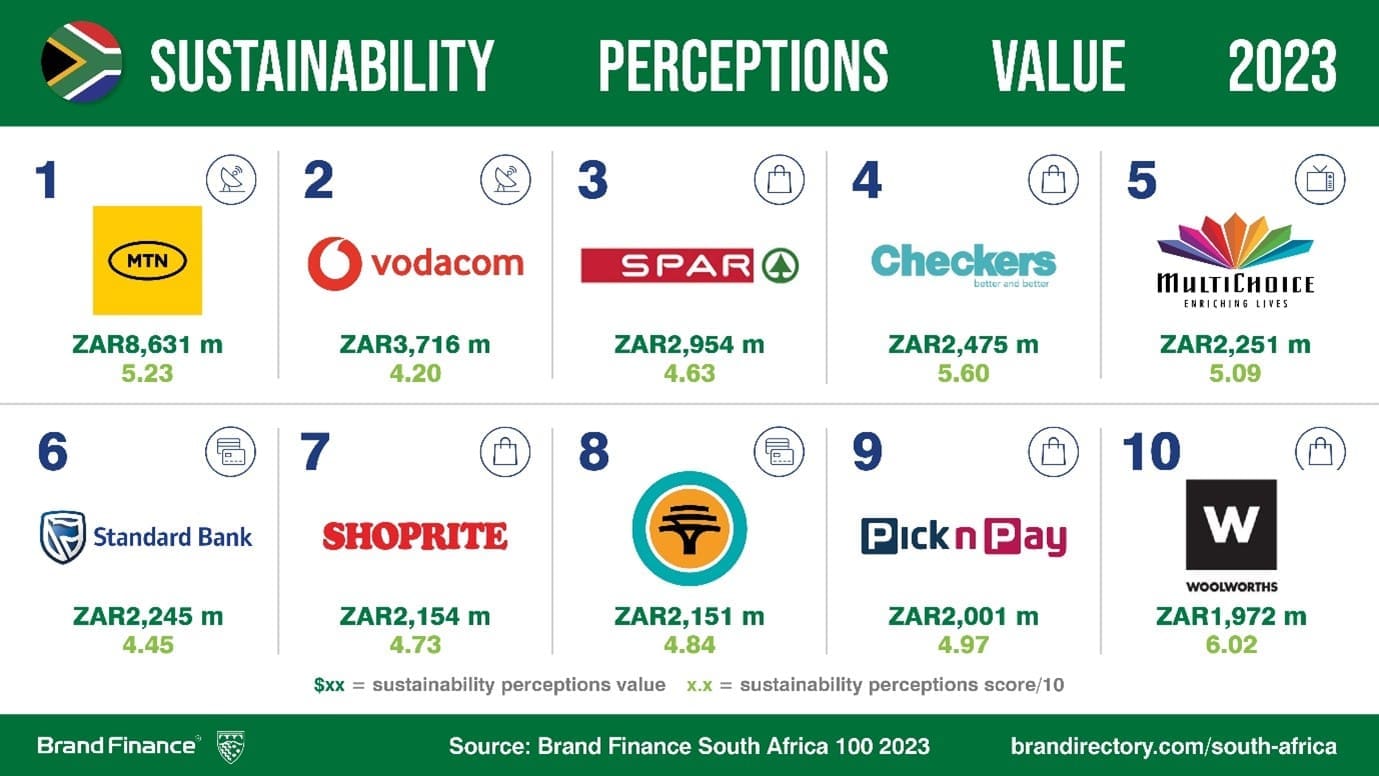

MTN has the highest Sustainability Perceptions Value, while Woolworths SA has the highest Sustainability Perceptions Score

As part of its analysis, Brand Finance assesses the role that specific brand attributes play in driving overall brand value. One such attribute, growing rapidly in its significance, is sustainability. Brand Finance assesses how sustainable specific brands are perceived to be, represented by a ‘Sustainability Perceptions Score’. The value that is linked to sustainability perceptions, the ‘Sustainability Perceptions Value’, is then calculated for each brand.

As well as being South Africa’s most valuable brand, MTN also has the highest Sustainability Perceptions Value (SPV) of any brand included in the South Africa 100 2023 ranking – ZAR8.6 billion. This indicates how much brand value MTN has tied up in sustainability perceptions (11.6%). The brand’s Sustainability Perception Score was 5.23 out of 10, the 10th highest in the ranking.

Woolworths SA (brand value up 25% to ZAR21.7 billion) has the highest Sustainability Perceptions Score in the ranking, 6.02 out of ten. Woolworths has long been recognised as a pioneering retailer in the sustainability field. Stakeholders resultantly gave it the highest Sustainability Perceptions Score, which equates to ZAR2 billion in value contribution to the brand.