Vodacom said it is not yet considering selling any stake in its mobile money entity M-Pesa Africa. Instead, the Vodafone-owned entity aims to grow the business further.

“We think it’s too early to have that conversation now,” Vodacom CEO Shameel Joosub said on Tuesday.

“Maybe two, three years down the line it will be a different conversation because we still want to unlock value.

“Because if you do it early, yes, we know we can get multiples of 25x and upwards, and we’ve had a lot of unsolicited offers coming through in that regard. But we’re not in that space yet.”

He said Vodacom wants to grow the business.

Joosub revealed that M-Pesa is not only considered a big entity in the group. It is the largest fintech provider with a significant presence.

He explained that Vodacom gets benefits from M-Pesa through Safaricom shares.

“A better reflection of that in Safaricom than we see, potentially, I would say, into the Vodacom share price,” explained Joosub.

The growth potential of M-Pesa and Financial Services in South Africa is huge.

“When you consider where we are today and the $1.3 billion that’s being generated by Financial Services and also the growth potential … we see this being able to grow in high teens for the foreseeable future,” said Joosub.

“We’re growing the platform. We’ve created M-Pesa Africa.

“We’re putting the focus on it.”

He said Vodacom has ensured that all the markets have basically implemented the product road map, which includes lending, payments, and merchants.

“We’ll be creating some exciting partnerships that we’ll announce in due course. But that allows us to expand the platform even further. So that’s on the one side,” said Joosub.

Vodacom is also developing a super app in South Africa in partnership with Alipay.

“So as we grow the smartphone penetration, and now that we’ve basically built and implemented the platform for South Africa, that now gives us the capability to then take elements of that platform and then replicate,” said Joosub.

“With Alipay into the international markets and leverage off that as we move into a more e-comm world, but also give our merchants the ability to expose their products in the e-comm world and sell beyond their immediate geographical areas.”

Through M-Pesa, Vodacom processes $24.5 billion (R366.4 billion) a month in transaction value across our International markets, including Safaricom, up 63.5%.

“This platform expansion sets up a very exciting growth outlook for M-Pesa, and this is borne out by the growth that we’ve seen in the fourth quarter with all the entities now generating, again, more than 20% growth year-over-year,” explained Joosub.

M-Pesa revenue was impacted by the free person-to-person transactions but still grew at 13% to up to R4.5 billion.

In the fourth quarter, with the reimplementation of person-to-person fees, normalised M-Pesa revenue grew 21%.

“We added 1.4 million M-Pesa customers in the period to 16.1 million customers, a growth of 9.6%, only 47% of our customers are using M-Pesa, again highlighting the opportunity for growth,” said Joosub.

Vodafone Chief Executive Officer Nick Read concurred that mobile money or FinTech in Africa was a huge opportunity.

“We believed in this for now, you know, a good 10 plus years. And we are, I’ll say number one in the African market,” said Read.

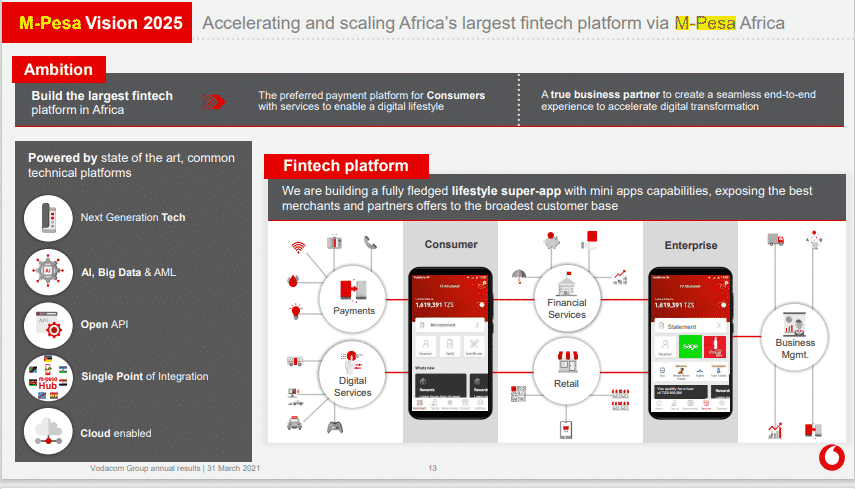

“What I would say is that we are focusing on investment in the platform. So that’s the M-Pesa platform. But how the M-Pesa platform evolves from what I would say is a feature phone world into a smartphone world.

“And what that’s going to involve is mini-apps. So a mini-app would deal with, for instance, loans or insurance.

“In other words, how do we build additional financial services? You’re going to see from Vodacom, the launch of VodaPay as a brand in South Africa. And ultimately, we want to evolve the super app strategy.”

Joosub said this envisaged development was a priority for Vodacom.

“We’re a scaled priority investment unconstrained at the moment,” said the Vodacom CEO.

“We are separating those assets out into separate legal entities because we think that the business will grow at a significant pace.

“But at this point, we are funding that expansion of the business.

“Clearly, you know, there’s intrinsic benefits between the FinTech and the telecom business

“But look, let’s see how it evolves over the coming years. Super exciting space.”

Meanwhile, Vodacom’s competitors, Airtel Africa and MTN, are considering listing their mobile money businesses.

For more read: Airtel Africa Mulls Floating The Mobile Money Business and MTN Says FinTech Business Spin Off Should Be Completed in 2022