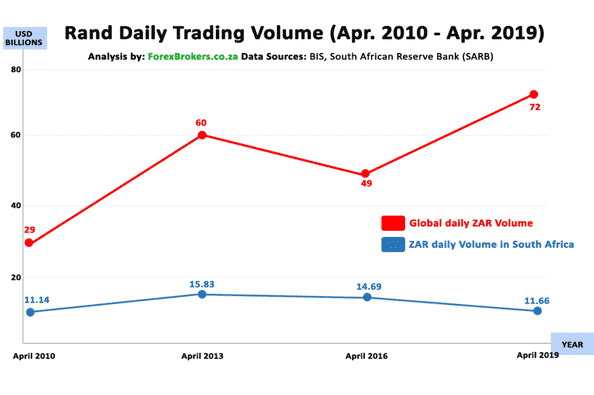

The South African Rand (ZAR) has been exploding in interest in the forex market. Over the last decade alone, the Rand’s trading volume has grown by over 182%.

The massive surge in interest surrounding the Rand has prompted the award-winning Bitcoin-based margin trading platform PrimeXBT to list ZAR alongside other new forex currencies from emerging economies.

ZAR was listed for trading against USD, EUR, and GBP, alongside other newly listed currencies MXN, THB, CNH, and HKD.

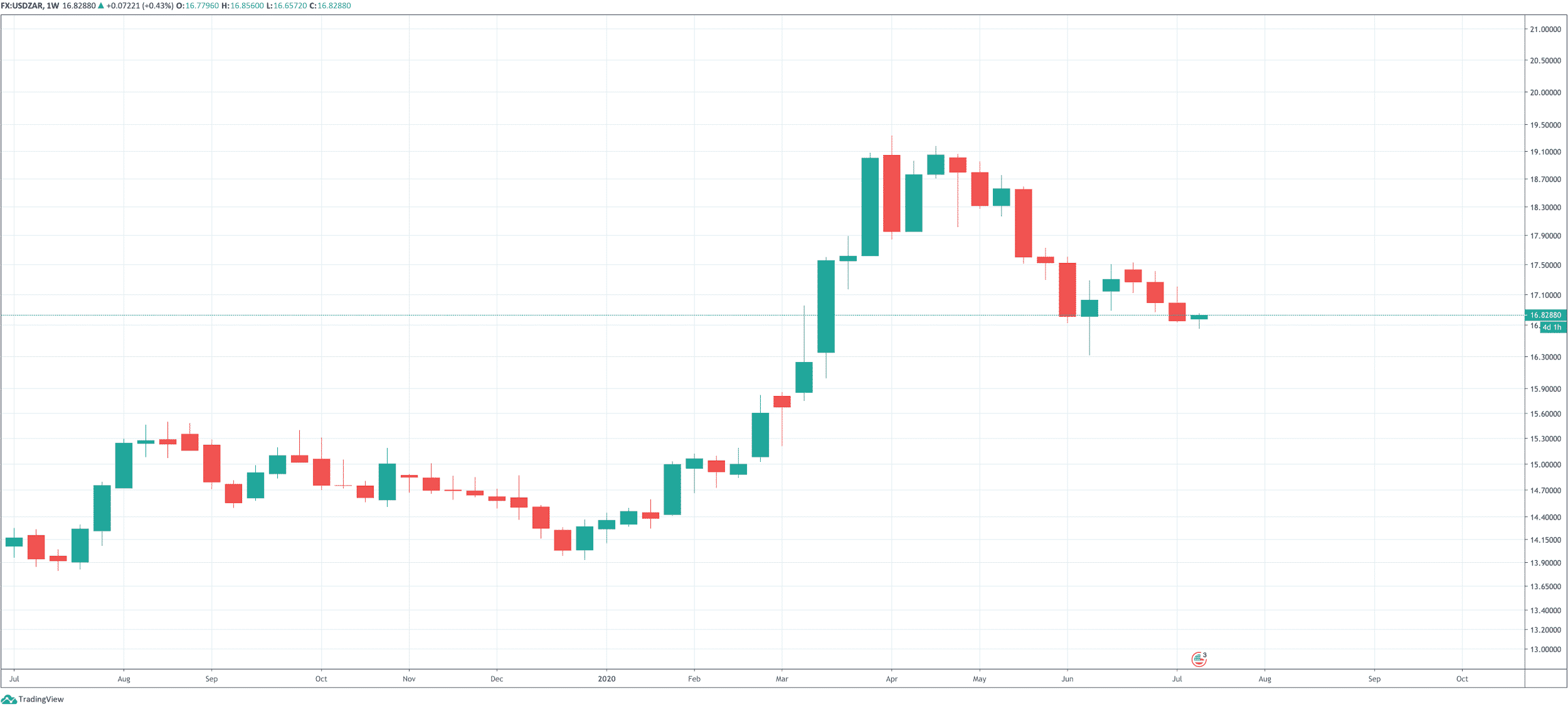

The Rand was hit hard by the initial outbreak of COVID, but has since gained against many top currencies. However, uncertainty surrounding remiposing quarantine-like conditions has markets potentially turning again.

Could a return to quarantine shake up the Rand and other markets for South African traders? And how can traders get prepared for the coming storm to turn volatility into an opportunity?

Rand (ZAR) Recovery in Jeopardy With Resurgence in Pandemic

The Rand has traded higher to start the new week, alongside the Johannesburg stock exchange showing signs of extended growth.

But just as the country’s stock market and currency begin to recover, cases of the pandemic have once again started to climb.

In the United States, cases are spiraling out of control. South Africa and other nations are making preparations to ensure their countries don’t fall to the same fate.

South Africa currently has the 10th highest confirmed coronavirus cases in the world, according to Reuters data.

However, President Cyril Ramaphosa kept any concerns at bay, revealing that restrictions won’t come back full force. The easing back slowly into restrictions could help keep the economy stay stable, and the Rand trading strong.

If risk and fear returns, however, a flight to USD safe haven could also make a comeback, and it could deal a blow to ZAR on the trading pair. But if the US continues to mishandle the sensitive situation, Rand could see another leg up.

Quantitative Easing Can’t Work For South Africa, Claims Analyst

In recent weeks, however, weakness in the Dollar and other currencies has led to recoveries in the Rand and other emerging markets.

The return of risk appetite also bodes well for the Rand, as does a healthier commodities market.

But the greater financial market is due for yet another shakeup, and even the best preparations from the South African government may not be enough to stave off a worsened recession.

Unlike the United States, the South African government cannot simply print more and more money to keep its economy afloat. Nazmeera Moola, Head of SA Investments at Ninety One, says that government funding must be cut rather than relying on quantitative easing.

The tough position could leave the nation’s currency exposed to downside as a result.

How To Survive Another Economic Shakeup With PrimeXBT

Whichever direction the Rand heads next, traders can get themselves ready for action with the award-winning Bitcoin margin trading platform PrimeXBT.

The advanced trading platform offers technical analysis tools as well as long and short positions on all major forex currencies, in addition currencies from emerging economies.

PrimeXBT recently expanded its list of forex currencies to include the South African Rand (ZAR), along with the Mexican Peso (MXN), Thai Baht (THB), Hong Kong Dollar (HKD), and the “offshore” Chinese Yuan Renminbi (CNH).

All of these new forex assets are available as pairs with major currencies and listed alongside cryptocurrencies, commodities, stock indices, gold, silver, and more.

The ever-expanding list of assets has something for all types of traders, and the platform’s easy to use interface is highly customizable, suitable for both novices and experts alike.